The floods in India, the heatwaves in Europe, and the California wildfires can all be attributed to the deteriorating environment and the advance of climate change, which pose an existential threat to humans and nature. Endangered ecosystems can have a devastating impact on human health, biodiversity, and even the economy. The WWF has estimated that the economic value of water and freshwater ecosystems is equivalent to 60% of the global GDP. This immediately raises concern over the current water scarcity crisis, and how over $58 trillion can be easily lost in the coming decades. These effects of climate change are commonly referred to as climate risks, defined as “the potential for adverse consequences for human or ecological systems (…)”. According to the IPCC, these risks can arise from the potential impacts of climate change as well as from human responses to climate change. The multi-billion-dollar industry of Climate Technologies seeks to both mitigate these effects and adapt to the new reality they cause.

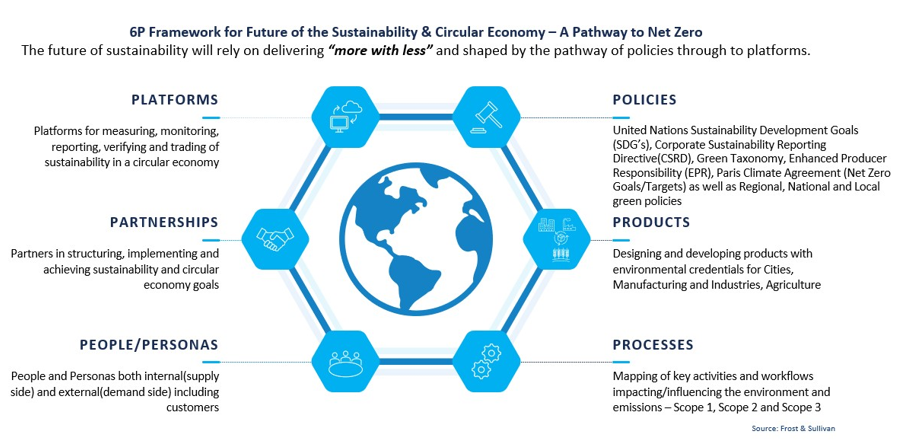

The contribution of climate tech companies towards the mitigation or adaptation to climate risks can be assessed through their commitment towards the Paris Climate Agreement, the Sustainable Development Goals, or their adherence to different standards, such as the EU Taxonomy for Sustainable Activities. Frost & Sullivan has devised the 6P Framework, a tool for analysis that considers the transition from policy requirements to the digital platforms that drive growth for sustainable technologies. Climate tech companies advance different SDGs according to the aspect of sustainable human development they focus on and adhere to a set of green taxonomy objectives depending on their solution. Still, most businesses integrate all the variables of the 6P Framework, seeking to ensure compliance with policies, partnering with other companies or organizations and digitalizing their solutions for widespread adoption and reach. This closed loop will be crucial in understanding this transition and its success.

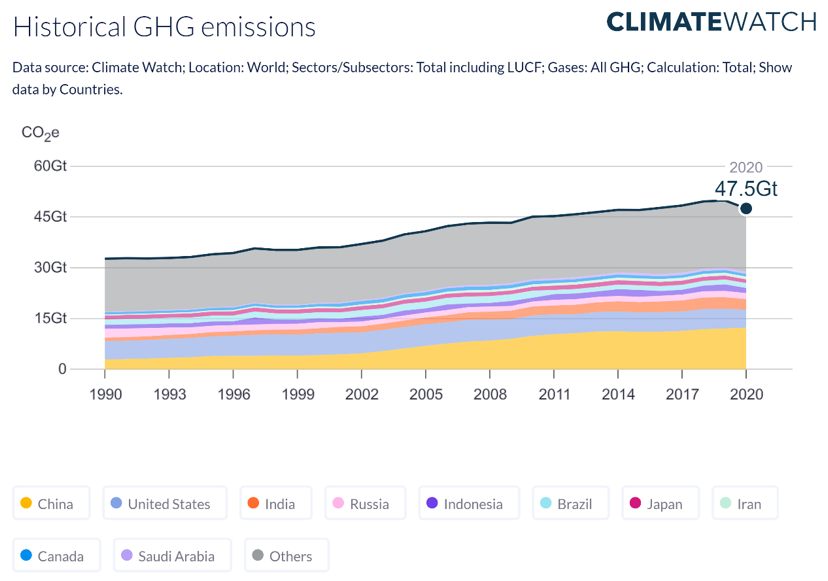

Given that the IEA claims that to achieve net zero, only 2/3 of the technology that would be required to reduce emissions is commercially available, the call for urgent action is evident. The growing amount of GHG emissions since last century has highlighted the need for technologies that can have a significant impact to halt this rise but also prepare the world for worst-case scenarios.

