Enhanced eyes-off and hands-off capabilities, Navigation on Autopilot (NOA), and other technological advances focus on enabling safer, more convenient, and meaningful engagement with vehicle occupants.

The advancement of technology and supportive regulations will propel the adoption of advanced driver assistance systems (ADAS) and autonomous driving (AD) features. Industry needs will drive the growth of eyes-off driving and the integration of multiple sensors within a sensor suite. OEMs will continue to collaborate with various companies in the automotive value chain to expedite the development and implementation of hands-off and eyes-off technologies.

In 2024, Frost & Sullivan anticipates several premium OEMs to introduce vehicles equipped with eyes-off driving systems in their flagship models across markets in the US, Europe, Japan, and China. Meanwhile, mass-market OEMs like GM will extend hands-off driving capabilities to urban roads in North America, as an optional feature in their top-of-the-line models. In China, some OEMs have already launched city assist features such as Navigation on Autopilot (NOA), a hands-on feature, with the potential for future upgrades to hands-off capability via over-the-air (OTA) updates. Additionally, tier suppliers are developing innovative parking solutions for various vehicle segments, which are expected to add value to the mass market ADAS offerings. The focus on connectivity and AD is transforming the interior cabin space to prioritize health, wellness, and convenience features that enhance passenger engagement during commutes.

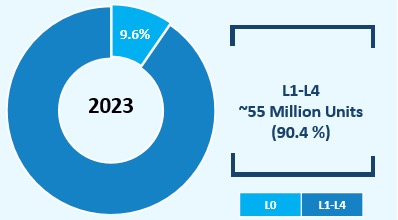

In 2024, Frost & Sullivan anticipates a decrease in the number of vehicles equipped with L0 ADAS features by 10%. They are expected to have a share of around 8%, while the remaining vehicles are expected to be equipped with L1-L3 features.

To learn more, please see, Global ADAS and Autonomous Driving Outlook and Growth Opportunities, 2024, Growth Opportunities in Passenger Vehicle High-definition Maps, 2024-2030, or contact [email protected] for information on a private briefing.

Top Five Trends for 2024

- Wider Launch of Eyes-off, Level 3 AD

Germany, China, Japan, and select US states have legalized L3 AD on highways. OEMs like Mercedes-Benz, BMW, Volvo, plan to incorporate L3 AD in their flagship models. This trend is expected to extend to other regions, including Canada, the United Kingdom, France, and Sweden, where automatic lane keeping systems (ALKS) and L3 AD may become legalized on highways. Initial deployment in flagship models has commenced in certain markets, with broader adoption anticipated to increase competition among OEMs.

- Evolution of Automated Parking Solutions

Automated Valet Parking (AVP), requiring specific hardware and software, remains limited to premium vehicles due to its complexity and cost. Global Tier I suppliers like Bosch, Continental, Valeo, APTIV, Denso, and Hyundai Mobis are developing various parking solutions to bridge the gap between assisted parking and AVP. While AVP is the pinnacle of automated parking, its availability is limited to select locations. OEMs are expected to capitalize on assisted parking solutions, such as memory parking, which offer the best value for mass market consumers.

- Domain Controllers in ADAS/AD Computing Systems

Increased levels of autonomy and sensor fusion have amplified data collection, necessitating domain controllers for centralized function management, a key aspect of evolving vehicle electronic and electrical (E&E) architecture. OEMs are transitioning to centralized architectures with specific controllers for different domains. Tier suppliers are already developing these architectures, benefiting OEMs. Collaborations between OEMs, tier suppliers, and semiconductor manufacturers will focus on creating tailor-made integrated circuits (ICs) and software-on-chip (SoCs).

- Semiconductor Collaborations in the Automotive Ecosystem

To ensure semiconductor availability, OEMs are pursuing long-term solutions even as the rise in ADAS and AD features is increasing the demand for ICs and SoCs within the vehicle’s E&E architecture. OEMs are partnering with semiconductor suppliers to maintain a steady supply chain and prevent chip shortages. Semiconductor suppliers are expanding their product portfolios to meet the growing needs of OEMs, while tier suppliers are enhancing their value proposition through partnerships with semiconductor suppliers.

- Advancements in ADAS/AD Sensor Suites

The emergence of higher ADAS and AD features has heightened the need for multiple sensors providing a 360-degree view of the surroundings. OEMs are already increasing the number and variety of sensors in their suites, incorporating multiple LiDAR sensors and imaging radars. In software-defined vehicles (SDVs), having multiple sensors enables higher ADAS/AD functions via OTA upgrades, with no changes to vehicle hardware.

Top Five Predictions for 2024

NOA will gain traction in markets such as China. Though hands-on driving features are already installed to help drivers navigate city traffic, they could be upgraded to hands-off driving through OTA updates. OEMs such as Nio, XPENG, Li Auto, and Great Wall Motor already offer versions of NOA in their models.

OEMs will prioritize incremental parking solutions, such as assisted and monitored parking. These solutions add value for customers by assisting with everyday parking needs while helping OEMs manage costs.

The semiconductor shortage has impacted ADAS, AD systems, and infotainment features reliant on chips. OEMs will deepen their collaboration with semiconductor manufacturers to ensure a steady chip supply, with tier suppliers investing in semiconductor manufacturers to enhance supply chain reliability.

ADAS/AD computing systems require efficient data processing within the vehicle’s E&E architecture, driving the adoption of domain-based architectures with high-performance computing systems (HPCs). This shift towards scalable, domain-based architectures will be the logical next step.

Automakers will intensify their focus on sensor suites in SDVs, with hands-off SDVs expected to be hardware-ready for eyes-off driving and other OTA updates. Eyes-off driving could be offered as a feature on demand (FoD) in SDVs.

Our Perspective

By 2029-2030, L2 autonomous vehicles will surpass L1 in unit sales, with an estimated 35 million L2 vehicles sold by 2030. However, L3 will experience the highest compound annual growth rate (CAGR) of nearly 79% between 2023-2030.

In markets like China, NOA has become a key differentiating feature, with OEMs such as Nio and Xpeng offering it under different trademarks. Legislation and regulations will likely support the adoption of NOA in other regions. OEMs should leverage changing regulations to enhance consumer value by offering NOA as an FoD with multiple subscription options.

The rise in autonomous driving levels has increased the demand for advanced perception sensors providing a 360-degree view. Tier I suppliers should collaborate with system developers to enhance sensor value while controlling costs. This will facilitate the adoption of perception sensors in mass-market vehicles.

SDVs can achieve higher autonomous driving levels through OTA updates if the hardware supports advanced ADAS levels. OEMs should, therefore, provide hardware for higher ADAS levels that can be activated via OTA updates, enabling vehicles with lower ADAS levels to operate at higher levels.

Automated valet parking remains niche, but daily-use features like assisted and memory parking add significant value for customers. OEMs should focus on providing parking solutions that offer the most value and equip vehicles with the necessary hardware. Offering parking solutions as FoD applications, along with subscription-based models, can further enhance consumer value.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility