Almost every product needs packaging, and this business serves a wide range of end markets. Because packing is essential to the supply chain in many industries, the industry is immune to downturns in the economy. It was undoubtedly affected by the 2008 global economic downturn and the more recent COVID-19 outbreak, but not to the same extent as other industries. This is one of the main reasons the packaging sector draws several M&A transactions from financial and strategic investors.

While there are frequent M&A deals in this space, a recent highlight is the merger announced by two of the largest paper-based packaging companies, Smurfit Kappa & WestRock. Smurfit Kappa, on one hand, has predominantly been a European company while WestRock, on the other hand, operates mostly across the Americas region. Hence, this merger will create a “truly global company.” This will not only bring two of the biggest players together but will also create the largest paper packaging company in the world, potentially even the largest packaging company from a revenue standpoint as assessed in Frost & Sullivan’s recent Food Packaging study – Increasing Food & Beverage Consumption Drives Future Growth Potential in Developing Economies.

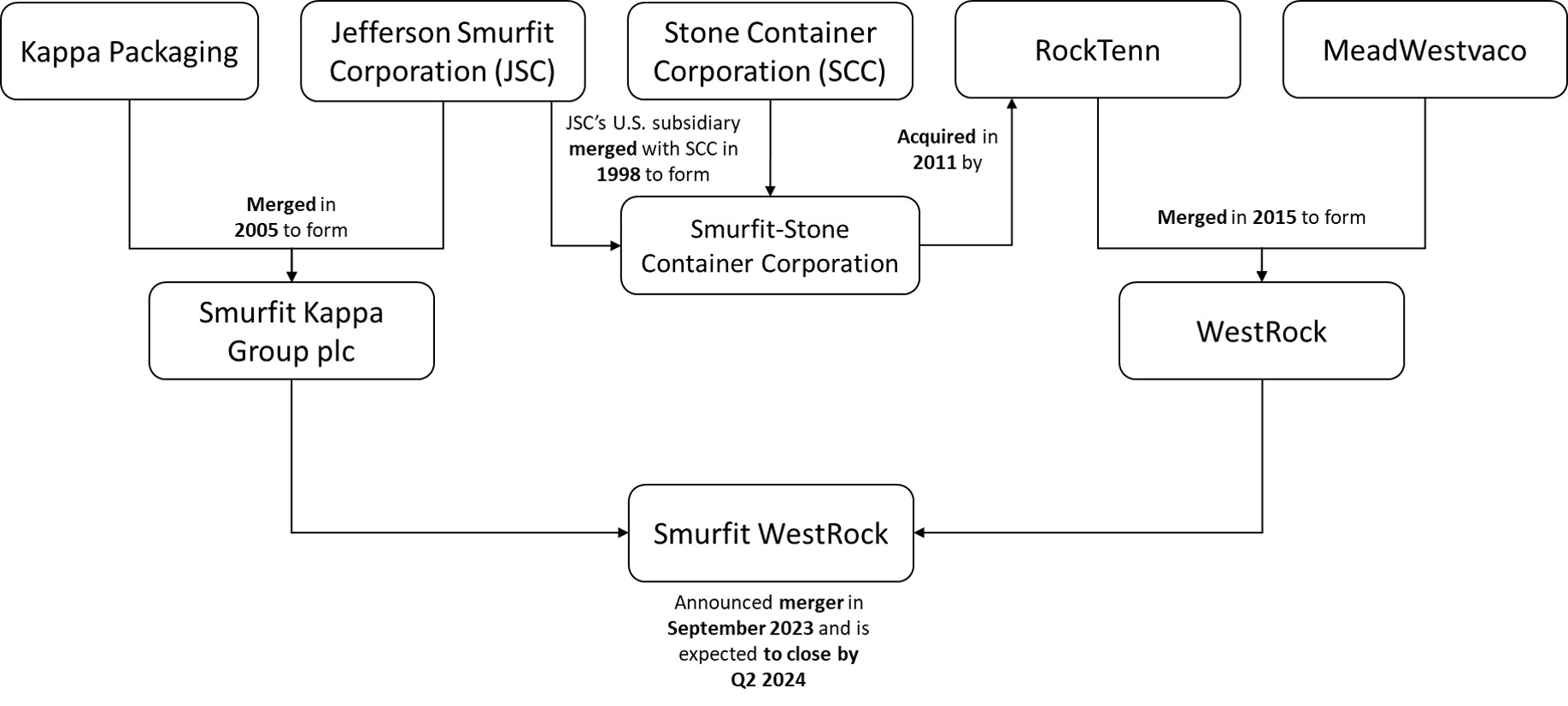

But what’s even more interesting is the evolution of both companies over the past two decades and how this deal comes full circle for Smurfit Kappa. The company was previously known as Jefferson Smurfit Corporation whose US subsidiary merged with Stone Container Corporation (1998) and formed Smurfit-Stone Container Corporation (SSCC). After an acquisition (2011) followed by a merger (2015), SSCC currently forms a part of what we now know as WestRock in the US. In Europe, Jefferson Smurfit Corporation merged with Kappa Packaging (2005) to form the current Smurfit Kappa Group plc.

This is explained in the chart below:

Figure 1: Evolution of Smurfit Kappa and WestRock Company over the years.

While this allows Smurfit to re-enter the vast American packaging market for the first time since 2011, it also indicates that the company could essentially be buying some assets twice. Having said that, the two companies have a stellar record of successful acquisitions by integrating smaller companies within their respective portfolios as well as expanding their geographical footprint.

Frost & Sullivan in its Food Packaging study notes that paper/pulp-based packaging is positioned as a sustainable alternative in terms of environmental impact as well as energy consumption. It does not require large amounts of energy to manufacture/recycle like glass & metals and faces minimal sorting challenges like plastics. Paper packaging degrades faster than other materials and is one of the compostable types. In addition to being sustainable, paper packaging also offers significant lightweight advantages. These are the factors leading to several M&A deals in the industry.

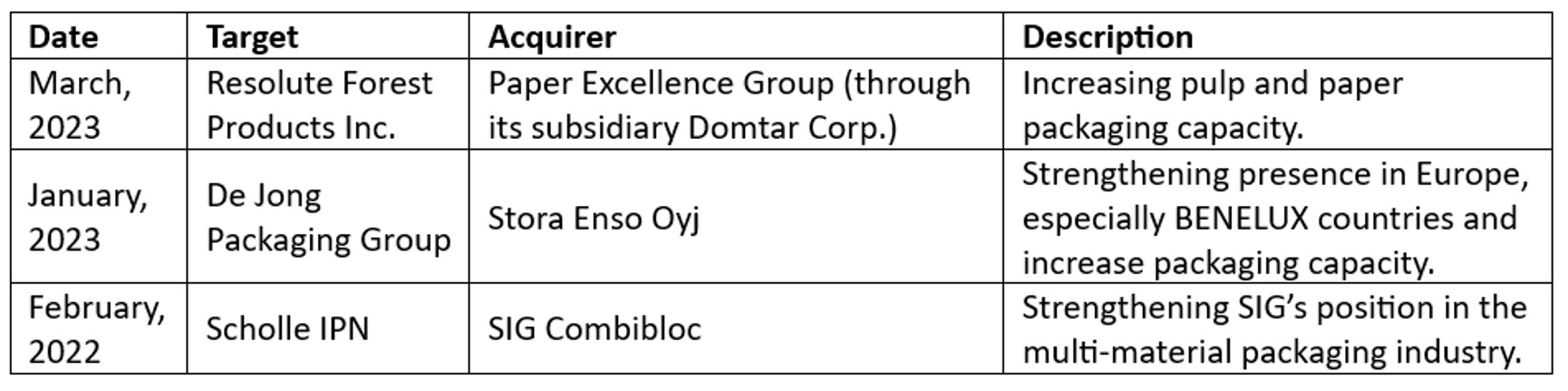

Some other M&A deals in the paper packaging industry over the last year are:

Hence, this category within the overall industry is expected to gain momentum from a growth perspective as well as attract M&A deals in the coming years.

The future prospects for, and growth opportunities in, different types of food and beverage packaging materials were analyzed in Frost & Sullivan’s two latest growth opportunity analyses on the global packaging market: