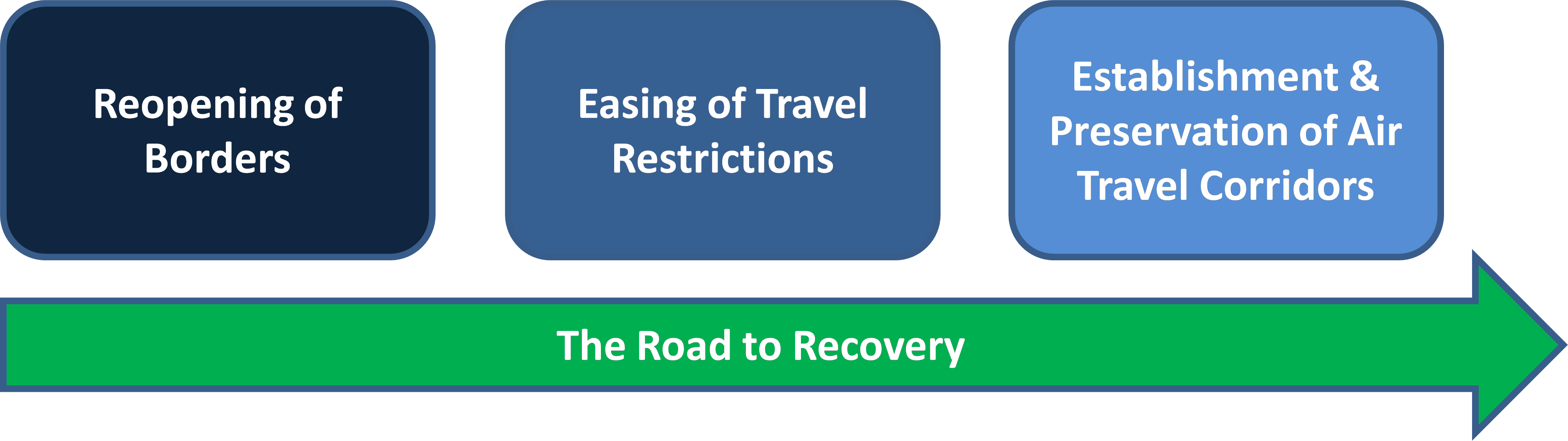

While the question of when premium traffic will make a comeback is something that is in the mind of every executive in airline boardrooms across the world, a more immediate question is what will it take for this all-important segment to take off again. Similar to leisure traffic, the underlying base requirements will be the same: reopening of borders, easing of travel restrictions, and preservation of air travel corridors.

The glimmer of hope provided to airlines in this corridor along with other airlines in their respective corridors globally, however small within the global context, came to a grinding halt with the announcement of new lockdown measures by the UK Government on 5th February 2021. Despite having ample capacity available, this latest development presents significant uncertainty and planning challenges yet again for airlines.

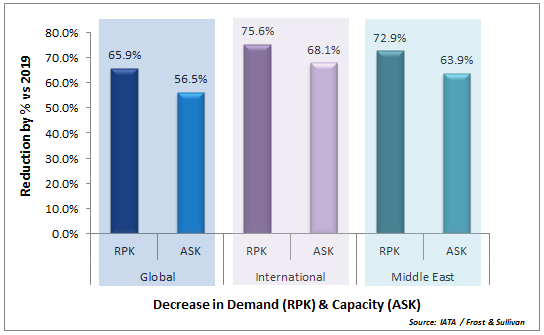

With the release of its 2020 full-year global passenger traffic results, IATA has confirmed what was already known within the industry: the industry is in dire straits, with 2020 officially the worst year in the history of air travel. With global passenger demand plunging by two-thirds compared to 2019, airlines have suffered extensively despite globally available capacity also shrinking by nearly 57% in the same period.

While domestic demand fared comparatively better with a decrease in demand just short of 49%, this provides little consolation for incumbent airlines of the Middle East. Particularly within the GCC, airlines are dependent on international demand, which declined by a disastrous 75.6%.

