Much like vehicle electrification, shared mobility is a concept that has appeal because of its ability to transform the mobility landscape in ways that are smart and sustainable. Then again, like electric vehicles, the success of shared mobility will depend on the development of effective infrastructure. In this context, how prepared are cities – the prime movers and beneficiaries of shared mobility – in terms of developing enabling infrastructure? How will their shared mobility landscape evolve over the next decade?

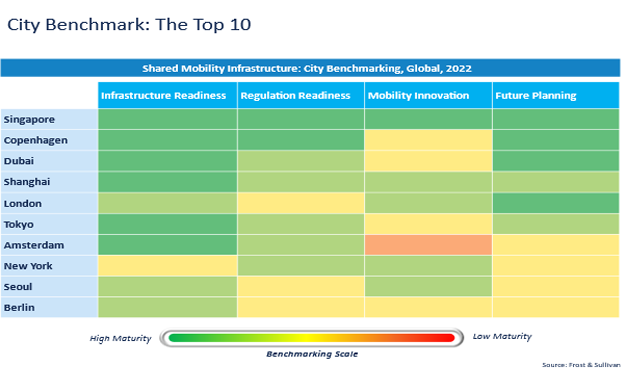

To understand more about the shared mobility infrastructure of 20 of the world’s leading cities and their outlook over the next decade, Frost & Sullivan assessed related economic, regulatory, and funding parameters. Among the shared mobility modes covered included kick scooters, bikes, car sharing, and autonomous vehicles (AVs). The comprehensive study examined growth drivers, challenges, and future outlook, while delving into factors like infrastructure readiness, regulatory readiness, mobility innovation and future planning. The cities drawn from across the globe ranged from Singapore, Dubai, London, Mexico City and Shanghai to Tokyo, New York, Sydney, Sao Paulo, and Bangalore.

London: A Brief Case Study

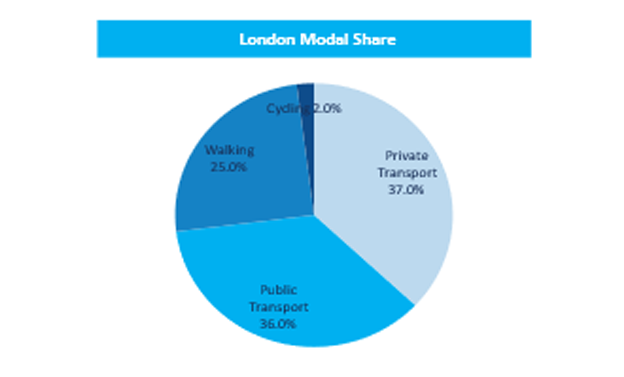

The study found that London’s vibrant and innovative shared mobility space is reflective of the city being a hub for shared mobility research and investments with an energetic start-up ecosystem.

The positive outlook for shared mobility in London is driven by imperatives such as the projected 40% increase in the city’s population by 2050. The UK government is set to invest more than $120 billion in London’s transportation infrastructure by 2050 to keep the country’s economic powerhouse – the capital accounts for a quarter of the UK’s GDP – in strong condition. The London 2050 Infrastructure Plan framework is poised to boost public transportation usage by 70%, with ramped up investments targeting expanded modal share of walking and cycling. Meanwhile, the expansion of London’s ULEZ to all London’s boroughs, is set to increase the modal share of shared mobility transportation at the cost of private transport usage.

Technology to the Fore

Overall, investments in shared mobility infrastructure are set to spike in tandem with zero emissions targets, and the push to reduce transport emissions in cities. Emissions reduction initiatives, including green bonds, carbon credits, congestion pricing, and subsidies for clean energy transport are being paralleled by higher investments in shared mobility infrastructure and incentivization of shared mobility services.

City authorities recognize that over the long-term, investing in shared mobility infrastructure, such as dedicated cycle lanes, is more cost-effective than spending money on constructing new road networks. Cost rationalization is further enabled by existing road infrastructure being repurposed to accommodate sustainable, shared transport networks geared towards cyclists, pedestrians, and autonomous shuttles. Moreover, steadily declining capital costs associated with building smart infrastructure for shared transport – whether a bike-lane or micro-mobility lane – is highlighting a solid economic case for such investments.

In the mid- to long-term, investments in dedicated biking infrastructure and pedestrian infrastructure will be accompanied by investments in supporting technology. Intelligent traffic management systems, sensors, tolling systems, data analytics are just some technological tools that will create a supporting framework for shared mobility uptake.

For example, AI is already being used to effectively reimagine and implement urban transportation networks for shared mobility. AI capabilities allow for more accurate forecasting of demand, physical infrastructure requirements, route planning, financing, and transportation interoperability. Overall, the result is enhanced and more efficient urban mobility planning. AI and new technologies like digital twins will shrink the time from ideation and planning to approval to implementation.

One of the key aspects of the shared mobility infrastructure market is the interlinked interests of shared mobility infrastructure developers, smart city technology providers, curbside management, and consumer apps. The convergence of technology, market segments, and end products has birthed new players that offer holistic solutions. These solutions are often in the form of mobility hubs where multiple shared mobility modes such as car sharing and bike sharing, smart parking spaces, cycle paths, pedestrians, and charging points integrate seamlessly with public transport centers like bus and metro stations.

Our Perspective

The shift towards shared mobility will bring with it multiple opportunities for innovation and growth. Smart city providers should launch pilot programs to demonstrate the myriad benefits of digitizing and integrating a city’s infrastructure and transportation. Simultaneously, they should explore the use of AI in optimally designing smart, sustainable, and shared urban transport. The move towards shared mobility will also open up growth potential for companies active in kerbside management services as well as EV charging.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility