New Leadership for India’s Central Bank

As the global economy will have to cope with the implications of Brexit over the next few months, India in particular will have to deal with its own exit situation—that of Raghuram Rajan from the Reserve Bank of India (RBI). With Raghuram Rajan choosing not to continue his second term as RBI governor after September 4, 2016, the baton to spearhead the country’s monetary policy will be passed on to a newly appointed official, marking the first time in RBI’s history since 1992 that a governor will leave after the first term. With an impressive career track including the position of Chief Economist at the International Monetary Fund (IMF), known for his prediction of the 2008 credit crisis, and having brought about positive measures for India’s stability, Rajan’s stepping down most definitely comes as a loss to India.

The Years of Rajan

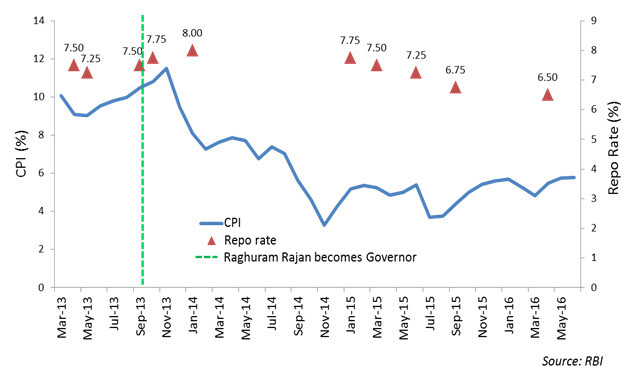

Raghuram Rajan took to office in September 2013 at a time when the economy was in crisis with staggering inflation, declining currency value, and rising bad debt incidence. Set to fight the inflation battle, just two months into office, the repo rate1 was raised twice to touch 7.75% in October 2013. The rate was again raised in January 2014 to 8.00% and held constant for the next year despite increasing pressure to cut the rate. Helped partially by these measures, India’s consumer price index (CPI) fell from a high of 10.50% to 5.19% between September 2013 and January 2015. In tandem with lesser inflationary pressures in the subsequent months, the RBI adopted a more accommodative monetary policy, with consecutive slashes in the repo rate.

Consumer Price Index (CPI)2 and Repo Rate, India, March 2013–June 2016

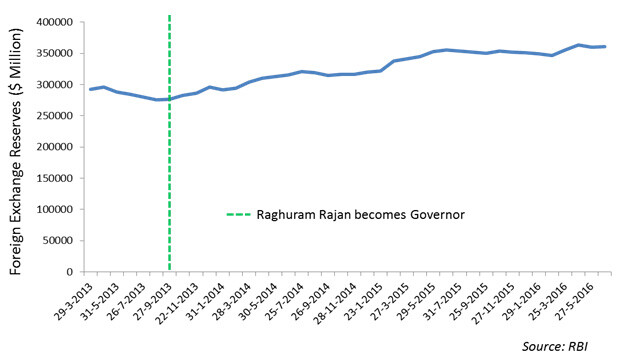

Helping to increase India’s foreign exchange reserves and minimize the risks of currency depreciation, the RBI in September 2013 introduced a scheme that allowed for the swapping of dollar funds in Foreign Currency Non-Resident (FCNR) deposits to rupees at a forward rate a 3.5% per annum compared to a market rate of about 7%. FCNR deposits allow Non-Resident Indians (NRIs) and Persons of Indian Origin (PIO) to open and maintain term deposits in permitted foreign currencies for a minimum and maximum term of 1 to 5 years respectively, with risks attached to currency fluctuation being undertaken by the banks. Banks, in turn, sell the foreign currencies in exchange for rupees at the prevailing exchange rate (using the rupees for lending activities) and enter into forward contracts for the purchase of foreign exchange. Given that the forward rate offered by the RBI was lower than the market rate, it incentivized banks to raise FCNR dollar funds, in turn allowing the RBI to augment the country’s foreign exchange reserves. The RBI’s swap window was only open until November 2013 and permitted only the swapping of funds in deposits with a minimum maturity period of 3 years and lock-in period of 1 year.

Foreign Exchange Reserves, India, March 2013– June 2013

Supported by this scheme, the buying of dollars in the spot market, and other measures, the country’s foreign exchange reserves have been expanding and have grown to touch $360.80 million for the week ending June 24, 2016 from $292.65 million for the week ending March 29, 2013.

Given the mammoth problem of bad debts and the fact that Indian banks had several undisclosed bad loans in their balance sheets, the RBI conducted an asset quality review during August-November 2015, forcing banks to reclassify stressed assets into non-performing assets (NPAs). Helping banks to manage these bad loans, the RBI in June 2016 introduced a provision allowing banks to bifurcate the loans into sustainable and non-sustainable debt. The sustainable debt is that which is deemed repayable and which the borrower is expected to continue repaying. The unsustainable debt can be converted into equity.

Apart from helping to control inflation, shoring up foreign exchange reserves, and addressing the problem of bad debts, Raghuram Rajan can also be credited with the setting up of a large loan database, licensing of niche banks (small finance banks and payment banks) and other positive measures, which have helped enhance the monetary system and bring about macroeconomic stability.

The Road Ahead

Based on an agreement between the RBI and the government in 2015, it was agreed that the CPI target range for 2016–2017 onwards would be between 2-6%, with deviation from the target range for three consecutive quarters requiring an explanation from the RBI. It is likely that this target will be retained. Given the rising inflationary pressures between April and June 2016 with a CPI reading of 5.77% in June 2016, it would appear that immediate large cuts to the repo rate might not be the best way forward. If, however, inflationary pressures are successfully managed and the CPI is brought down by about 1%, it would then become safer to pursue a more accommodative monetary policy.

On the currency front, given that the RBI has successfully shored up foreign currency reserves, India is currently in a good position to defend its currency. However, with FCNR deposits maturing between September and November of this year (given the 3-year minimum maturity period on deposits raised back in 2013), there is likely to be a huge outflow of dollars from the country. In this situation, the onus of maintaining dollar and rupee liquidity will fall on the new RBI governor.

Sustained monitoring and addressal of the bad debt situation by the new RBI governor will also become very important in order to augment credit growth and in turn help accelerate India’s economic growth.

The list of hopefuls for the position of the new RBI governor has now been narrowed down to 4 candidates including the current and former RBI deputy governors and State Bank of India (SBI) Chair. The new governor will have to take up the responsibility of preserving macroeconomic stability and will play a highly influential role in maintaining India’s position as the fastest growing major economy. With Raghuram Rajan’s term set to expire in about a month, India is keenly awaiting the government’s decision on the new appointee who will steer the country’s monetary policy.

1Repo rate: The rate at which the RBI lends to commercial banks

2CPI is calculated using 2012 as the base year