Equipment as a service and online marketplaces, along with business model transformation in service, maintenance, rebuild, and financing to provide a springboard for increased profitability and customer acquisition.

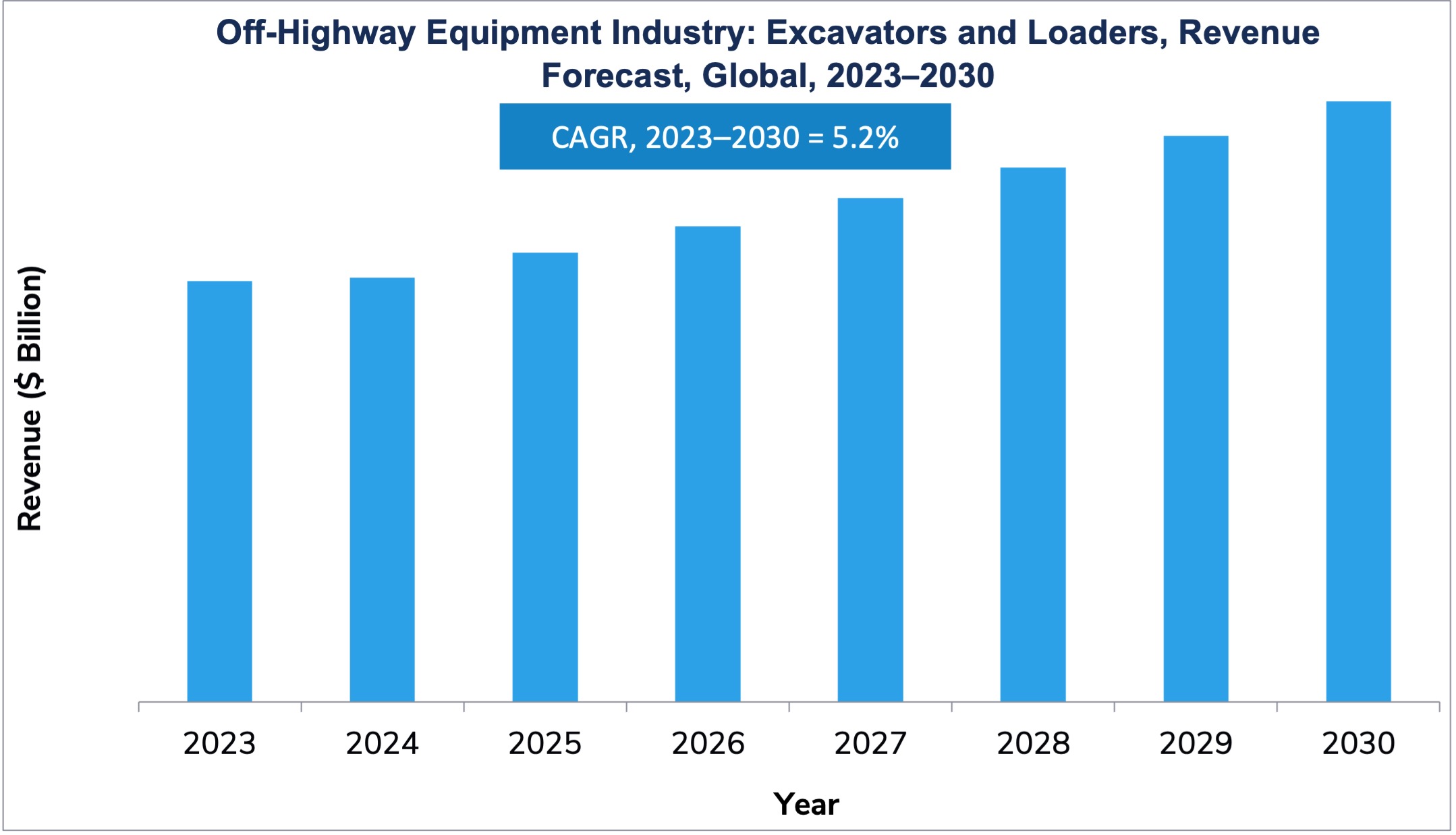

The global excavators and loaders market is expected to reach $79.48 billion by 2030, growing at a CAGR of 5.2% between 2023-2030. Key trends that will define the market till 2030 and beyond include business model transformation (BMT) and advances in electric equipment and smart machines.

BMT will change dynamics in the global excavators and loaders market. Companies are already changing the way they do business throughout the value chain—from delivery of machines to aftermarket solutions—with the goal of deepening customer engagement, boosting customer acquisition, and improving margins. Major manufacturers have started focusing on alternative revenue streams such as aftermarket portfolios, rentals, and financing.

The Equipment as a Service (EaaS) business model is based in a pay-as-you-go approach, with OEMs handling all maintenance and ownership responsibilities. Meanwhile, transparency, vendor ratings, and convenient and comprehensive analysis of products, specifications, and pricing are underlining the rising appeal of online marketplaces. BMT in the rebuild space is gaining traction among end users that engage in intensive operations with high equipment utilization rates, such as the mining sector. In the financing sector, new models are pivoting around flexible ownership and competitive pricing options, with OEMs and lenders seeking to increase customer acquisition. In terms of service and maintenance, BMT is focusing on tangible value adds for customers, with solutions across the entire product lifecycle, beginning from point of sale.

Advances in electrification represent another key market trend. Electric equipment offers multiple advantages, including precise maneuverability, efficient power operations, better operator ergonomics owing to reduced noise/vibration and rapid acceleration, simpler maintenance, as well as operational and cost efficiencies. While electric excavator capabilities have evolved, primary deployment has been in the mini-excavator segment, due to slower market adoption and battery infrastructure constraints. The potential for enhanced TCO is underscoring the appeal of electric wheel loaders over their diesel counterparts, while fully electric excavators could be game changers in that they would require virtually no maintenance and would eliminate the need for hydraulic components.

Intelligent machines with smart features are showing steady progress, incorporating various sensors for superior vision, control, and machine optimization. Innovations will spur the demand for smart machines, with companies like Caterpillar, John Deere, Komatsu, Hitachi, Hyundai, and Kobe Steel ramping up the development of products with smart features.

To learn more, please see: Growth Opportunities in the Excavators and Loaders Industry, 2024-2030, Global Off-highway Equipment Industry Outlook 2024 and Electric Off-highway Equipment Growth Opportunities, or contact [email protected] for information on a private briefing.

Our Perspective

Market participants like Caterpillar, John Deere, Hitachi, Hyundai, Kobe Steel, Komatsu, Sany, Volvo, CNHI, Kubota, JCB, Liugong, Shantui, and XCMG have a presence in multiple markets and offer a range of products. The thrust is on designing more sustainable and efficient vehicles that reduce emissions and improve fuel efficiency. This, in turn, is driving innovation, with manufacturers focused on electrification and autonomous technologies.

For these market participants, BMT will be a springboard for increased profitability and customer acquisition. Accordingly, OEMs should design innovative EaaS and pay-as-you-go models, while transitioning from being product suppliers to becoming solution providers. Simultaneously, both emerging and established companies can tap into the revenue potential of commissions and advertising, presented by the shift to online marketplaces. Incorporating a broad portfolio of offerings, targeting opportunities in the aftermarket, rebuild, financing, and rentals space will ensure sustainable aftermarket revenues for manufacturers.

The spike in hybrid and electric excavator and loader launches over the past decade heralds the next phase of electrification that will focus on efficient powertrain technologies. Here, cross-industry collaboration between OEMs, suppliers, digital solution providers, battery manufacturers, and construction/mining customers will be crucial to creating turnkey solutions. OEMs will have to critically evaluate battery technology innovations and charging choices, particularly with electric powertrains poised to disrupt the market in the long run.

Intelligent machinery and smart features will be crucial for increased efficiency and productivity. Artificial intelligence and system innovations, focused on areas like hydraulics, energy recovery, and hybridization, are set to shake up the market. Against this backdrop, agile technology innovation and rapid market implementation, reinforced by a strategic partnership strategy, will be critical to gaining first-mover advantage.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility