Multiple advantages underpin emergence of Silicon carbide (SiC) and Gallium-nitride (GaN) WBG semiconductor technologies as the future of electric vehicle power electronics.

By Aman Gupta, Industry Analyst – Mobility

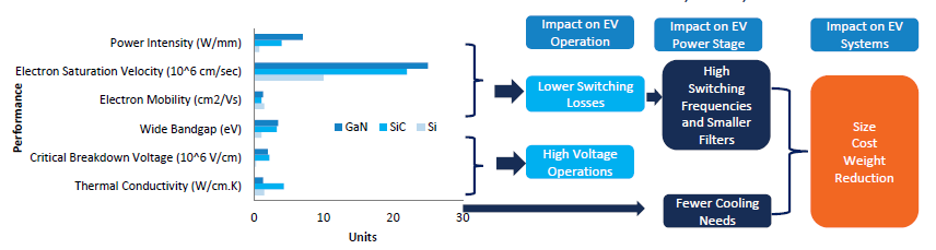

Rising electric vehicle (EV) adoption and the ongoing shift to 800 V architecture, together with the ability to improve charging capabilities, reduce charging time, boost component efficiency, and lower power losses in EVs will spark increased demand for wide-bandgap (WBG) semiconductors in the North American EV market. The spotlight, in particular, will be on silicon carbide (SiC) and gallium-nitride (GaN), two leading edge WBG semiconductor technologies that offer significant benefits over existing silicon-based equivalents in terms of size, weight, and cost reduction. They are seen which are seen as critical to the future of EV power electronics.

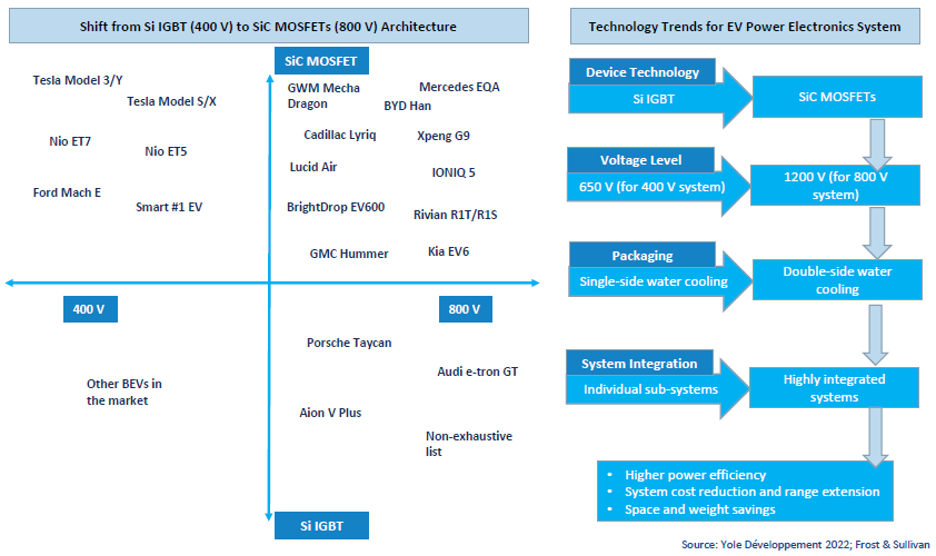

SiC semiconductors operate at higher voltages and temperatures, reduce conduction losses, and boost thermal conductivity. GaN semiconductors enable faster and more efficient circuits in a high-power environment and are favored in high voltage circuits due to the faster flow of current through them. Therefore, while silicon semiconductors will continue to dominate for the next three to four years, Frost & Sullivan projects that they will be overtaken by SiC and GaN semiconductors over 2027 to 2030.

To learn more, please access Strategic Analysis of WBG Semiconductors in Power Electronics Applications for EVs, Forecast to 2030, Strategic Analysis of Disruptive EV Start-ups, 2023, the forthcoming Gigafactory Analysis, Forecast upto 2030, or contact [email protected] for information on a private briefing.

Government Regulations and Shift to New Electrical Vehicle Architecture to Drive Demand

Government regulations, including those promoting powertrain electrification, are accelerating EV market growth and, by extension, demand for WBG semiconductors. In a virtuous cycle, the ability of high-voltage, high-performance SiC and GaN powered semiconductors to improve charging capabilities, reduce charging time, boost component efficiency, and lower power losses will drive EV development. In 2022, EV sales in North America surged to almost 300,000 units, almost doubling sales volumes from 2021. OEMs like Tesla, Ford, Hyundai, Kia, GM, Lucid and Rivian are adopting WBG / compound semiconductor technology in their current and upcoming vehicles.

A range of benefits— efficiency, robustness, and compactness, among them—will underpin the use of WBG semiconductors in EV powertrain components, such as main inverters, onboard chargers (OBCs), and converters.

Meanwhile, OEM adoption of 800V electrical architecture will result in a doubling of WBG semiconductor content in EVs over 2026 to 2027. The transition from 400 V silicon (fast charging system) to 800 V silicon carbide (ultrafast charging system) device technology, represents the ability to realize cost effectiveness with low losses for mass production. Therefore, OEMs will use SiC MOSFET semiconductors in their 800 V system architectures.

