Electrification, connectivity technologies, and alternative flexible fuels will add impetus to market development.

By Shraddha Ramdas Manjrekar, Industry Analyst – Mobility

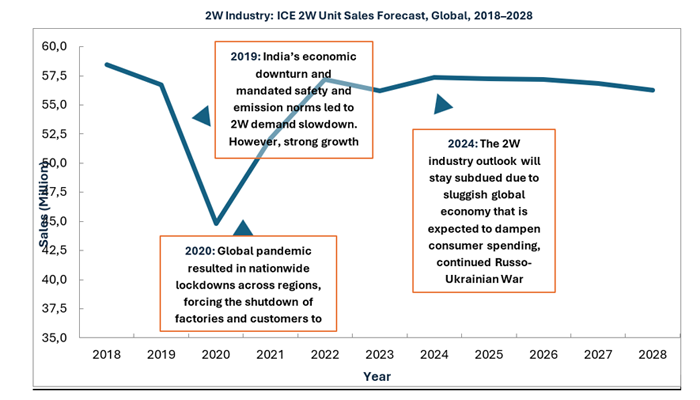

The global two-wheeler (2W) market—comprising motorcycles, scooters, and mopeds—has experienced tremendous growth in recent years. Led by South Asia, APAC and ASEAN, annual sales are set to increase to almost 56.3 million in 2028. Evolving consumer demands, including personal mobility needs and the rising appeal of adventure motorcycles among younger age groups, are providing a fillip to growth prospects. On the supply side, established 2W manufacturers are launching new ICE-powered models with advanced features.

The continuing popularity of ICE 2Ws notwithstanding, a major trend has been the rising appeal of electric two-wheelers (E2Ws). Several leading 2W manufacturers have been ploughing investments into new electric models.

To learn more, please access: Global Two-wheeler Growth Outlook 2024, Strategic Analysis of Battery Chemistries in Electric Two-wheelers and Growth Opportunities, Growth Opportunities for Electric Vehicle Battery Salvaging in Europe and the United States, 2024 to 2030, or contact [email protected] for information on a private briefing.

Strategic Focus Areas in 2024

- Diversification and Portfolio Expansion

Surging demand will emphasize the need for strategic expansion, whether in terms of geographic footprint, portfolio diversification, or technology access. Global expansion strategies will be driven by a localized manufacturing approach. This is likely to take the form of establishing local manufacturing facilities in high-growth potential markets or entering partnerships with or acquiring local brands to strengthen a business presence in these regions. Portfolio expansion will take the form of diversifying into new business segments like electric solutions, semiconductors, or component manufacturing. Another focus area will be strengthening access to advanced technologies and implementing digital solutions with a view to accelerating product development.

TVS Motor’s investments in companies like the Swiss e-Mobility Group (eBikes), Drive X (2W leasing), Killwatt, ION Mobility (eMobility,) and EBCO UK as well as the SAR Group’s diversification into E2W mobility are reflective of such trends.

- Integration of Connectivity and Vehicle Telematics

2W manufacturers are collaborating with telecom companies to fast-track the development of embedded telematics and mobile connectivity services in their offerings. Many are assessing new business models, including innovative subscription models such as pay-as-you-go with the aim of tapping into diverse customer groups and offering flexible financing alternatives. Assistive technology will gather momentum as OEMs look to improve driver/road safety and offer immediate emergency assistance. The focus will be on high-impact features like theft detection and tracking and built-in navigation, among others. Illustrative of such trends is Pierer Mobility’s partnership with Sibros, incorporating the in-vehicle and cloud applications supported by the Sibros Deep Connected Platform, with a view to boosting the performance of its motorcycles.

- Circular Economy and Sustainable Practices

The need to reduce carbon emissions in the supply chain is highlighting the importance of partnerships with suppliers that commit to responsible sourcing practices and resource sustainability. Investing in technology start-ups with certified recycling practices and the development of closed-loop recycling processes are poised to further the circular economy agenda. Increasing the use of recycled content and sustainably sourcing materials in production reinforce the thrust towards sustainable practices. Collaboration across the E2W ecosystem is crucial to enable circularity and sustainable practices. Examples of such trends abound. For instance, Harley-Davidson launched a pilot program to collect and refurbish used LiveWire motorcycles. Suzuki uses recycled aluminum in motorcycle frames and is exploring closed-loop recycling partnerships. Gogoro created its own ecosystem with sustainable technology—battery swapping, a virtual power plant, and Smart Gen—for an efficient energy distribution strategy.

Our Top Predictions

In 2024, the industry will grow by 1.6% to reach annual sales of 57.1 million ICE 2W units. Overall industry performance will remain sluggish amid tight financing and reduced confidence. However, with gradual economic growth, demand will increase in the second half of the year.

South Asia will perform well, with India leading ICE 2W sales and introducing new 2W models with advanced features in the 125cc and above segments. The rural market will continue to recover and support demand uptick in the country.

The E2W industry will grow in South Asia, APAC, and ASEAN as traditional brands such as Hero Motocorp, Bajaj Auto, TVS Motor, Yamaha, Honda, and Suzuki launch new E2W models and governments promote electric vehicle (EV) policies in these regions.

Connectivity and telematics will be crucial in driving the demand for 2W features such as navigation, GPS tracking, emergency assistance and safety, convenience, and personalization for individual and commercial riders. Subscription plans for advanced features will provide recurring revenue streams.

In 2024, top players in the Indian market will introduce motorcycles that run on alternative fuel technologies such as flexible (flex) fuel—a blend of petrol and methanol/ethanol (biofuel) that is cheaper than petrol—to support policymakers’ initiatives and provide sustainable mobility alternatives, setting the stage for wider adoption.

Our Perspective

The future of the 2W industry hinges on collaboration and innovation. Partnerships between established manufacturers, technology start-ups, and government bodies will be crucial for developing a robust 2W ecosystem, including E2W.

Governments in various regions are encouraging flex fuel to address increasing gasoline prices and pollution issues. Sugarcane and corn processing companies can collaborate with 2W OEMs to explore production, usage, and supply opportunities.

Traditional 2W OEMs must launch strong hybrid 2W models with functionalities such as advanced start-stop and electric motor drive. Traditional OEMs like Yamaha, Hero MotoCorp, and Kawasaki have already launched hybrid 2Ws. In turn, last-mile delivery companies can collaborate with OEMs to source these models for their fleet operations. Government incentives will further accelerate the adoption of hybrid systems in 2Ws.

Any focus on maximizing growth potential in emerging markets must look at entry-level 2W models to make them more affordable and expand the market reach to a larger customer base.

With inputs from Amrita Shetty, Senior Manager – Communications & Content, Mobility