Business Case for Adopting DPG in Southeast Asia

During the summer of 2015, the Philippines experienced a severe power crisis characterized by rolling blackouts or ‘summer brownouts’. It was observed that the utility had failed to meet the country’s power demand by as much as 1,000 MW, leaving quite a significant gap between electricity demand and supply. In neighboring Indonesia, the country’s utility PLN has estimated that there could be a severe power crisis in 2016, whereby electricity margin would decline to 16% (from 27-28%) in the areas of Java and Bali, which is far beyond the safe limit of 30% indicating a major cause for concern. These cases cannot be ignored as one-off cases for the mere fact that blackouts such as these are common in these archipelagic nations. The topography of both the Philippines and Indonesia has made a cross-section of their islands inaccessible to the central power grid system, leaving them to the rescue of temporary stand-alone and backup power systems. Another country in Southeast Asia known for its pitiable state of electrification is Myanmar at 26%. As of 2014, 74.0% of the population in Myanmar (consisting of 55.0 million people) does not have access to electricity. Additionally, the high transmission line loss to the extent of 25.3% makes the power infrastructure system a weak one.

It would take decades for the power utilities in the aforementioned countries to strengthen the power supply through large-scale power plants. However, the sheer magnitude of the ongoing power crisis calls for an immediate short-term solution. Utilities are, therefore, driven to look beyond the scope of their traditional business models, and are increasingly willing to shift toward the concept of aiding and adopting distributed power generation (DPG) solutions through decentralized systems.

DPG Market: Regional Hotspots

In terms of application, DPG solutions provide a strong support system to aid the development of base-load, peak, and emergency power operations. Looking at the present scenario, it is quite axiomatic that countries with poor electrification rates, such as Indonesia, Myanmar, and the Philippines have been the front runners of the DPG solutions market. As per Frost & Sullivan analysis the overall DPG solutions market in Southeast Asia had an installed base of 20,450 MW in 2015, and is forecast to reach 34,747 MW by 2020. Out of this, Indonesia has the largest share in the market with an installed base of 8,570 MW closely followed by the Philippines and Myanmar.

Customers Spoilt for Choice with a Plethora of Technologies

Diverse technologies ranging from diesel engines, gas engines, renewable energy (RE) systems such as wind power, solar power, and small hydropower to hybrid systems have been deployed for DPG projects in these countries. Customers and project developers are spoilt for choice with the sheer range of DPG technologies available in the market that can be selected based on fuel availability in the chosen project site, power output requirements, and government incentives, if any.

In Myanmar, to manage the looming power crisis, the country has undertaken a few fast-track DPG solutions over the last two years where the fuel (natural gas) and project site have been provided by the utility. For instance, in 2015, Aggreko, a global DPG solutions provider signed a contract with Myanmar Electric Power Enterprise (MEPE) to commission a 95 MW natural gas DPG project to support the national grid during the peak summer month where drop in rainfall levels affects the hydropower output in the country.

Indonesia’s power demand is likely to rise from 249.3 TWh in 2015 to 353.4 TWh in 2020. This surge in electricity demand and delay in constructing the centralized power projects have forced the country to evaluate various power sources including renewable energy based DPG projects. Therefore, DPG solutions are increasingly being viewed as a remedy to Indonesia’s power market woes.

In the Philippines, the government has formulated the Interruptible Load Program (ILP) aimed at large commercial establishments to address its severe power crunch. Through this program, heavy electricity consumers such as commercial establishments and condominiums are expected to disconnect from the grid and turn on their generators when there is power shortage. This utilitarian system brought in by the government has been a novice strategy that has proved quite reliable, as large government-owned and controlled corporations (GOCCs) with backup generators bearing loads of more than 1 MW have voluntarily signed up for this program.

Even in countries like Thailand and Vietnam, where the power infrastructure is relatively good, DPG projects have seen strong developments. For instance, Thailand enjoys a strong track record of consistently meeting its RE targets aided by favorable policies and comprehensive regulations. On the contrary, Vietnam lacks a clear RE roadmap but adopts DPG solutions during the dry summer months to offset the reduction in hydropower output.

Fuel Availability is a Key Decision Making Criteria for DPG Project

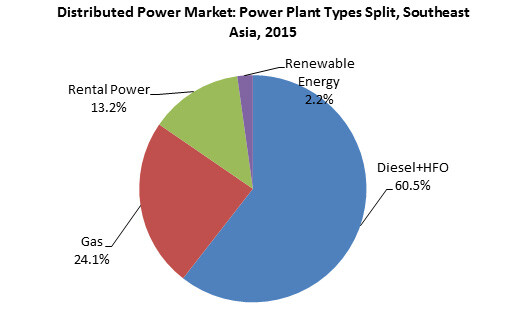

With a current installed base of DPG projects at 12351.8 MW, the above chart exhibits the dominance of diesel and heavy fuel oil (HFO) based DPG plants in the market. However, this equation is bound to change, as low carbon emission technologies are gaining considerable traction. Demand for gas-fired DPG systems is also on the rise, as a result of removal of diesel subsidies and plummeting natural gas prices and RE systems all over the region?. The recently concluded CoP21 Paris Climate Talks will bind countries to steadily shift toward the use of cleaner fuel-based DPG solutions.

Though there are immense opportunities and benefits that come along with the deployment of DPG solutions, the market is not bereft of challenges such as high cost of batteries for Solar PV and fuel supply contract risks that affect investment returns for project developers. However, the necessity of providing continuous and reliable power does not stop the utilities from adopting DPG solutions. Strong policy support coupled with a shift in a utilities’ business model is warranted for the Southeast Asian DPG market to thrive and unleash its true potential.