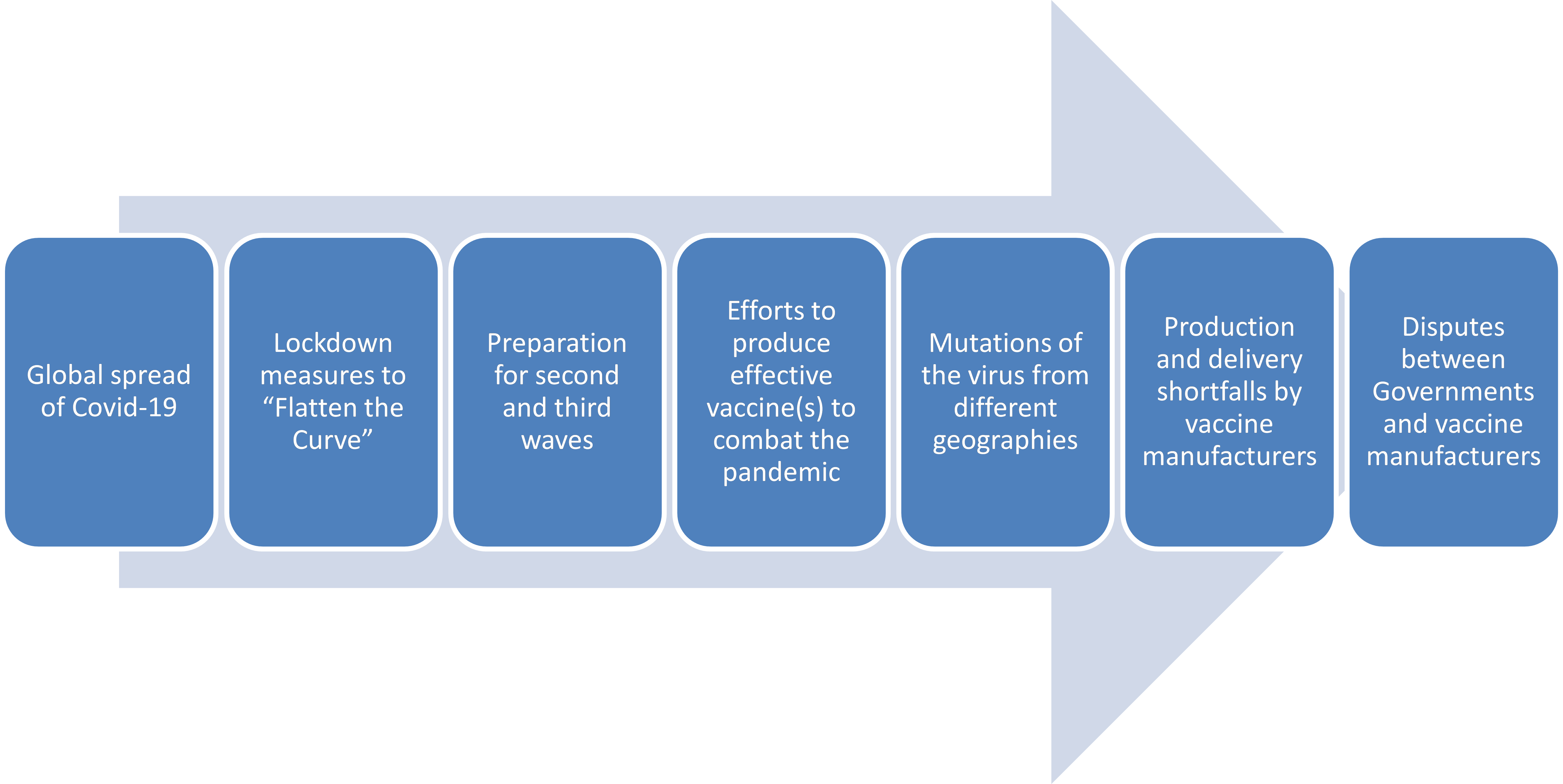

Today’s scenario is very different – not only is the world and its economies more interconnected than ever before, but we also have an ongoing global pandemic. Furthermore, the persistent lack of a truly globally coordinated approach to deal with the pandemic has meant that no two countries have been the same with regards to the spread of the pandemic, their response to it, or in the roll-out of their vaccination programs.

This will have distinct and substantial effects not only on changing trends within companies regarding corporate travel but also on the business models of a vast majority of airlines, going forward.

Corporate travel managers are likely to have additional concerns and a more complicated process flow when it comes to deciding and arranging travel for their employees. At a high level, these can be categorized as below:

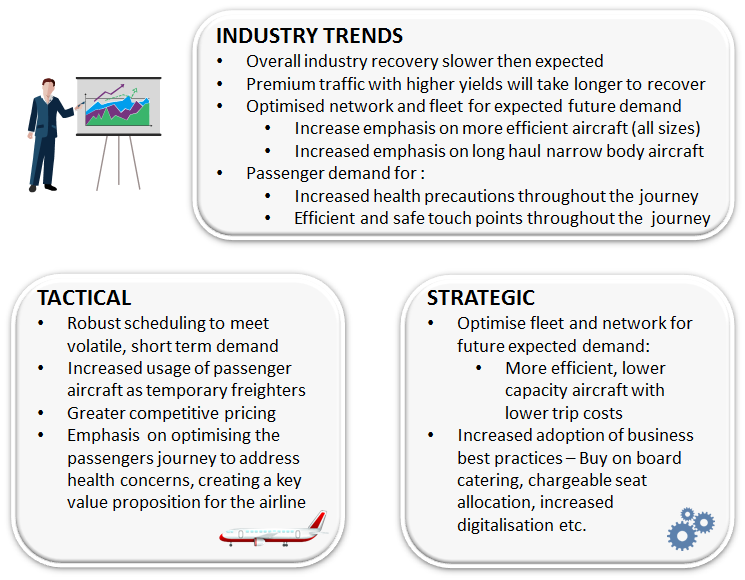

In general, airlines face momentous challenges but only a limited arsenal with which to deal with them. With cash liquidity being the most important part of this arsenal, through strong cash reserves or governmental support during the crisis, airlines are limited in their ability to respond to such drastic changes in the market.