The recent partnership between German auto giant, BMW, and leading cloud computing solutions provider Amazon Web Services (AWS) underlines the critical need for effectively handling, processing, managing, and protecting vehicle data at a time when the automotive ecosystem is being transformed by C.A.S.E.

By 2030, over 95% of new vehicles are expected to come equipped with connectivity technologies. Frost & Sullivan research forecasts connected and autonomous cars to generate 1 zettabyte (ZB) of road and in-car data daily in 2030. Data-driven insights will be the building blocks to unlocking new direct and indirect revenue streams, designing lucrative business models, rationalizing costs, streamlining operations, and strengthening customer loyalty.

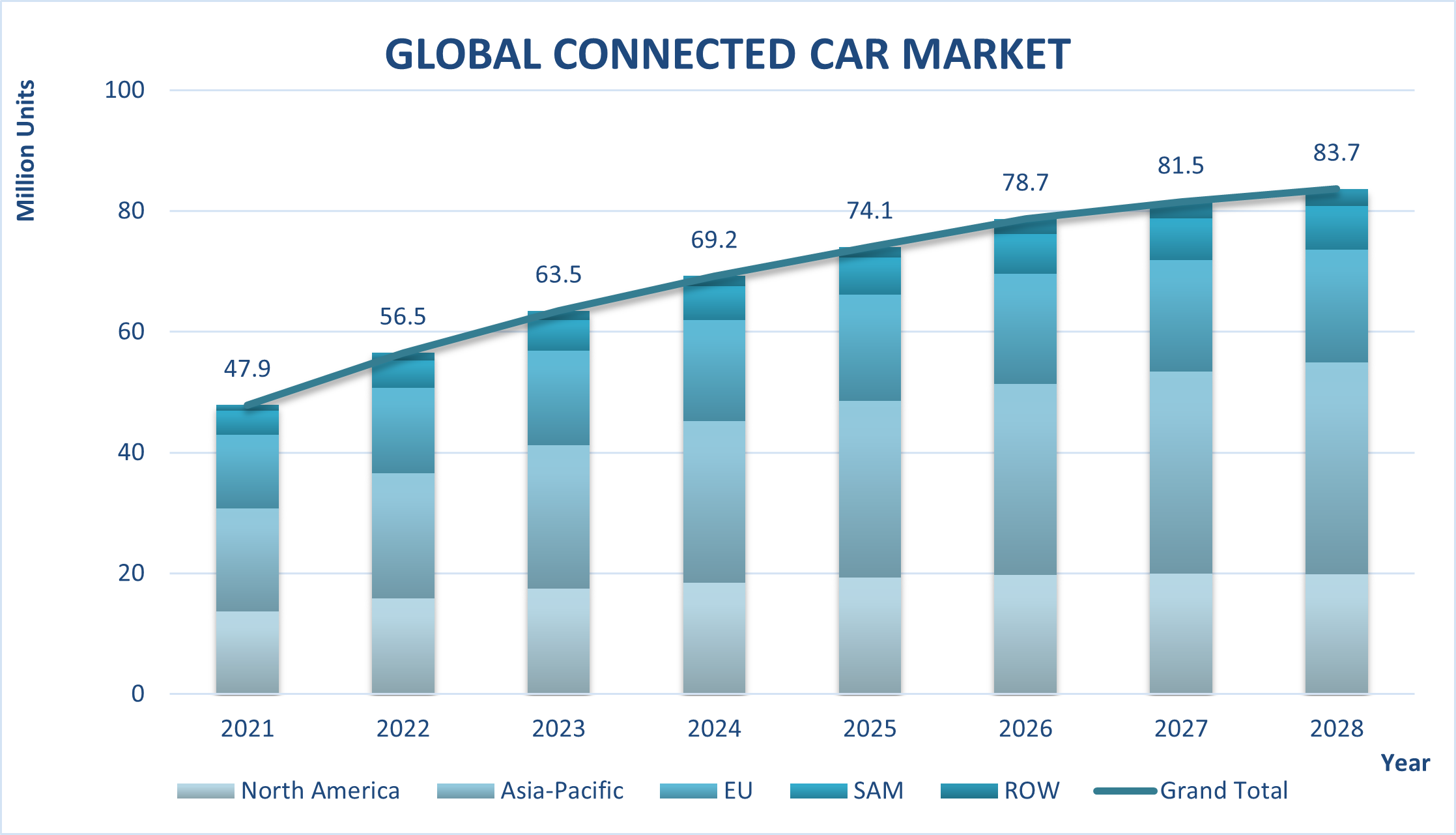

Global Connected Car Market, 2021-2028

Global Connected Car Market, 2021-2028

Source: Frost & Sullivan, 2022

Against this backdrop, the BMW-Amazon collaboration aims to optimize the data insights gathered from BMW’s connected vehicle fleet which currently stands at around 20 million vehicles to create more innovative services, functions, and features for customers. BMW claims that its connected vehicle fleet currently generates about 10 billion queries every day, highlighting the need for effective data management. In this context, AWS will provide the cloud infrastructure and services to facilitate the processing of vehicle data produced by BMW’s connected vehicles. The two companies are also working to develop commercial off-the-shelf cloud solutions for the secure management of vehicle data.

On the one hand, this partnership anchored in advanced cloud technology development seeks to improve the in-vehicle experience through over-the-air (OTA) updates, My BMW app, and driver assistance features. On the other hand, it aims to enhance associated areas like customer engagement and aftersales services.

BMW envisions using data insights to design innovative, high quality digital experiences for its customers. Provisional to customer approval, the company has also indicated the prospect of data being shared with other companies with the objective of fostering new applications.

As the quantum of vehicle data explodes, data protection and privacy are emerging as key focus areas. Here, the partners have put safeguards in place: processing will adhere to established data protection regulations, while data access will be restricted to the BMW Group.

To learn more about the latest trends and forecasts in the global connected cars market, please access our research reports – 2030 Vision of the Automotive Industry, Strategic Analysis of Google, Amazon, and Microsoft in the Global Connected Car Ecosystem, Global Connected Cars Outlook, 2022 or contact [email protected] for information on a private briefing.

