Introduction

Smart building technologies enable enterprises to control and monitor the performance of buildings through smart solutions, including air conditioning (HVAC) management, lighting management, automated fault detection, micro-grid management, and building data analytics.

After several years of moderate growth, the smart building technology market is expected to grow rapidly due to an increase in market awareness of the value generated by smart building solutions.

The convergence of information technology and building automation is enabling facility optimization, leading to the maturity of the smart building technology market.

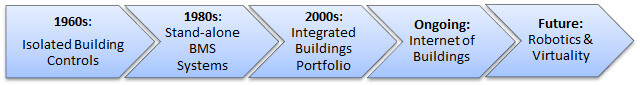

Evolution of Smart Building Market, Asia-Pacific, 1960–2025

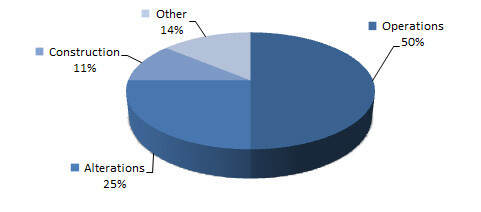

Typical Building Costs Over a 30-year Life Cycle

Operations costs that comprise the major portion of the building life cycle can be brought under control by adopting smart solutions such as building automation systems (BAS), integrated facility management (IFM), and efficient LED lighting systems. On average, commercial buildings use about 29% energy for lighting, 40% for HVAC purposes, and 31% for other uses such as equipment and cooking.

The projected growth in the BAS, IFM, and LED lighting markets will drive the growth of smart building technology markets in the Asia-Pacific region.

The APAC BAS market is likely to reach $1.50 billion in 2018, with an annual growth rate between 5% and 7%. The growth of BAS in APAC is fueled by the increasing focus on energy efficiency, user comfort, and the lifestyle cost of buildings. Data centers and retail buildings will remain the key end-user groups, as these end-user segments grow rapidly. Key market participants in APAC include Johnson Controls, Honeywell, Schneider Electric, and Siemens Building Technologies.

LED lighting is expected to grow exponentially. With an annual growth rate between 25% and 30%, the market in APAC is likely to reach $19.46 billion by 2018. Significant growth can be expected in emerging APAC economies such as China and India because these countries continue to phase out inefficient lamps. In addition, evolving regulations and policies that advocate energy efficiency in new infrastructure development will drive market growth. Countries such as China, Australia, Japan, Singapore, and South Korea will become LED lighting growth centers in APAC.

By 2018, the IFM market in APAC is expected to reach between $20 and $25 billion in revenue. The growth of the IFM market is likely to be fueled by an increasing number of high-end office buildings across APAC. Additionally, the rising concern for sustainable business and energy efficiency among APAC end users is making energy management using IFM outsourcing a high priority. The public sector will remain as a strong growth engine for the IFM market and will subsequently drive a higher adoption of IFM in the private sector.

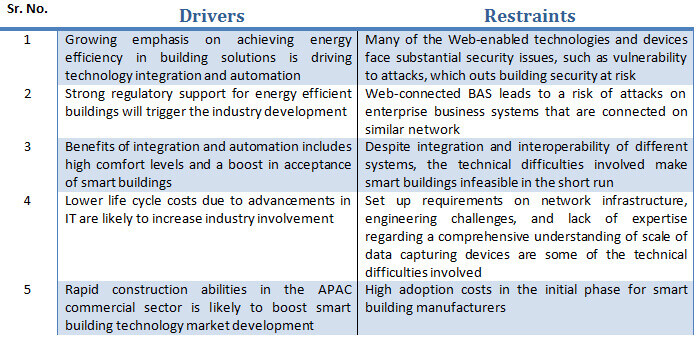

The drivers and restraints of the smart buildings technology market are summarized below.

Trends & Implications

- Future advancements in the building technology sector will lead the integration of data, video and voice with security, HVAC, lighting, and other controls on a single platform. These developments, along with green and eco-friendly elements, are likely to drive the growth of smart buildings by 2020.

- The upcoming technologies in the areas of nanomaterials, electronics, and lasers will drive multiple applications and will present a high return on investment (ROI) for companies in 2020. The future of smart building solutions lies in the convergence of technology with cognitive computing that is supported by cost-effective data sharing technology and sensory data.

- Increasing urbanization will lead to the integration of core cities with suburban areas and daughter cities, resulting in the expansion of cities. The growing urbanization in APAC indicates a future requirement for infrastructure specifically built to support a larger urban population.

- The vertical industry growth will have a large impact on the rate of adoption of smart building technology. Government and healthcare building management tends to be more mature and advanced in appreciating the benefits of smart building technologies.

- Building owners are now recognizing the importance of collected data interpretation and prioritization, in addition to the value generated through it in terms of operational efficiencies, cost management, and sustainability benefits to all stakeholders across the value chain of building management.

Moving Forward

The majority of market opportunities for smart building technologies reside in new developments in emerging economies and in upgrading the existing infrastructure of developed APAC nations.

Commercial buildings remain the largest and most potent building category for smart system installation and application. The increase in green-certified commercial buildings pushes the adoption of smart technologies to keep track of and maintain the use of energy to fit within green criteria.