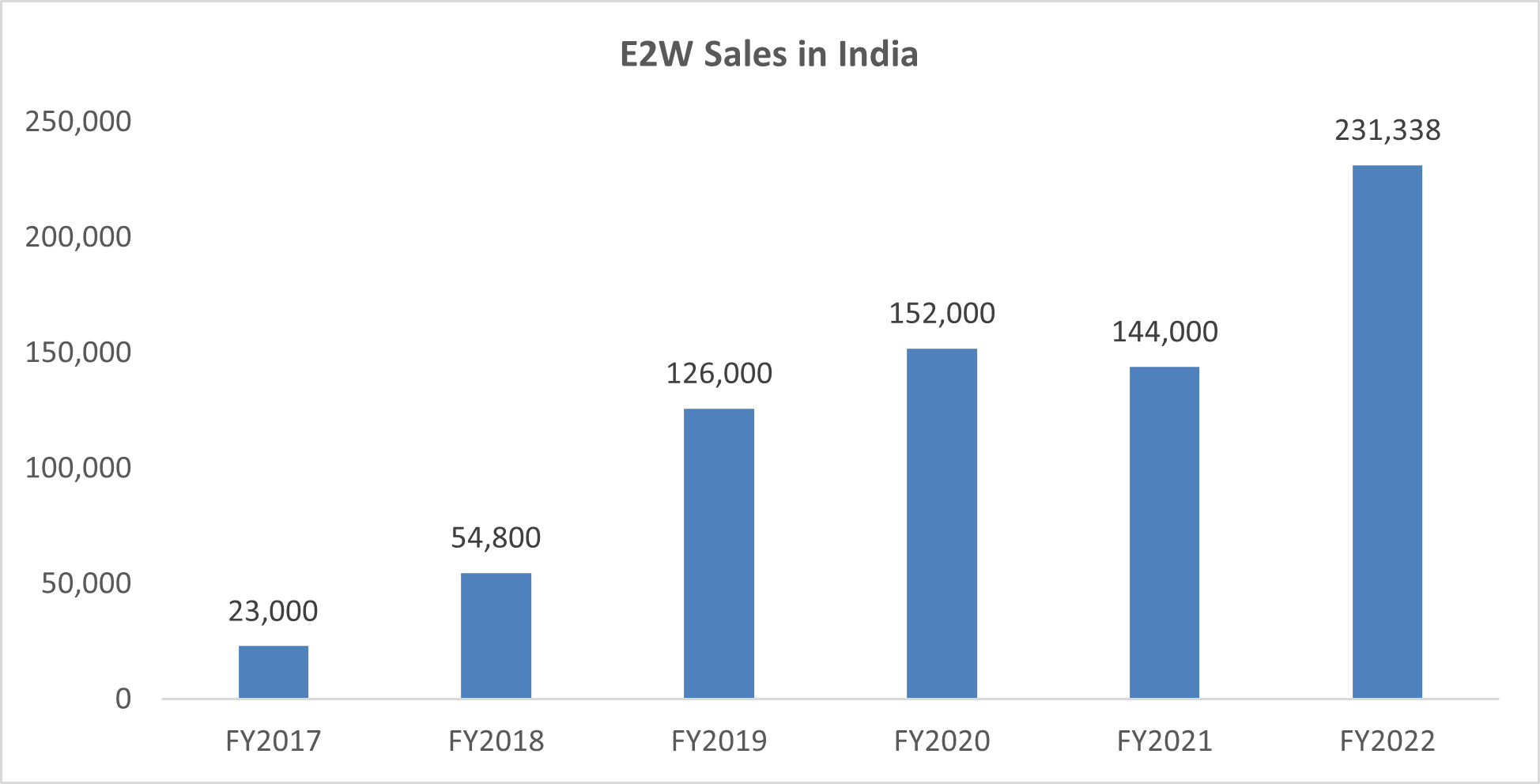

India has set sweeping goals in its bid to accelerate the country’s transition to green mobility. Among the key milestones envisaged in the journey to decarbonized transport include electrification of 80% of two-wheelers and 30% of passenger cars by 2030. In a sign of steady progress, recent official statistics highlight that collective sales of electric two-wheelers (e2Ws), three-wheelers (e3Ws) and four-wheelers (e4Ws), crossed the magic one million mark in FY 2023. Promisingly, this marks a 153% increase in EV sales in FY 2023.

Sales across every major segment – two-, three- and four-wheelers – have more than doubled. Data from the Society of Manufacturers of Electric Vehicles (SMEV), the country’s leading EV industry body, reveals that e2Ws accounted for 62% of the industry’s total sales, driven by a tripling of e-scooter sales.

