The Australian automotive aftermarket, now in a mature phase, is on a trajectory for significant growth through 2030. The increase in total vehicles in operation (VIOs), coupled with the increasing proportion of aging vehicles, is set to generate robust demand for automotive parts and services.

High Vehicle Ownership and Aging Vehicle Parc to Drive Growth

Despite global economic uncertainties and declining per capita income, the Australian automotive aftermarket is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Several factors underlie this growth, including high rates of vehicle ownership and an aging vehicle parc.

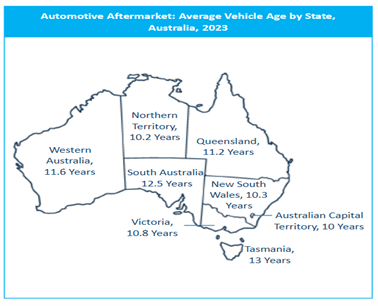

Australia ranks second globally in vehicle ownership, with 749 vehicles per 1,000 people. This places it ahead of major automotive markets such as Japan, Germany, the United Kingdom, and China. Meanwhile, average vehicle age in Australia reached 11.3 years in 2024, with nearly 75% of the VIO being over six years old.

Australia ranks second globally in vehicle ownership, with 749 vehicles per 1,000 people. This places it ahead of major automotive markets such as Japan, Germany, the United Kingdom, and China. Meanwhile, average vehicle age in Australia reached 11.3 years in 2024, with nearly 75% of the VIO being over six years old.

This aging fleet significantly drives demand for independent aftermarket (IAM) solutions, as these vehicles typically fall outside OEM warranty coverage. Heightened cost sensitivity linked to the rising cost-of-living will also compel consumers to seek economical repair and maintenance options, further boosting the IAM channel.

To learn more, please see: Growth Opportunity Analysis in the Automotive Aftermarket, Australia, 2024-2030, or contact [email protected] for information on a private briefing.

Skills Shortage in Electric Vehicle (EV) Repair Poses a Challenge

The Australian aftermarket is crowded with over 200+ parts manufacturers; 2,000+ distributors, wholesalers, and retailers supplying both specialized and general automotive products, and over 27,000 workshops ranging from independent repair centers to franchise networks.

Leading brands like Repco, Bapcor, Supercheap Auto, and ACDelco dominate the market. Key segments range from tires, spark plugs, collision body parts, starters/alternators, and lubricants to brake parts, batteries, filters, lighting, and exhaust components. The quest for improved vehicle safety, performance, and durability will fuel demand for advanced materials and cost-effective products, while shaping long-term market trends.

A key challenge continues to be the dearth of trained technicians and the skills shortage in electric vehicle (EV) repair and maintenance, creating a demand-supply mismatch. This factor, along with customer price sensitivity, is expected to lower barriers for new entrants but could also squeeze profit margins for small-scale workshops by 2030.

Our Perspective

Estimated at $7.59 billion in 2024, the Australian automotive aftermarket is well-positioned for sustained growth but must first contend with several headwinds, including global inflation, economic volatility, and a price-sensitive consumer base that may restrain household spending on vehicle repairs and parts.

Equally, however, the market stands to benefit from tailwinds including steadily expanding vehicle ownership and VIO.  This will support a growing customer base for aftermarket solutions, many of whom will turn to IAM solutions to prolong the use of their vehicles.

This will support a growing customer base for aftermarket solutions, many of whom will turn to IAM solutions to prolong the use of their vehicles.

Meanwhile, digitization is already disrupting conventional value chains, fostering seamless interaction between workshops, distributors, and end consumers. Enhanced connectivity enabled by digitization will, moreover, create opportunities for transparent and efficient service delivery.

While EV adoption will impact specific aftermarket categories, such as oil filters and spark plugs, internal combustion engines (ICEs) will continue to dominate VIO, thereby ensuring stable revenue streams for most segments.

To maintain the market’s growth momentum, stakeholders will need to implement strategies centered on consumer retention, service innovation, and value chain optimization. With IAM workshops driving aftermarket revenues, stakeholders should prioritize efficient parts procurement and competitive pricing strategies tailored to price-sensitive consumers. IAM stakeholders, in particular, stand to benefit by aligning their strategies with evolving consumer needs, enhancing customer touchpoints, and integrating digital solutions. Competitive pricing and a focus on quality will serve as foundational pillars for long-term success.

Skills development will need to be prioritized. Investments in technician training, particularly in EV repair, will bridge the talent gap and position stakeholders for long-term success. To deepen customer engagement, stakeholders should deploy digital tools that enhance customer interactions and offer personalized service packages. Transparent and proactive communication will facilitate brand loyalty.