Simultaneously, advances in material chemistry will be accompanied by innovations in design and manufacturing processes. As startups and semiconductor firms push forward on innovation to address the demands of the rapidly expanding electric powertrain industry, intense competition is set to ensue among WBG market participants over the next 5-10 years.

A Market with Exciting Growth Potential

With over 40 competitors, North America’s sizeable WBG semiconductor market is characterized by high degrees of fragmentation, providing opportunities for new entrants. Major competitive factors include cost, performance, technology, reliability, supplier’s relationship, and OEM’s relationships, among others.

Today, the market has leading competitors like Infineon Technologies, STMicroelectronics, Microchip Technology, Texas Instruments, NXP Semiconductors, Wolfspeed, Qorvo, onsemi, GaN Semiconductor Systems, Qorvo, Navitas Semiconductor, and Odyssey Semiconductor, among many others.

Demand for high-capacity batteries, high power motors, and fast-charging capabilities for EVs will boost demand for both SiC and GaN WBG semiconductors. According to Frost & Sullivan, the WBG semiconductor market in North America for EV powertrain systems is set to hit around $2.5 billion by 2030. An overwhelming 90% of WBG semiconductors will be used in main inverters in EV powertrains, with the remainder in OBCs and DC-DC converters.

The US CHIPS and Science Act 2022 will reinforce the development of domestic semiconductor manufacturing. A slew of financial incentives is encouraging several suppliers to ramp up investments in manufacturing facilities. For example, TSMC is poised to establish a new $12 billion facility, Intel is set to invest almost $20 billion in two new semiconductor plants, TI is pumping $30 billion into chip manufacturing, while Wolfspeed has committed $1 billion towards expanding its SiC semiconductor manufacturing plant.

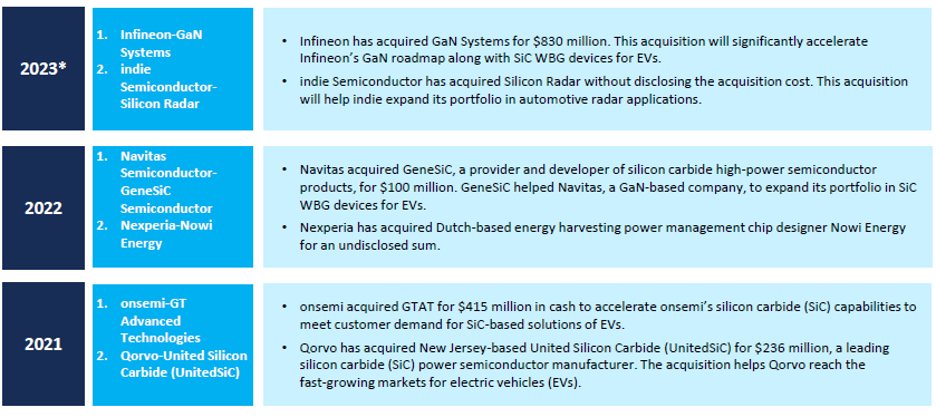

Collaboration and Consolidation are Key Themes

There has been a flurry of mergers & acquisitions across the semiconductor ecosystem as suppliers have sought to expand their portfolios and leverage anticipated demand for WBG semiconductor devices – including GaN and SiC semiconductors – from EV OEMs. For instance, Infineon acquired GaN Systems for $830 million in 2023 to fast-track its GaN roadmap and reinforce its existing SiC WBG capabilities. Navitas acquired SiC high-power semiconductor developer GeneSiC in 2022, thereby adding SiC WBG expertise to its existing competencies in GaN technology. Other notable acquisitions over 2018-2021 include onsemi’s of GT Advanced Technologies, Qorvo’s of UnitedSiC Semiconductor, Infineon Technologies’ of Cypress Semiconductor and Microchip Technology’s of Microsemi.

Similarly, with a view to optimizing cost and performance, automotive OEMs are investing in SiC and GaN-based semiconductor technology. For example, Mercedes Benz has invested in Wolfspeed SiC Technology, while GM and Lucid have adopted Navitas’ and Wolfspeed’s WBG semiconductor technology, respectively, in 2023.

Our Perspective

Frost & Sullivan projects prices of SiC and GaN semiconductors to rise by 1.5 times over the next 4-5 years due to high demand and launches of new EVs with 800 V architecture. This makes it incumbent on automotive OEMs and Tier I suppliers to establish clear, fixed-price contracts with material suppliers. Simultaneously, automotive OEMs and semiconductor Tier II/Tier III suppliers will need to establish long-term strategic partnerships to optimize demand value and supply chains.

In parallel, the shift of the EV industry from silicon to SiC and GaN-based semiconductors will highlight the need for both skilled workforce as well as capacity expansions.

According to Frost & Sullivan, establishing WBG semiconductor chip manufacturing plants near automotive EV manufacturing plants will be critical to ensuring the smooth functioning of supply chains. This strategy will become increasingly crucial as demand booms in conjunction with the shift to 800 V architecture.

WBG semiconductor suppliers should leverage the incentives offered by the US Chip Act to diversify production capacity, invest in R&D, and collaborate with academic institutions and the government to create training and skilling programs.

With inputs from Amrita Shetty – Senior Manager, Communications & Content, Mobility