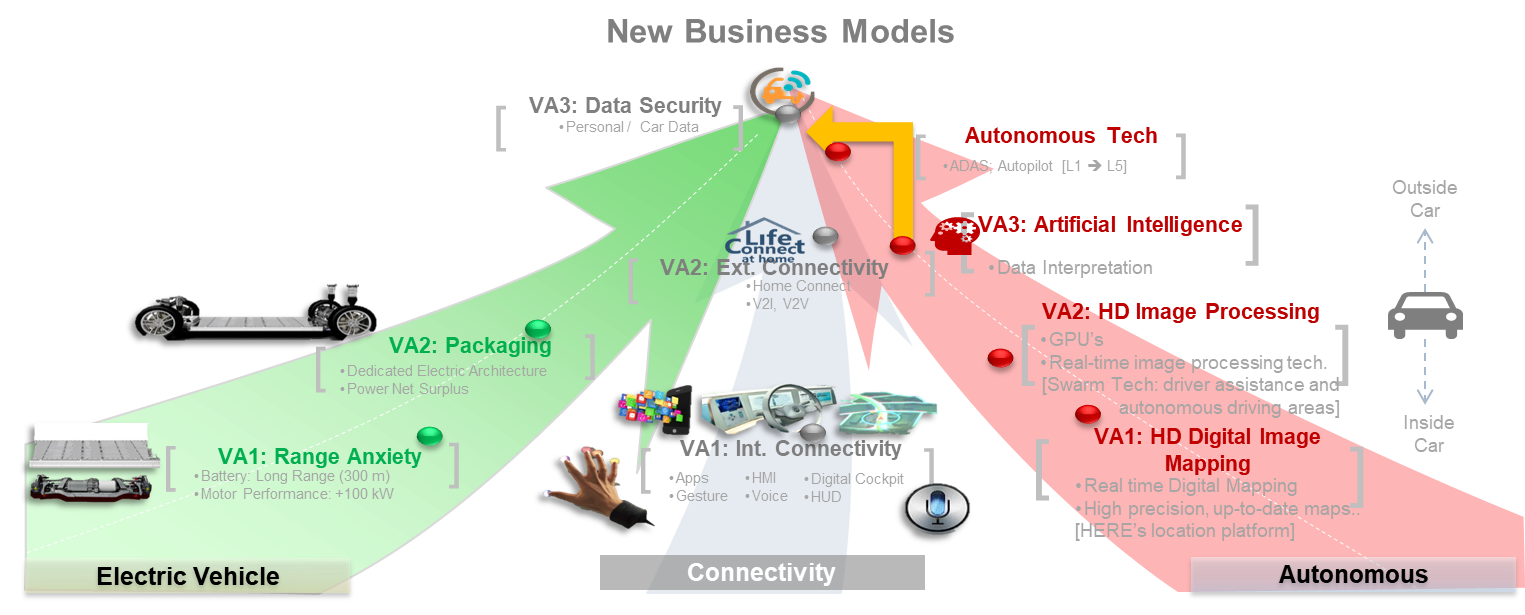

As the automotive industry hurtles towards an autonomous future, with all its possibilities and challenges, question marks loom over who will get there earlier – will it be traditional vehicle manufacturers , disruptive new entrants or non-traditional, technology companies.