Source: Frost & Sullivan, 2023

Nonetheless, penetration rates of e2Ws remain low at just under 5% of the total two-wheeler market. Such low penetration is attributed to concerns over safety as well as lack of affordable financing. Indeed, apart from fixing technological snags, the role of expanded financing access will be crucial to scale up vehicle electrification.

To learn more, please see: Growth Opportunities for Two-wheeler Financing in India, Top 10 for 2023: Growth Opportunities for the Two-wheeler Industry, or contact [email protected] for information on a private briefing.

The NITI Aayog has asserted that EV financing in India could represent a market size of Rs 40,000 crore by 2025 and Rs 3.7 lakh crore by 2030.

With an eye on boosting financial access and employment generation, it has recommended that lending by banks and non-banking financial companies (NBFCs) for EV purchase should fall under the rubric of the Reserve Bank of India’s (RBI) priority-sector lending (PSL) guidelines.

Increasing competition in the 2W financing space, in general, reflects the increasing participation of NBFCs and fintechs. In coming years, competitive intensity will be aggravated by companies looking to leverage opportunities in the high-growth potential e2W market.

Promisingly, technology is making financial instruments accessible to a larger audience. The incorporation of blockchain, machine learning, and artificial intelligence with financial software has streamlined processes, widened consumer accessibility, and rationalized operating costs for financial institutions. The trend of integrating these technologies is picking up momentum and is set to continue over the next 4-5 years.

Collaborations are also being seen as crucial to competitive survival. Such convergence is already evident as fintech, OEMs, and other e2W stakeholders have been partnering to rapidly grow their consumer base. The convergence trend started in 2022 and is projected to continue over the next 2 to 3 years.

Increasing electrification, the emergence of fintechs, and improved private banking services, meanwhile, are set to transform competitive dynamics. These trends will result in a whittling of the traditional dominance of NBFCs in the 2W financing market.

A View from the Other Side: A Roadmap for e2Ws Lenders

In the coming years, market participants in the E2W financing space will need to prioritize certain key areas. Firstly, digitalization aimed at streamlining processes and expanding accessibility to consumers. This will be a powerful tool with which to boost lending in rural and semi-urban areas, and drive uptake of e2Ws.

Secondly, India’s booming eCommerce market will have a domino effect on market prospects. Last-mile delivery fleets are open to exploring innovative financing business models, such as leasing and subscription, with many preferring to use e2Ws for their logistics operations. This enterprise sector, therefore, will be a strong growth driver for e2Ws and, by extension, of e2W financing.

Thirdly, India’s e2Ws and its allied financing market will also receive a shot in the arm from disruptive start-ups. New fintech companies are offering novel and flexible solutions that support improved transparency, accessibility, and simplify the entire financing processes for e2Ws.

Another factor that will impact e2W financing is the recent revision in FAME 2 subsidies. Incentive per kWh of battery capacity is set to fall from the current ₹15,000 per kWh to ₹10,000 per kWh from June 1, 2023. In addition, there will be a cap on incentives as well as a downward revision from 40% to 15% in the total incentive amount applicable on ex-factory prices. While subsidy reductions will result in a hike in e2W prices, they will also spur OEMs and other stakeholders to innovate in terms of design, features, and business models. Considering this major change, e2W financing companies will have to be more creative in devising financial offerings and business models that ensure the continued affordability of e2Ws to price-sensitive Indian consumers.

| FAME 2 Subsidy Reduction on e2Ws | ||

| Existing Subsidy | Revised Subsidy (wef 1st June 2023) | |

| Incentive per kWh of battery capacity | Rs.15,000 | Rs.10,000 |

| Total incentive amount Applicable (ex-factory price) | 40% | 15% |

| Incentive Cap Amount | Cannot exceed Rs. 1.5 Lakh | |

Source: Frost & Sullivan, 2023

Disruptive approaches will be crucial as despite government support for electrification and increased consumer demand, prices of e2Ws still remain relatively high. The development of new business and ownership models by both fintechs and OEMs will need to be geared towards making e2Ws a financially viable option for consumers. In parallel, NBFCs and e2W life cycle management companies will need to deepen partnerships to offer consumers more attractive e2W financing options.

And, lastly, India’s e2W space is a fast evolving one in which collaboration will be vital to ensuring the survival of major stakeholders, including OEMs, banks, financial institutions, and fintechs. Collaborative models will allow partners to offer consumers a wider range of ownership and business models like subscription, leasing, and rental; offer various financing options, and distribute products across multiple platforms.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility