South Africa’s metal industry represents a large, well-developed sector that relies on a vast array of raw materials. The metals sector represents approximately a third of the manufacturing sector and is globally known for its quality and quantity. South Africa is ranked 21st among the crude steel producers in the world and 1st within the African continent.

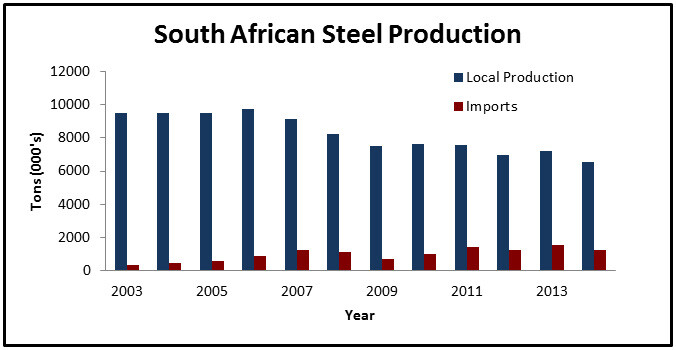

Steel has been one of the prolific sectors in South Africa; however it has suffered from a lack of domestic demand in recent years. Following the peak in steel production in the years leading up to the 2010 FIFA World Cup, the steel market in South Africa has consistently suffered. Steel production peaked country wide to 9.7 million tons in 2006 and dropped to 6.6 million tons in 2014.

This sector has seen an average contracting demand of 5 per cent year-over-year.

To account for a drop in local production, imports increased 77 per cent from 2010 to 2013, while real-time consumption only increased by 9 per cent. This diverts attention to the international sources that are selling steel to South Africa, particularly China and the European Union.

In 2014, South Africa’s total iron ore production was above 55 million tons for the year. According to Trade Map, which lists international trade statistics, China imported 44.8 million tons of iron ore and concentrates. Some of this raw material is further beneficiated and sold back to South Africa at a cost that local producers cannot match. Not considering China’s selling price, one of the reasons for the international interest is that the import tax on many steel products coming into South Africa is 0 per cent, in contrast to other major steel-producing countries which levy taxes at 100 per cent to protect their local industry. This is the case for galvanised steel, mainly used in the construction industry. South Africa ought to investigate ways to protect the industry, attracting investment and stimulating demand.

While efficiencies at plants have been improved, many factors are outside the primary control of the steel industry, making it problematic to keep costs below that of China’s. On-going load shedding at ESKOM, labour unrest at the mines and the delay of the South African National Infrastructure Plan have all contributed to the suffering sector.

Opportunity in the industry does not lie within South Africa but with neighbours of Southern Africa. Zambia imported 35,000 tons of galvanised steel from South Africa in 2014, and Zimbabwe was close behind at 31,000 tons. The demand for this type of steel is never ending in the Southern African Development Community (SADC) region, as these nations have not yet looked to the Far East for all importation. The multinational Infrastructure Master Plan that is currently in place will see over $200 billion invested in projects ranging from energy to information and communication technologies (ICT) to water, in several member states. This type of opportunity will demand high quality steel for decades of construction and operation. Projects to take note of are: developments of gas infrastructure in Mozambique and the much-delayed Inga hydroelectric dam in the Democratic Republic of Congo.

The South African government announced 26 renewable energy projects that were preferred in the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP). Each project is unique in its demands, but it is certain that a quality source of steel would be needed. However, the question remains. Where will management prefer to source their material for these projects, locally or from the Far East?

The steel sector has not suffered like this in many years. There is belief in the industry, however, that it ebbs and flows and that South Africa is merely in a demanding cycle. Improvements are expected, but for now, the high growth among other African nations is where the focus ought to lie.