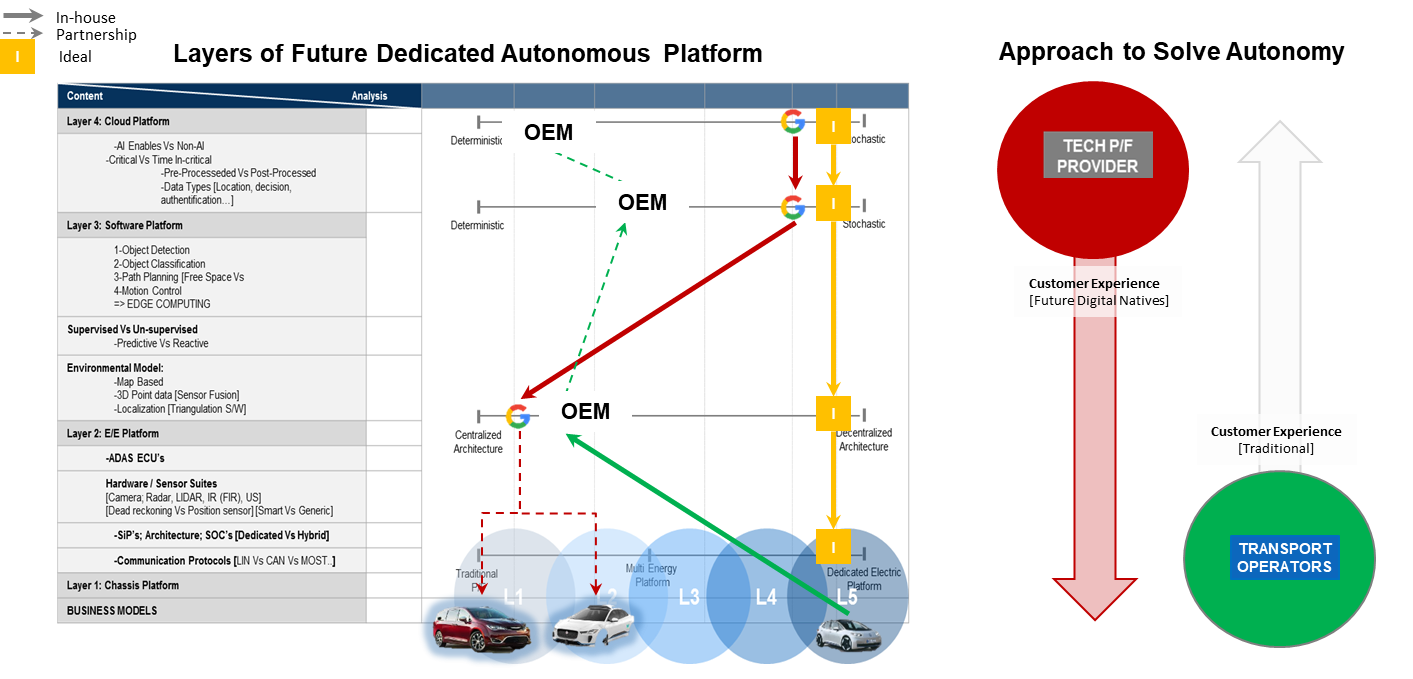

Which of two radically different approaches—a steady, incremental, building from bottom up approach or a bold, aggressive, top down strategy will yield better dividends? What will be the best method, go-it-alone, partnerships or acquisitions, to drive the autonomous agenda? With the race towards Level 4/5 autonomy accelerating, we use the prism of three key platforms—chassis, electric/electronic (E/E) and software—to evaluate who is likely to succeed, how and why.

Chassis Platforms: Conventional vs Multi Energy vs Dedicated Electric Platforms

Currently, most automakers continue to use traditional chassis platforms to develop electric powertrains with L1 and L2 autonomy. To a large extent this cautious approach has to do with cost considerations; shifting to a dedicated electric platform not only requires the jettisoning of well-established legacy systems, it also means tremendous investments in new platform R&D development. Added to this is the certain upheaval that will be caused by the manufacturing transition to an entirely new platform architecture.

An ideal balance to this transformation for many OEMs will be the development of a multi energy platform (MEP). The MEP represents one step up from the conventional chassis platform giving the OEM the flexibility to house multiple energy sources to the same vehicle chassis. So far, BMW has been a lone rider in the space, using this platform to roll out future hybrid vehicles (HEVs), battery electric vehicles (BEVs) and traditional internal combustion engine (ICEs) based vehicles. The strategy here is clear: maintain a foothold in both ICE and EV camps, while retaining the flexibility to adjust volumes according to demand.

Dedicated electric platforms, like that of Tesla’s, are positioned at the opposite end of the spectrum from conventional chassis platforms. Unlike most traditional automakers, Tesla’s inherent advantage is that it is not encumbered by legacy platforms and, instead, has had the freedom to build a wholly new, electric and autonomous focused platform from the bottom up.

The results of these two starkly divergent approaches are evident: in traditional platforms, which straddle both conventional ICE as well as electric powertrains, battery extent is limited and range anxiety ever present. In short, their long-term potential is severely limited in a future defined by electrification and autonomy.

Tesla and VW (the only major traditional automaker with a dedicated electric platform), in contrast, are looking at vehicles with a potential power surplus of upto 150 KW and range battery of 400-500 kms (possibly even 600 kms). This allays range anxieties, supports enhanced performance and steps up the pace on vehicle autonomy and electrification

Our take: The decision of switching to a dedicated platform/MEP for AD development is inevitable.But the decision of the platform and the time of switch will need to be assessed by OEMs based on their volume strategy for L2-L5 and their regional focuses. Broadly, OEMs, with a higher weightage towards quicker and higher L4 adoption especially within a usership business model within the portfolio will benefit from an early adoption of a dedicated electric platform. On the other hand, OEMs who are relying on an incremental but balanced adoption of L2, L3 and L4 vehicles will benefit from an MEP platform.

E/E Platforms: Centralised vs Decentralised Architecture

Todays’ vehicle E/E architecture is riddled with complexity of multiple protocols and overlaps due to years of feature addition on the base E/E platform. The explosion of electronic content influenced from the mobile industry forced OEMs with little time to adapt their E/E platforms. The emergence of new chassis platforms now provide OEMs with an opportunity to rethink their electronic layout and are faced with two distinct approaches to E/E platform development. On the one hand, a completely centralised architecture with a select set of master electronic control units (ECUs) and domain controllers for key functions. The second, a similar clustering and consolidation with a vital difference that there is no centralisation in terms of a master ECU or a single master controller. Instead, there is a discrete ECU for each critical function embedded to smart sensors for various applications. The feasibility of ths decentralized approach is driven bysmart sensors, with decision making capabilities, are not only collecting raw data but are also processing it themselves. But while 1-2 smart sensors can effectively perform neural networking for simpler tasks, the question is what happens in safety critical applications?

