Mergers and acquisitions, investments in innovative tech start-ups, and development of comprehensive product portfolios through partnerships to present growth opportunities.

The commercial vehicle telematics industry in South Africa is experiencing robust growth, driven by increased adoption among medium and heavy trucks and owner-operated trucking companies. Rising customer awareness and the demand for comprehensive fleet management solutions are expected to propel service revenues to approximately $423.5 million by the end of 2028.

Strategic partnerships between telematics service providers (TSPs), original equipment manufacturers (OEMs), and other technology facilitators are delivering new value propositions for users. TSPs are expected to introduce subscription plans with gradual price adjustments, avoiding abrupt increases. This strategy, combined with affordable enhancements, will open up opportunities to expand into mid-tier and advanced solutions, thereby fueling market growth.

However, the industry faces several challenges. These include a lack of supportive government regulations and incentives for foreign players, as well as inconsistent enforcement of mandates across different regions. Additionally, high initial hardware and setup costs pose a barrier to market expansion, with many commercial trucking fleets considering telematics more of a luxury than a necessity.

To learn more, please see: Growth Opportunities in the South African Connected Truck Telematics Industry, Global Connected Medium & Heavy Commercial Vehicles Growth Opportunities, Growth Opportunities in European Heavy-duty Electric Trucks, or contact [email protected] for information on a private briefing.

Source: Frost & Sullivan

On Track for Increased Penetration Rates

The industry is currently in a growth phase, with more vehicles being equipped with telematics systems. Established technologies, distribution networks, and supply chains will support steady growth until the end of 2030. As a result, penetration rates of telematics devices and services among commercial vehicles, currently around 26%, are poised to rise. This growth phase will likely see increased activity from international players and local OEMs.

As the market approaches maturity post-2030, there will be sustained adoption of telematics among commercial trucking fleets, the mainstreaming of video telematics and digital freight solutions, and the emergence of new business models, such as profit-sharing.

High Market Consolidation

The South African telematics industry is currently highly consolidated, with the top five players—Mix Telematics, Ctrack, Altech Netstar, Cartrack, and Tracker—accounting for nearly three-fourths of revenue share. Local TSPs dominate the market due to their targeted customer application expertise.

Market leader Mix Telematics has been actively pursuing partnerships and mergers and acquisitions (M&A) to consolidate its leadership position. It has combined with Powerfleet to create a top-tier global automotive IoT SaaS provider. Cartrack acquired 70% of Picup Technologies, partnered with local mobile operator Smart Axiata Co Ltd, and joined with SMART Fleet Management to expand into Southeast Asia. Netstar, a subsidiary of Altron, has established a global fleet bureau in South Africa to serve as an advanced vehicle telematics hub. The Bidvest Group is exploring acquisition opportunities both locally and internationally to expand its business.

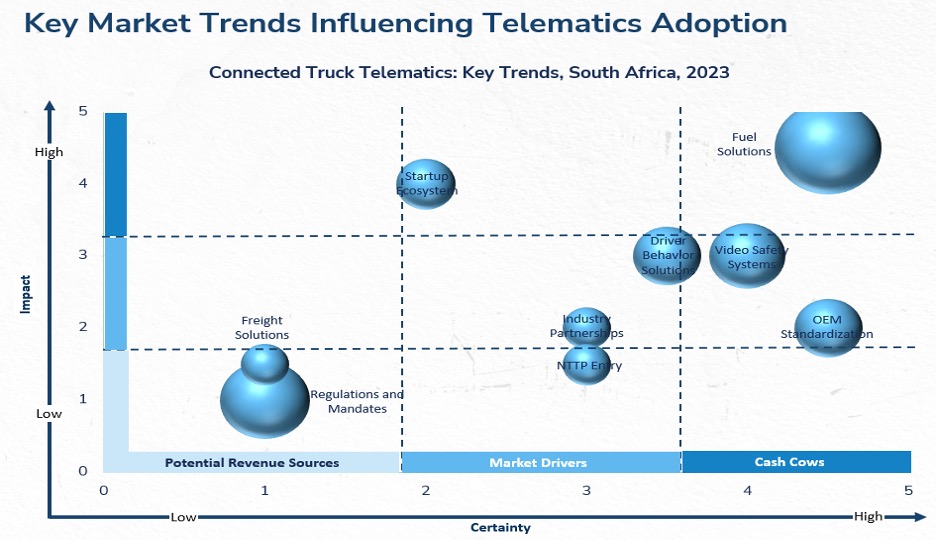

Compliance with existing safety regulations and driver-focused mandates is essential for market growth, as these factors compel fleet operators to adopt telematics solutions. In South Africa, the primary drivers for fleet investment in telematics are fuel efficiency and vehicle safety, which take precedence over compliance and performance considerations.

Although track-and-trace providers currently hold the majority of the market share, there is substantial growth potential in upselling to mid and advanced tiers through affordable solution enhancements. New entrants can capitalize on market opportunities by introducing innovative solutions, while OEMs can expand their market share by forming partnerships with tech start-ups and TSPs.Our Perspective

Our Perspective

Local TSPs have traditionally benefited from limited foreign competition, but this landscape is changing. To maintain their market position, local TSPs need to adopt a collaborative approach. Increased M&A activity will offer mid-sized companies opportunities to gain additional resources and adapt to market trends. Concurrently, the government must create a favorable environment that encourages foreign companies to operate and collaborate with local firms, thereby maximizing growth potential.

OEMs and Tier I suppliers with significant operating margins should pursue innovative business ideas, invest in promising start-ups, and lead technology-driven transformations in the country. As global markets become more accessible, local start-ups are increasingly able to attract investments from international firms. Local market leaders must identify and invest in emerging technologies to ensure long-term relevance.

Given that customers increasingly favor a single provider for all fleet management needs, offering a comprehensive solutions portfolio is essential. TSPs, OEMs, and Tier I suppliers should develop strategies to diversify and integrate multiple partners through a marketplace business model, akin to those in North America and Europe. Frost & Sullivan anticipates more integration opportunities and the expansion of the ecosystem to include additional network partners and seamless API integration.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility