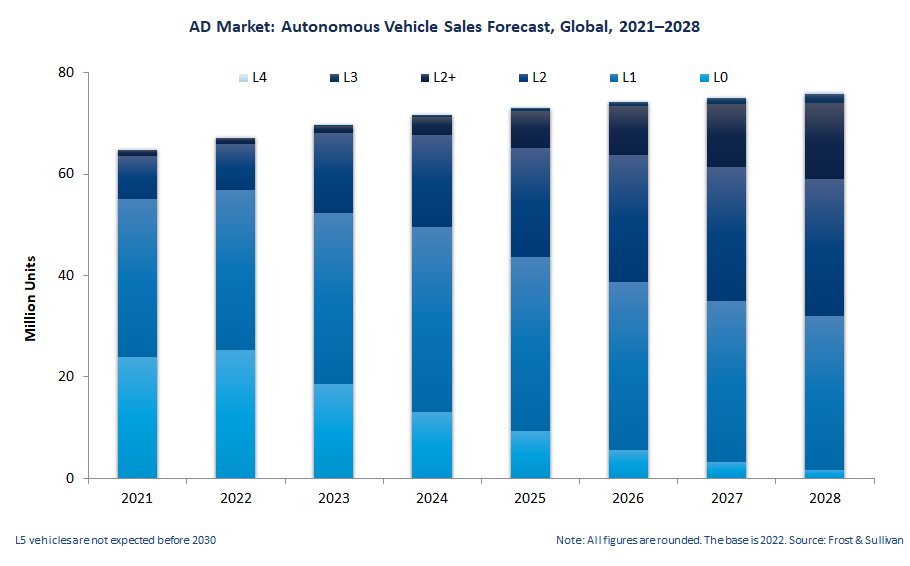

The pandemic and semiconductor shortages proved a double whammy for the automotive industry, disrupting value chain components supply, delaying technology introduction, and triggering a shift in consumer preferences. As economies floundered and vehicle sales dipped, OEMs and value chain partners realigned their R&D initiatives, product development strategies, launch timelines, and long-term roadmaps to respond more effectively to this challenging environment. To generate short-term returns, capital investments were reprioritized, being diverted away from Level 4 (L4) autonomous driving (AD) towards assisted and piloted driving.

Recently, automotive technology company Veoneer entered into an agreement to provide high definition 8 MP cameras for BMW Group’s vehicles. The camera, positioned behind the rearview mirror, tracks the forward path of the vehicle to deliver highly accurate information to the vehicle control system.

In other words, we will see BMW’s next generation of AD systems underpinned by a combination of its current AD stack with Arriver’s vision perception and NCAP drive policy products on Qualcomm Technologies’ system-on-chip. The objective here is to enable industry-leading AD functions that cover NCAP, Level 2, Level 2+ and Level 3.

Veoneer’s camera heads are aligned with the ongoing shift towards central and scalable software architecture and are pivotal to the sensor suite that will form the foundation of next-generation AD platforms.

To learn more, please access our research report – Global Advanced Driver Assistance Systems (ADAS) and Autonomous Driving (AD) Industry, Outlook 2022 or contact [email protected] for information on a private briefing.