The overreaching effect of climate change calls for the development of technologies across various sectors, guaranteeing a holistic approach. While mitigation technologies seek to reduce or offset GHG emissions, adaptation technologies prepare communities to deal with risks, creating sustainable and resilient infrastructure, economies and services.

Some of the key Climate Tech clusters Frost & Sullivan has identified include:

- Alternative Fuels & Feedstocks

- Circular Economy Platforms

- Sustainable Food & Crops

- Protection of Nature & Biodiversity

- Infrastructure Resilience & Asset Risk Management, and

- Water Transition Technologies.

Some innovative businesses seek to transform the way we think of climate tech categories, focusing each cluster on how they can aid in the transition towards a climate-friendly economy, rather than the industry vertical they represent. Mazarine Ventures has put together a novel framework for analysis, categorizing the market into technologies for Observation (measuring and monitoring changes), Analysis (understanding trends and risks), and Addressing (tackling risks and doing something to reduce vulnerability). This categorization is extremely useful when understanding what the priorities of climate investment are and how they support the struggle against climate change.

The relevance of climate technologies has amassed over $20.6 billion in pledges from the Green Climate Fund members, the largest international climate fund presently. There are several disruptions that are driving growth in the market and are set to increase both funding sums and entities. On the one hand, the increasing body of regulation and the strengthening targets are compelling companies to invest in revamping their operations and products, both reducing the environmental impact of their supply chain by implementing net zero and low waste solutions and investing in carbon credits and nature restoration projects to offset their emissions. Similarly, governments are pressured by international organizations and other entities to increase their investment in climate tech, leading to the introduction of grants, subsidies and taxes to promote sustainable solutions. Key examples include the US Inflation Reduction Act, the EU Green Deal Industrial Plan and the Green Climate Fund. Public awareness and consumer demands are also crucial in urging companies and governments to commit to the climate transition.

Apart from the efforts that have been dedicated towards the decarbonization of highly polluting industries such as energy, transportation and manufacturing, which account for over half of the global total of emissions, some sectors need development due to their overlooked influence in mitigating and adapting to climate risks.

There is an increasing realization that the Climate Crisis is not just an Energy Crisis but also a Water Crisis. The call for technology development has been set on water availability and risk management, given that water quantity and quality will be central to sustainable development, affecting human health and infrastructure. Companies such as Desolenator and Oneka Technologies are revolutionizing the desalination market by offering desalination powered by renewable energy and Water-as-a-Service, respectively, reaching a wider audience and ensuring potable water supply; others, such as Waterplan, specialize in water risk mitigation, assessing current and future vulnerability.

Furthermore, infrastructure and asset risk management are an expanding cluster that seeks to prepare companies and individuals for climate disasters, controlling their vulnerability and looking for opportunities to reduce the incidence and cost of risk. From a prevention perspective, Arcadis leads the way in sustainable design and consulting solutions, including aiding businesses in their transition towards renewable energies and net zero facilities. At the same time, Swiss Re offers insurance solutions to manage uncertainty and the shock of a disaster.

A thriving market in the coming years will undoubtedly be the green hydrogen industry, which has drawn attention from across the globe as a substitute for traditional carbon-intensive fossil fuels. Accordingly, many companies have focused their projects on the development of this alternative fuel, with Baker Hughes partnering with Air Products to develop advanced hydrogen compression technology.

Lastly, advancements in food and crops are imperative to tackle growing food insecurity, an expanding population and land erosion. For yield enhancement, quality and quantity-wise, some farm management software such as AgroScout facilitates risk prevention and crop control. On the other hand, for sustainable farming promotion, Ucrop.it’s platform integrates actors across the entire agricultural value chain, sharing relevant farming data in exchange for benefits for farmers.

The imminent COP28 will be an excellent opportunity for businesses and governments to redouble their efforts and commitments towards climate tech, spotlighting adaptation technologies for a scenario in which net zero targets are not achieved, especially since the conference will be aimed at discussing emissions reductions, climate finance and climate action based on nature and people.

For our upcoming analysis on Growth Opportunities in the Global Climate Tech Market – Profiles of 100 Leading ClimateTech Solutions and Portfolio Companies, Frost & Sullivan has identified leading businesses in the industry and put together a database of over 300 organizations that are driving growth and innovation, selecting 100 pioneers in the market for in-depth analysis, according to proprietary and external frameworks and criteria.

To learn more about the implications of COP28 developments on your Growth Journey and to speak to Frost & Sullivan Growth Experts, contact Nimisha Iyer at [email protected]