Policy initiatives to strengthen electric vehicle (EV) ecosystem align with US government’s focus on clean transport and domestic manufacturing expansion.

By Sanchita Mendiratta, Industry Analyst – Mobility

Electric vehicle (EV) sales in the US crossed the four million mark at the end of June, underlining the rapid pace of market development. Unlike Europe which has been at the forefront of vehicle electrification, uptake has been sluggish in the US. Now, however, a clutch of factors such as improved production capacity, expanding charging infrastructure, falling prices, and enabling government policy are accelerating the transition from conventional fuel powered cars to EVs.

With supply chains having stabilized, manufacturing output has been rising to keep pace with surging demand. Agreements to extend the use of Tesla’s supercharger network – which accounts for almost three fifths of fast chargers in the US – to automakers like Ford and GM is set have a beneficial impact in terms of alleviating range anxiety linked to limited charging infrastructure. Such positive trends are being reinforced by price cuts from market leader, Tesla, as it strives to maintain its dominance amidst intensifying competition.

To learn more, please access Global Policies and Regulations Supporting Electric Vehicles by Region and 2023 Prediction of Global Electric Car Growth Outlook or, contact [email protected] for information on a private briefing.

Policy Impetus is Key

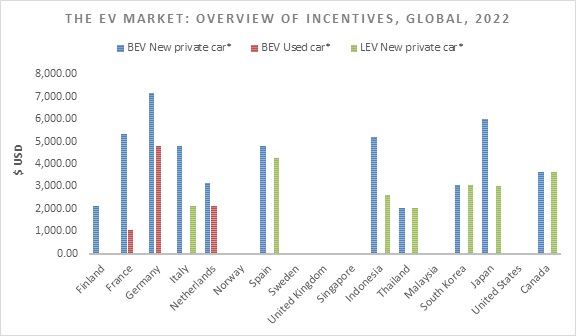

Government support has been a major growth driver for EV markets, worldwide. Confronted by the climate change crisis and the urgent need to embrace carbon neutral practices, governments have been championing electrification as a way to reduce carbon emissions and move towards sustainable transport alternatives. This has taken the form of a raft of tax credits, subsidies and incentives aimed at encouraging EV adoption.

While initial purchase tax benefits on light EVs (LEVs) and battery EVs (BEVs) have been commonplace in Europe and Asia, depreciation write-offs have been more widely favored in the US. Policy support in the US includes tax credit of up to $7,500 on the initial purchase price of new plug-in hybrids (PHEVs) and electrified light commercial vehicles (eLCVs) and a slightly lower incentive of 30% up to a maximum credit of $4,000 on used cars for individual buyers. The tax credit for business owners is marginally higher with a maximum credit of up to $40,000. Moreover, the government offers a tax credit of 30% or up to a maximum of $1,000 towards installing a home EV charger.

In tandem, the US government as part of the Bipartisan Infrastructure Law is pledged to investing $7.5 billion towards EV charging, $10 billion for clean transportation, and over $7 billion for battery components and critical materials. A government statement declared that the aim of these programs is to “complement the Inflation Reduction Act’s landmark support for advanced batteries and new and expanded tax credits for purchases of EVs and to support installations of charging infrastructure.”

Another important initiative from the Department of Energy (DoE) will see an investment of $7.4 million across seven projects in twenty-three states to promote EV charging and hydrogen corridor infrastructure development.

The US government’s agenda foresees a national network of 500,000 EV chargers by 2030, at least 50% of vehicle sales to be electric by 2030, and100% zero-emission federal fleet procurement by 2027.

Our Perspective

Although the US is committed to vehicle electrification and is among the largest EV manufacturers globally, it still trails Europe in terms of progressive legislation. For instance, unlike Europe, the US does not have zero emission targets. Nevertheless, both the private sector and the government have been demonstrating strong intent to push the EV agenda. So far, participants in the EV ecosystem have pumped in nearly $100 billion to ramp up EV, battery, and charger manufacturing.

Progressive policies will need to continue their focus on extending tax benefits to consumers. Making tax credits easy to avail and consistently highlighting the fiscal and non-fiscal benefits accrued from EV usage will reinforce positive consumer sentiment towards EVs. Tax breaks can also be extended to automakers in order to promote technology innovation and lowered production costs. In a virtuous cycle, this will allow for more affordable EVs and higher demand.

Collaboration across the ecosystem will be crucial. Larger automakers will need to collaborate with their smaller counterparts to help them improve scale and reduce vehicle delivery wait times. Simultaneously, partnerships with technology startups will support a stream of innovative offerings. Meanwhile, the US government will need to work with market participants to achieve supply chain resilience in terms of crucial components and raw materials required for EV production.

Batteries are vital to the development of the EV ecosystem. Targeted investments will help boost production and lower battery costs even as collaborative strategies will ensure uninterrupted supply of critical raw materials, such as nickel, lithium, cobalt, and graphite.

With inputs from Amrita Shetty, Senior Manager, Communications & Content – Mobility