The COVID-19 vaccine is at least 12-18 months. Implementation of better global public health policies and responsiveness to a pandemic may have resulted in the spread being nipped at its bud. The viral spread has driven key shifts: Factories have shut down, corporations are stepping up to help build ventilators, generative manufacturing is helping in innovative ways (printing ventilator valves), technology is helping with remote work, telehealth is poised to emerge as a preferred medium for non-COVID health issue resolution and many more shifts are on the horizon.

First, as realized by many, this is a medical crisis and not a financial one. At the same time, we don’t know if there will be another wave down the road. However, the recovery for industrial and energy markets will be driven by two main things:

Pent-up demand: Restricted movement, production delays, consumer demand drops, delayed plant shutdowns, and turnarounds will progressively open up as the situation improves.

Preparation for uncertainty and volatility in the future: Government stimulus packages will be another chief driver of growth. Corporations will also need to be astute to prepare for possible pandemics in the future. Supply network resilience, integrated business planning, business simulation to understand what-if scenarios, inventory management, additive manufacturing would be key areas of focus.

How does the recovery look like for industrial and energy markets?

Industrial: Corporations are still reeling under the shock of new normal scenarios. This new normal includes re-allocation of the workforce, business priority shifts and adapting to an uncertain scenario. While COVID-19 is a common factor, specific critical issues are impacting every industrial market. Herein lies the complexity to analyze the recovery. At a high-level, we can expect broad-scale normalization mid-way 2020, but this entirely depends on the tipping point of COVID-19. The domino effect on how inter-connected the industries have become is an interesting point to note (for ex: Refining and its impact on chemicals. Subsequent impact of automobile production on chemicals). I have tried to make sense of industries, based on our market understanding.

1. Food & Beverage, Consumer Packaged Goods: An uptick of consumer demand for basic needs will continue to drive growth for these two industries. It is ‘make hay while the sun is shining’ scenario for these two industries. Corporations that have consistently invested in digital (connected machines, warehouse automation, product traceability, etc.) will be able to see better profit margins as top-line increases. The majority of production lines are highly automated, requiring minimal workforce to manage these assets. However, the availability of raw materials might impact the industry. Low-medium impact

2. Medical Devices, Electronics and Semiconductors: The majority of the hi-tech space has consistently invested in automation and digital technologies. A few years back, I visited a semiconductor manufacturing facility in Milpitas and another one (recently) in Austin. The shop floors were pretty much run by robots and algorithms. Hence, I expect the impact on this to be low. Low impact

3. Lifesciences: Similar to the electronics industry, the lifesciences industry will see renewed focus as drug needs will increase and Governments will ask for better preparedness for a potential next wave. More emphasis will be placed on clinical R&D, drug discovery, etc. As the industry focus shifts towards drug discovery, production operations will see a transformation. Micro factories, single-use technologies, continuous manufacturing, outsourcing of plant asset maintenance will see rapid offtake. Low impact

4. Chemicals (Bulk, fertilizers, and specialty): Since automotive is a big user of chemicals, the decline in automotive production will squarely impact the chemicals industry. Organizations are already bracing for a tough 2020. Investments have been scaled back, plants are being idled, alternate revenue drivers (like sale of assets) are being pursued to unlock capital. As per ACC, 96% of all manufactured goods rely on chemistry. Some areas that will see growth are chemicals used in PPE, antiseptics, plastics, cleaning solutions, and industrial chemicals. Fertilizers could see a significant offtake, as Governments may make policy changes to drive security in regional food webs. Agriculture may also see an improved uptick, driving the consumption of fertilizers. Recovery is expected in Q4 2020. Moderate-high impact

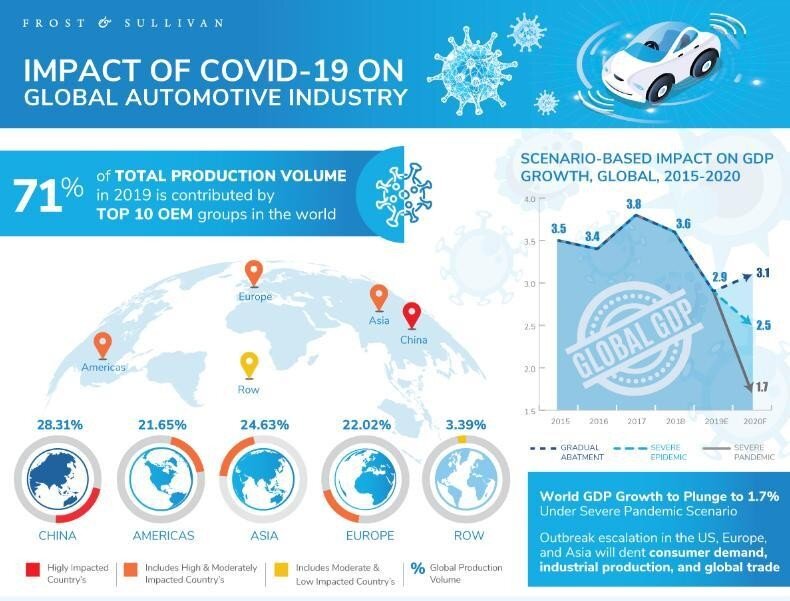

5. Auto and A&D: Most hit industry. Please see the infographic below on auto. Organizations like DAIMLER have shut down production in Europe for two weeks, which in turn has created a ripple effect in North America. Dependency on parts/inventory is the reason for this ripple effect. I am not entirely sure if its Factory 56 (a highly automated smart and digital factory) will become a standard for all factories within its portfolio in the future. The aerospace and defense industry is in a similar scenario/maybe in deeper trouble compared to the automotive industry, due to the impact faced by airline operators. Recovery in Q4 2020. High impact

Source: Frost & Sullivan

Energy markets:

1. Utilities and water: Essential services will not be hit. Industrial production hit may impact power consumption, but largely speaking – the power generation industry would see a low impact. Planned capital construction, shutdowns and turnarounds will be impacted as a large congregation of construction personnel will be avoided. This will impact EPC firms and their contractual obligations signed with operating companies. Renewable energy will also be hit, as the majority of raw materials (solar PV) are sourced from China. Even though China is inching back to recovery, operators may violate the contract and choose alternate/local suppliers. As workers remotely operate in these critical infrastructure facilities, utmost pressure will be on cyber resilience. At times of such connected work, cyber-attacks may peak. Like personal hygiene (hand washing for 20 seconds), practicing cyber hygiene could avoid attacks. Low-moderate impact

2. Oil & gas upstream: Price decline will have a massive impact on the industry. Operators have already scaled back on capital and operational expenditures. Our energy forecasts point out that, oil is here to stay. The OPEC price wars inadvertently could eke out smaller producers out of the market, leaving only the giants as viable players of the long game. Onshore/shale plays are pretty much un-profitable at $30/bbl. Supply is at an all-time high. Demand is low, primarily due to less consumer fuel consumption and jet fuel. The recovery may not be sharp as industrial, but it is not going to be like a bathtub economic model too. As governments recover from COVID-19 and prepare stimulus packages for recovery, we are better prepared than before. The re-focus on energy issues will reset the price war and markets will ultimately recover. At the least, before Q1 of 2021. High impact

3. Oil & gas refining: One might imagine that low oil prices might give a boost to refiners across the world. However, industry operations are people-intensive. China, for instance, cut back on refinery production and is poised to impact its economy. At the same time, refinery majors in the US and EU have consistently invested in ‘above site’ management to monitor, manage and control facilities in an exception based style. The impact would be moderate, as a drop in demand on one side is offset by the consumption of ethane and liquified petroleum gas. As more consumers face shelter in place situations, gas consumption may also see an uptick in the short-term. Moderate-High impact

While the world gradually finds its footing in unchartered territories, it is important to find order in chaos. In my next post, I will outline key growth opportunities across the industrial and energy markets.