Automakers must take the initiative to provide a robust repair framework for EVs and batteries, collaborate with insurance companies, and partner with repair workshops to ensure more efficient repair processes, lower insurance costs, and a more sustainable approach to EV ownership and maintenance.

By Dorothy Amy, Industry Analyst – Mobility

The surge in electric vehicle (EV) adoption has introduced a range of challenges for insurance companies. Key issues include limited visibility into battery diagnostics data, the high cost of electronic components, and non-standard vehicle structures, battery designs, and repair procedures. These factors are driving up EV repair costs, leading to higher insurance premiums and an increase in write-offs.

In 2023, severe structural damage and expensive repair costs were the primary reasons for EV write-offs. Although they accounted for only about 5% of total insurance claims with the majority being internal combustion engine (ICE) vehicles), the average claim severity cost for EVs was 38% higher than for ICE vehicles. This disparity is attributed to several factors, including battery safety challenges, lack of visibility into diagnostics data, non-repairable designs, unavailability of parts, and high replacement costs. Consequently, many insurance companies have responded by setting record-high premiums or excluding high-risk EVs from their policies to minimize potential payouts.

To learn more, please access: Growth Opportunities in EV Insurance Write-Offs in North America & Europe, or contact [email protected] for information on a private briefing.

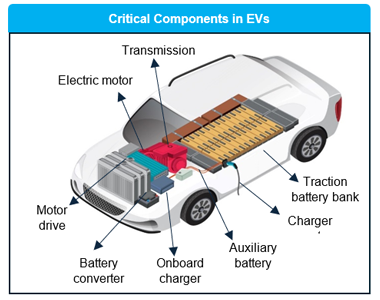

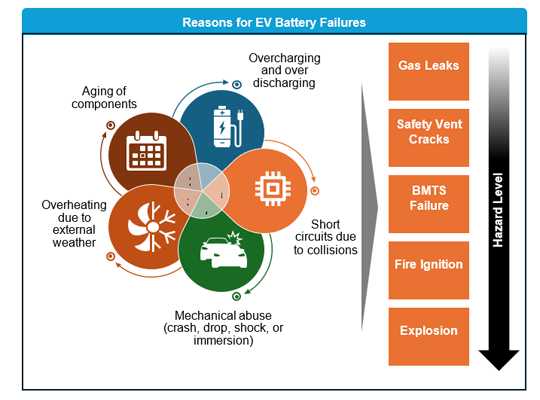

Repair and Safety Challenges

The absence of standardized repair procedures for EVs, particularly for key components like batteries, presents significant safety and liability concerns. Negligence during repairs can result in short circuits, fires, or explosions, making repair shops liable for damages and posing serious risks to technicians. The challenges are compounded by a lack of skilled expertise, the absence of standard battery designs, a scarcity of authorized parts, costly battery and electrical components, limited visibility into original equipment manufacturer (OEM) battery data, quarantine requirements for damaged battery storage, and additional labor hours required for EV repairs. These factors hinder the repairability of critical EV components, even for minor damages, leading to higher claim severity costs and an increased likelihood of write-offs.

Automakers must take the initiative to provide a robust repair framework for EVs and batteries to address aftermarket challenges. Some OEMs, such as General Motors, Nissan, and Ford, have implemented strategies to mitigate repair costs. These strategies include offering third-party access to battery data, streamlining battery designs, introducing simplified repair methods, providing repair kits at authorized workshops, and offering comprehensive training for technicians. Companies like Tesla and Rivian have in-house insurance arms that leverage vehicle data to set fair insurance rates and lower insurance-related expenses.

Regulatory and Environmental Considerations

Government regulations play a crucial role in addressing EV insurance challenges. The European Union (EU) and California have taken proactive steps to make vehicle data available to third-party service companies, reducing premature EV write-offs and facilitating repairs. For example, the EU’s November 2023 regulation mandates vehicle data sharing with third-party service companies, while North America plans to require EV diagnostics systems in all upcoming models from 2026. These initiatives aim to expedite repair services and reduce the likelihood of premature EV write-offs by enabling the repair industry to access standardized guidelines for various EV batteries.

Another critical issue is the responsible disposal and recycling of components from written-off EVs. The proportion of EVs in salvage yards, currently at 2-3%, is projected to reach 5-10% by 2026. However, many auto salvagers in North America and Europe lack specific guidelines for the safe repurposing and reuse of batteries from written-off EVs. European car dismantlers and salvage operators are collaborating with OEMs and recycling companies to maximize the value extracted from end-of-life and damaged EVs through reuse, recycling, and recovery. Government-mandated recycling rates in Europe push insurers and salvage operators to maximize battery recovery processes before discarding damaged or written-off EVs. In North America, more stringent regulations are needed to minimize environmental impacts. New Jersey, for instance, has passed a bill regulating lithium-ion battery recycling and safe disposal of EV batteries, fostering competition among local recycling companies.

Industry Collaboration for Future Solutions

Collaboration between OEMs and insurers is essential to develop data-driven and usage-based insurance packages that can offset high premiums and streamline the claims process. OEMs should expand their collision repair networks and provide rigorous training for repair shops in vehicle diagnostics, battery repairs, and safety procedures. Training dealers, vehicle damage assessors, and technicians on vehicle architecture, wiring structures, and battery pack designs is crucial to improve repair efficiency and safety.

By working together, the industry can create modular and repairable EV designs that ensure long-term sustainability and safety. Secure vehicle data access from OEMs is critical to avoid premature EV write-offs in the future. Such industry-wide cooperation will ultimately lead to more efficient repair processes, lower insurance costs, and a more sustainable approach to EV ownership and maintenance.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility