Introduction on Beneficiation

Beneficiation is slowly evolving to become a value proposition for countries rich in minerals and resources. Beneficiation is considered the next gold mine for resource-rich governments and largely forms part of a government’s resource nationalism plan. More emphasis is on making the export of raw materials more expensive through taxes that would encourage manufacturing within the region. However, this strategy is not as simple as it sounds, and governments must implement the right strategies and create appropriate channels to generate value through the beneficiation process. The Sub Saharan African (SSA) region is a classic example, especially relating to diamond beneficiation, given it is besieged by high concomitant costs and poor productivity. Most rough diamonds from major centers such as South Africa and Botswana are exported to low-cost centers such as India for polishing, cutting, and jewelry manufacturing. In 2013, a poor volume of approximately 273,000 carats of polished diamond exports were generated out of 23 million carats of rough diamonds produced in Botswana. This volume accounts for a meager 1.2% of rough diamond conversions within Botswana, resulting in the region losing out on tremendous value and revenue generation from the other processes of diamond beneficiation. The various governments across the SSA region are now adopting policies to change this trend as they realize beneficiation could well be the instrument where a particular country’s resource is used as a competitive edge to harness it into a region-based competitive advantage. This change in thought process, from where SSA started to now, presents beneficiation as an opportunity for the region rather than an obstacle.

The Current Case of Africa’s Diamond Beneficiation

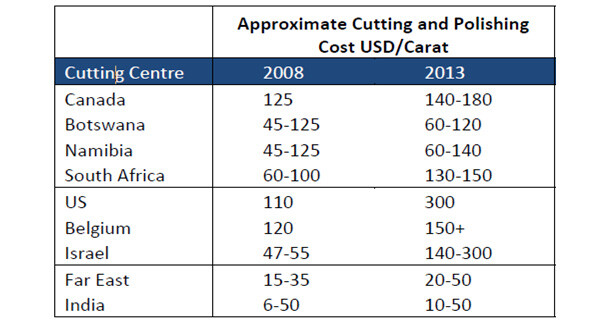

The SSA region is currently unable to use the advantage it has from the rough diamonds it generates on a large scale. Despite similar labor costs between Botswana and India, costs associated with cutting and polishing are higher in Botswana. As of 2013, the cutting cost per carat varies from $60 to $120 in Botswana, as compared to $10 to $50 in India. Another important aspect to consider is the number of cutters in operation in both these countries. India has approximately 900,000 cutters, compared to 4,000 cutters in Botswana, thereby making the region highly counterproductive. These factors have resulted in Botswana being 6 times and 3 times more expensive for small and large stones, respectively, when compared to those in India. The table below provides the costs pertaining to cutting and polishing per carat across different countries.

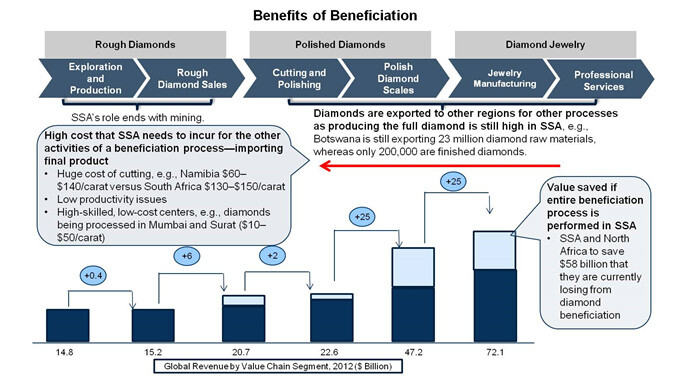

Another aspect to consider is the benefits SSA stands to lose, given its role ends with the mining process comprising exploration and rough diamond production. The chart below shows the potential value savings from which SSA would likely benefit if the entire end-to-end beneficiation process is performed in that region.

The diamond beneficiation chain is considered one of the largest worldwide, in terms of value creation. According to the above chart, value would increase multi-fold as it flows along the beneficiation chain until the final process. When diamonds are mass produced into jewelry, the market for rough diamond sales generates $14.8 billion, and revenue triples to $47.2 billion. When mass-produced diamonds are sold at retail, revenue from the rough diamond sales process increases nearly five-fold to $72.1 billion, which means the region stands to benefit by approximately $58 billion if it plans to conduct the entire beneficiation processes within SSA. The greatest value add comes from non-mining sectors such as large-scale jewelry production and retail sales, which are currently not the case in the SSA region.

So What Is Likely to Change?

Diamond-producing countries are looking at different methods to generate more value from diamonds produced from their mines, given these mines typically have a limited shelf life. Such regions are looking at opportunities to realize value generation arising from cutting and polishing activates, which would increase local employment, and to benefit from any value-added activities emerging from a competitive diamond mining and processing destination.

Governments across the SSA region have started to re-assess in terms of how to make the SSA region a beneficiation hub that would generate tens of thousands of employment opportunities. These governments have already started to liaise and negotiate closely with trade unions and workers that would allow them to be more productive. Different regions within SSA have started to demand a higher proportion of allocated diamonds from the rough diamond distribution of De Beers, one of the major suppliers of rough diamonds. For instance, the Botswana government has started to extract a greater share of unprocessed diamonds for the next couple of years. Alternatively, the local government has started to distribute approximately 15% of production from Debswana, which is a mining firm comprising a joint venture between the Botswana government and De Beers. These activities will bring about a decline in diamond processing across other regions worldwide, given there is a potential decline in availability of rough diamonds produced by De Beers. This decline has brought about a change as De Beers predicts that over the following years, approximately 50% of high-quality unprocessed diamonds will be delivered to diamond producing regions.

In addition, major rough diamond-producing nations have started to pressure cutting and polishing operators to move closer to the producing region to allow for the creation of local diamond manufacturing hubs, which could largely impact low-cost centers such as India, which is considered the largest diamond processing center.

The above table shows how newer workarounds have impacted the other global regions, in terms of reduced employment generation and reduced revenues and profits from the overall diamond industry.

Conclusion

With more revenue to be generated, governments across the SSA region have started to take beneficiation processes more seriously. Integrating new policies is showing some impact in terms of creating value across the region. Nonetheless, the process is still slow, and by 2020, SSA will likely become one of the major epi-centers for the beneficiation of minerals and resources.