The issue here is of over reliance on sensors such as, the dependence on only one sensor for the braking function. Therefore, while smart sensors undoubtedly offer benefits, in the context of safety and time critical operations, perhaps the more prudent course of action would be to depend on a sensor suite and data fusion.

While today the path to a central domain controller approach is more prominent among the OEMs, the reason for this beyond that of redundancy is the existing OEM-supplier networks. At present, suppliers dominate and determine the direction of E/E architecture. Either due to the lack of technical capability or willingness, supplier networks are not equipped to meet the requirements related to higher levels of automation. This situation, in turn, will compel OEMS to carefully evaluate the cost impact on the value chain before opting to either centralise or decentralise.

Our take: OEMs’ supplier relationship and the partnership with technology startups will be vital for OEMs direction towards a centralized or decentralized approach. While smart sensor advances will work optimally on a decentralized E/E architecture platform as this will support greater flexibility wherein existing sensors can be easily replaced by more advanced equivalents. Second, this plug-in approach can be easily merged into a decentralised E/E architecture to ensure instant upgrades without impacting other components and software in some instances. And, thirdly, this will expedite the rapid incorporation of smart sensors that enable faster decision making and reduced reliance on latent networks like the cloud.

As this happens, new tech disruptors are well positioned to address changing OEM requirements. By progressively offering one smart sensor at a time, they will facilitate the transition to full autonomy through incremental advancements. If suppliers do not embrace such transformational change and continue to persist with legacy systems, they stand to be frozen out of the evolving ecosystem. Chip manufacturers and new age tech disruptor players are already emerging that threaten to overtake traditional suppliers on the value chain, even while making their role as integrators redundant.

Software Platform: Deterministic vs Stochastic

Much like centralized and decentralized E/E architecture, both deterministic and stochastic platforms come with their own set of benefits and challenges. For instance, the deterministic platform uses traditional software and machine learning (ML) to develop core autonomous driving software solutions. The stochastic platform, on the other hand, uses deep learning (DL), artificial intelligence (AI) and neural networking as a basis for improved decision making.

The deterministic approach provides OEMs with a structured and defined approach to developing AD platforms as the core technology is similar to the one used for developing driver assistance systems.

However, there is a threshold to incremental improvements. The migration from L4 to L5 is unlikely to occur if the industry perseveres with a deterministic platform since there is no provision for self-learning or self-improvement in terms of skills, with such learning/skills needing to be constantly taught and updated, while a stochastic approach will possibly enable the system to self-learn and tackle these challenges.

Thus, the deterministic approach has its limitations since it cannot account for all possible situations, especially in edge cases which are infinitely variable. Stochastic approaches come with their own challenges. For a start, they push the automotive industry out of their comfort zone into unexplored territory. Furthermore, a stochastic approach also has limitations in validating and type approving sofware due to its underministic approach towards reacting to edge cases.

Our take: The preferred strategy will be to identify the optimal use case and applications for stochastic and deterministic platforms, respectively, and then merge them. Among the building blocks to AD software development, blocks such as object classification will benefit from advances in stochastic software development methods, while blocks such as motion control will primarily still reply on deterministic development. An OEMs decision to outsource/co-develop/develop in-house will play a critical role in the influence of each of these approaches within the automotive industry. The direction of current technology players indicate that a stochastic approach to development could be first to achieve full automation capability and OEMs will now need to homogenise development by merging activities with other players (tier 1s, startups or OEMs) or go the acquisition way to internalize the capability.

Which Way Forward: Organic Growth vs Partnerships vs Acquisitions

The muddling automotive value chain for autonomous driving system development and service deployment is a clear indicator of the anticipated change to the automotive value chain. The dystopian future for the automotive industry would be one where OEMs become isolated hardware providers while the major service pie will be led by future mobility and technology companies.

The counter argument to this is a more eutopian scenario for the OEMs where the technology investments, partnerships and acquisitions pay dividends giving OEMs a significant share in the future mobility market with a highly cost optimized and flexible product and service portfolio ebabling them to stay atop the food chain and ensure status quo even in the new mobility world.

The path to either of these extremes are not clear today, but the traditional automotive industry players are the ones faced with the uphill battle to lose their value proposition and the an ideal approach to developing the convoluted layers of AD platforms will be essential to determining the path each OEM would take in the mobility world. At present the options ahead of them are three: firstly, partner with adjunct technology companies; secondly, grow organically by hiring in-house software talent; and, thirdly, acquire companies with relevant technological capabilities.

There is no single silver bullet solution for all OEMs in the space and the path to electrification if gauged from a long term stand point may result in the most cost effective and fruitful path in the future for many players. We believe this to be the key for OEM to have a cost effective autonomous driving development to be in optimize AD platforms for ownership and usership business models.

We are currently validating the above fact based hypothesis on each OEM’s direction towards achieving the next generation automated driving platforms and if you would like to get in touch to discuss further on this initiative, please reach out to:

Benny Daniel, Vice President, Mobility – [email protected]

Arunprasad Nandakumar, Team Leader, Automated Driving, [email protected]