Our Perspective

As has been widely discussed, cars have become more than a one time purchase product. Instead, automakers will leverage connectivity and service offerings to achieve competitive differentiation, growth, and monetization. Data-driven analytics will play a central role in revealing new revenue streams using mobility services and IoT applications.

OEMs and other relevant stakeholders are set to collect anywhere from between 15 to 100 parameters such as vehicle speed or vehicle condition from cars to build 40 to 50 use cases for each. Processing and managing connected vehicle data will be crucial from three perspectives. Firstly, for updates. Secondly, for data monetization. And, thirdly, for customer retention. Here, data-led strategies will help OEMs understand customers by analyzing data over the ownership life cycle to build customer loyalty through data-assisted customer support.

In terms of data driven monetization, connected mobility subscription services will offer direct avenues for revenue growth in the form of tolling, tax and usage-based insurance (UBI), predictive maintenance, navigation, and smart parking services. Indirect revenue streams will encompass more targeted R&D, emergency assistance services, software updates and early-stage recalls, and driver coaching.

“Although BMW and AWS are collaborating to develop cloud technologies, the BMW Group’s announcement that it will own the vehicle data is perhaps not surprising,” says Manish Menon, Program Manager, Mobility Practice, Frost & Sullivan. “Full ownership and control of vehicle data allows BMW to leverage the data to build monetizable applications and services, and thus a sustainable, alternative revenue source.”

Automakers will use cloud computing to gain powerful insights into customer needs – both met and unmet. Cloud-based data analytics will be used to improve the customer experience whether in terms of greater customization and convenience, sales and aftersales, in-vehicle entertainment and commerce, occupant comfort and convenience, or enhanced vehicle safety.

In essence, the BMW-AWS collaboration reflects the deepening collaboration between vehicle manufacturers and technology companies for data management and building IoT platforms for connected services deployment. Technology companies like AWS, Google and Microsoft are at the forefront of building a cross-industry partnership-based, data-led ecosystem that will revolutionize the automotive industry as value creation shifts from hardware to software and products to services.

Schedule your Growth Pipeline Dialog™ with the Frost & Sullivan team to form a strategy and act upon growth opportunities: https://frost.ly/60o.