Our perspective – Vision-based systems are key enablers for ADAS and AD

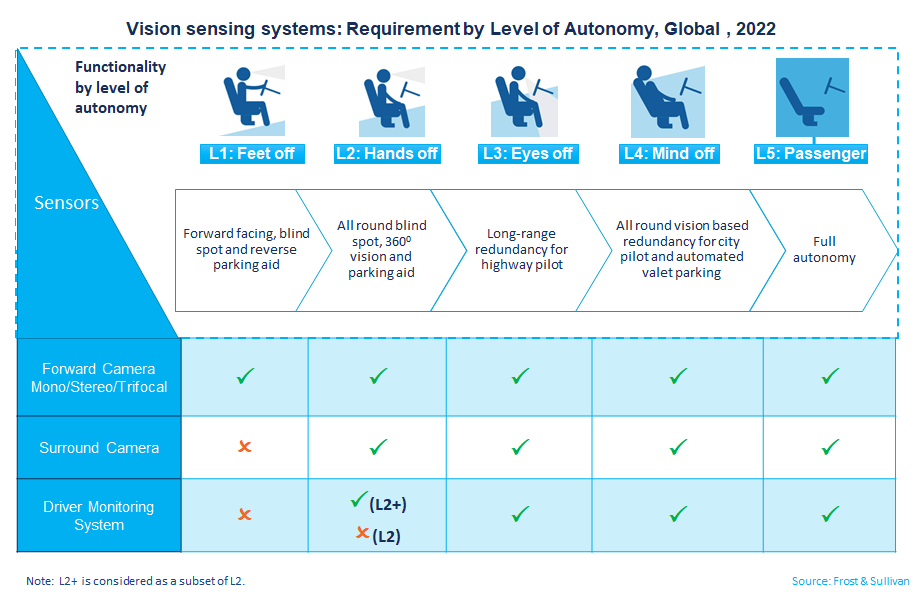

Vision-based systems are key enablers for ADAS and AD. Vision systems are a critical part of the L1-L5 sensor suite, which requires up to two forward-facing cameras. Simultaneously, 360° perception sensors such as surround-view cameras are gaining popularity for low-speed applications, such as parking assist and reverse assist.

In terms of technology, we will see OEMs offering cost-effective, camera-based L0 and L1 ADAS features in lower segment vehicles (A, B, and C). Cameras that offer better price-performance value for ADAS applications compared to other perception sensors such as Radar and LiDAR will continue to hold appeal. This will be crucial to increasing the penetration of ADAS systems in emerging markets like India.

We will see vision-based systems precede perception sensor suites for ADAS and AD. Vision-based ADAS systems in modern vehicles typically comprise two core components – a camera module or embedded vision system and ADAS algorithms. Camera-based ADAS systems accurately detect and recognize other vehicles, pedestrians, traffic signs, obstacles, and lane lines, among others. ADAS and AD perception sensor suites comprise forward-facing, rear-facing, and surround-view cameras. This is critical for applications like traffic sign recognition, blind-spot detection, pedestrian detection, lane departure warning, driver monitoring, collision warning, and parking assistance.

For L2 and above applications, vision-based systems act as a primary sensor or complement the information detected by other sensors in the sensor suite, such as Radar and LiDAR. However, barring a few key regions such as North America, the EU, and parts of APAC, including Japan and China, the penetration of L2 and above is still very nascent.

Global OEMs such as Ford, GM, and Nissan, use camera systems as a critical part of their sensor suite for driver assistance packages such as Ford Blue Cruise, GM Super Cruise and Nissan Pro Pilot Assist in regions such as Europe and countries such as the US, Japan, and South Korea.

Other tier suppliers such as Qualcomm have also developed advanced vision systems for autonomous driving.

Autonomous Vehicle Development Picks Up Momentum

Findings from our recent research into the global advanced driver assistance systems (ADAS) and AD industry highlight the increased proliferation of L1 and L2 ADAS across all vehicle segments, with significant market penetration in countries like South Korea, Japan, and India.

The adoption of Driver Monitoring Systems is set to rise due to regulatory mandates in regions like Europe and the widening use of assisted and piloted driving. DMS is proposed to be made mandatory in North America and China by 2023.

In Europe, the EU General Safety Regulation (GSR) has mandated ADAS systems such as autonomous emergency braking (AEB) and lane-keeping assist (LKA), qualifying all vehicles at L1 by 2022. In Europe, in addition to progressive regulations, the high cost of L3 automated lane-keeping systems (ALKS) features will drive the L2 and L2+ assisted market.

In APAC, Japan has been the first country to launch L3 with the launch of the Honda Legend in 2021. The road has now been paved for L3 market take-off in Japan.

Meanwhile, led by Hyundai-APTIV, GM Cruise, and Waymo in the usership market, we will see the L4 robotaxi market begin proliferating by 2024 across North America and the EU.

Focus on Affordability

“Currently, the main limiting factors for ADAS and AD adoption are affordability and regulations. In cost-sensitive markets like India, the development and introduction of affordable vision systems will pave the way for greater penetration of ADAS technologies into the entry- and mid-segment passenger cars, thus enhancing vehicle performance and safety,” says Kamalesh Mohanarangam, Research Manager, Mobility Practice, Frost & Sullivan.

In India, only a few OEMs, such as Mahindra and Morris Garages offer ADAS features such as Adaptive Cruise control with stop and go, lane keep assist, and traffic sign recognition. Honda has announced the L2 ADAS sensing suite in all upcoming vehicle models from 2022. Other OEMs such as Maruti and Hyundai are expected to launch ADAS in India by 2023. Major tier suppliers such as Continental and Bosch are also developing affordable camera solutions for ADAS applications, specifically for emerging markets such as India.

Schedule your Growth Pipeline Dialog™ with the Frost & Sullivan team to form a strategy and act upon growth opportunities: https://frost.ly/60o.