In an ambitious attempt to accelerate the advent of “Zero Emission Mobility”, Germany’s Bundesrat (a legislative body representing 16 states of Germany) has passed a resolution that bans the use of internal combustion engines (ICE) by 2030 in Germany. Key area of concern for the German government is the effect of diesel on automotive industry and environment, which resulted in many original equipment manufacturers (OEMs) to pursue unethical means to meet diesel emission norms.

German Bundesrat has also urged the European Union (EU) Commission to review the taxation practices that stimulate emission free mobility. The incentives provided by the EU states on purchasing electric vehicles (EVs) have not been able to match the low cost of diesel fuel coupled with high mileage. Frost & Sullivan anticipates this (if mandated) would result in higher taxation of diesel and gasoline fuel and powertrains across the industry. The taxation would discourage OEMs to manufacture the ICE powertrains and help governments develop the economy required to facilitate the transition to electrified mobility.

The Cascading Effects of the Resolution

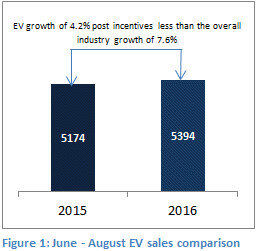

As of May 2016, Germany has started providing incentives of nearly $4,455 for EVs and $3,340 for plug-in hybrids (PHEV). The incentives are provided to meet a target of 500,000 EVs and PHEVs sales by 2020. This would represent 13.8% of the market by 2020. However, these incentives have not impacted the sales of EVs in the past 3 months. Between June – August 2016, 5,394 EVs and PHEVs were sold which is a growth of 4.2% year on year which is less than the total passenger car market growth of 7.6% during the same period, suggesting that the incentives have not been effective. The resolution (if mandated) would initiate policies to tax Diesel and Gasoline fuels and powertrains to narrow the gap of the price difference of ICE vehicles and EVs. Frost & Sullivan expects Germany to frame its policies in the coming years (2016 – 2026) to discourage the manufacturing of ICE vehicles for domestic consumption through steadily increasing taxation and duties.

Although Bundesrat has no direct control over the EU Commission, the country historically has had an influence over the EU Commission’s decisions due to its economic power and contribution to EU. If the resolution is mandated in Germany, EU Commission is likely to mandate it across its member countries within a span of 5 years. Considering the recent price decline of fuels, EU spends $580.8 million per day to import oil or $212 billion per year. The shift to “Zero Emission Mobility” would directly save $148.4 billion per year; moreover, the shift energy production through renewable sources would enable EU to save $212 billion per year. This would also increase opportunities in infrastructure development, research in battery technology, packing, designing, and recycling and development of EVs; which would directly boost job opportunities and economic growth.

The biggest effect of the resolution would be on the OEMs, which are anticipated to increase their R&D budgets for the development of EVs. This would result in higher job opportunities and enable the OEMs to expedite the launch of EVs in various markets such as the United States.

Impact on Automobile Manufacturers

By 2030, Europe passenger car market is forecast to manufacture 20.2 million vehicles per year, of which Germany alone would account for 19.7% or 4 million vehicles per year. Currently, all the German automakers are availing PHEV versions of their flagship models. However, development of EV platforms will be critical for OEMs to compete and grow in the European market. Volkswagen, BMW, and Daimler are among the first to develop dedicated EV platforms. VW alone expects 30 models to be manufactured on the modular electric vehicles platform (MEB) architecture, which is capable of producing 3 million EVs by 2025. Ford, which is the third largest OEM by sales in Europe, has developed EVs and battery capability. However, these vehicles are built on their global platforms which lack the optimization for competitive pricing. Hence by 2020, policies in Germany would force manufacturers to develop dedicated EV platforms to compete in the German market.

Battery accounts for over 30% of the vehicle cost, although technology breakthrough would bring the cost optimization down to 10%, economies of scale would be crucial to cut the production costs by up to 35%. Investments in battery production would be one of the biggest challenges for OEMs. VW has announced its $11 billion plan to develop a battery plant in China. The resolution is expected to result in OEMs such as BMW, Daimler, and Ford to explore partnership opportunities and investments in battery plant.

Key Challenges

From oil cartels to battery cartels – China, South Korea, and Japan accounted for 88% of the global lithium-ion battery (LIB) production in 2015. Japan is the largest producer of LIB with an annual production of 13.62 GWh, closely followed by China with an annual capacity of 11.15 GWh and an additional 38.52 GWh in pipeline is anticipated to make China global leader by 2020. The United States is anticipated to become the second largest manufacturer of LIB with an annual capacity of 44.07 GWh by 2020 (annual capacity 8.92 GWh in 2016).

The focus of LIB manufacturing in China and the United States might force the German government to enter free trade deals for batteries with China to reduce the impact of battery imports. Moreover, batteries are the largest cost factor in vehicles and carry a significant economic value add in the supply chain. Europe would lose the opportunity to capitalize on this resource.

Infrastructure – The relatively small size of European countries (in terms of square miles) has given EV manufacturers the benefit of mileage per single charge. However, the charging time will be the major challenge for the OEMs to address. Battery swapping technology is gaining popularity to address this challenge, but the high costs for setup and purchase would require compensation from the government. TankTwo has addressed this challenge through its patented battery packaging technology, yet the product has not been commercially used.

Conclusion

EU is currently pushing for a Zero Emissions Target by 2050 for all industries including energy production and automobile. Norway was the first to propose zero emission vehicles policy which if mandated will get into effect by 2025. Now Germany has also passed the resolution to ban ICE by 2030. These initiatives, if mandated, would help rest of the world to benchmark policies that facilitate this transition. Furthermore, if mandated Germany would witness massive economic gains from reduced oil imports ($23.3 billion per annum) and increase in job opportunities and economic growth through EV infrastructure research and development. This would also enable the automobile supply chain in Europe to gain competence in mass manufacturing EVs enabling them to explore export opportunities.