The global automotive market has witnessed a rapid demand surge for EVs over the past two years. Despite the COVID-19 pandemic severely impacting the automotive market, EV sales saw record growth in 2020 and 2021. For instance, in 2021, global EV sales (BEVs and PHEVs) totaled around 5.8 million units, exhibiting a growth of about 79.3% over 2020. The market is expected to witness continuous double-digit growth over the next five years.

The growth will be driven by significant fiscal incentives such as purchase incentives and vehicle registration tax rebates implemented by governments across all regions. Further, the rapid decarbonization strategies by governments worldwide will contribute to EV sales growth. More than 20 countries worldwide have announced the phasing out of conventional ICE-based vehicles within the next 10-30 years, and over 100 countries globally aim to attain net-zero emissions within the next few decades.

Moreover, several leading OEMs have announced visionary plans to reconfigure their product lines for the expected electric vehicle boom. Some of the recent OEM announcements are listed below.

- Volvo aims for 100% EV sales from 2030

- Ford to have 100% EV sales in Europe from 2030

- General Motors would sell only electric light-duty vehicles (LDVs) from 2035

- Volkswagen announced 70% electric car sales in Europe and 50% in China and US by 2030.

- Stellantis announced 70% of EV sales in Europe and 35% in the US by the end of the decade.

Move from 400V to 800V battery systems – why?

EVs accounted for more than 9% of global car sales in 2021, a rise of nearly four times compared to 2019. And owing to the aforementioned factors, the penetration is expected to continue its high growth trajectory in the coming years. However, to become a viable alternative to the currently dominant ICE-based vehicles, the next-generation EVs need a longer range, faster-charging capability, and higher power output. To address this, the EV battery architecture needs higher voltage; hence, the shift from 400V to 800V is inevitable.

Benefits of shifting from 400V to 800V:

- 50% reduction in charging times compared with 400V battery systems due to a higher charging power output of up to 350-360kW. These vehicles have the potential to charge from 5% to 80% (200 miles range) in less than 23 minutes! With superfast charging speeds, there would be no need for batteries with a 1000km range.

- Doubling the battery voltage from 400V to 800V lowers the current required for charging, resulting in reduced overheating and better power retention. This contributes to a longer driving range and higher performance levels

As of mid-2022, the majority of EVs in the market run on 400V battery systems. However, EV makers realize the techno-commercial benefits that a move to 800 V architecture can bring. Therefore, the transition to 800V systems is expected to be rapid in the coming years, and by 2027-2030, more than 90% of EVs are likely to have 800V battery systems.

Currently, the 800V EVs are at a very early stage of commercialization. Automakers such as AUDI, Porsche, Hyundai, and Kia already sell 800V EV systems, while LUCID motors has a 900V battery system built into its vehicle model Lucid Air. Porsche Taycan launched in 2019 was the first 800V EV in the market with a 270kW charging power, while Lucid Air is the fastest charging EV in the market with a 350kW charging power output. Hyundai has committed to 23 EV models to be launched with 800V systems by 2025.

WBG Semiconductors – Enabling the Move to 800V EV Systems

Silicon-based MOSFETs and IGBTs were the dominant power semiconductor device technologies in the EV industry. However, silicon-based power semiconductors have reached their theoretical performance limits with 400V EVs. Therefore, as mobility industry transitions to 800V battery architecture the need for newer materials like Wide Band Gap (WBG) semiconductor that offers better electrical and thermal performance is preferred over Silicon based semiconductors. Silicon carbide (SiC) and Gallium nitride (GaN) are the two WBG semiconductor materials gaining the maximum traction in the EVs for applications such as traction inverters, onboard chargers, and DC-DC converters. Specifically, SiC continues to attract more interest from all major EV manufacturers and is considered inevitable for 800V battery systems in EVs. All major automotive OEMs are working towards the development of 800V EV systems in the current and future offerings.

SiC in Traction Inverters – A Key Application Enabling 800V EVs

Traction inverters are one of the most critical EV systems that are responsible for overall vehicle performance. The key role of a traction inverter in an EV is:

- To convert DC from the battery to AC for the traction motor

- Convert AC back to DC for regenerative braking

- Control the EV motor speed based on the accelerator inputs by the driver.

The key focus is shifting toward developing 800V-capable traction inverters with SiC modules. Several automotive tier-1 suppliers have been showcasing their 800V inverter capabilities. Delphi Technologies (now acquired by BorgWarner) was the first in the industry with volume production of 800V SiC inverters utilizing SiC MOSFETs from Wolfspeed. McLaren Applied offered a glimpse of its 800V SiC-based traction inverter (Inverter Platform Generation 5) in early 2022. Vitesco signed a deal worth nearly $1.08 billion with a major North American automaker (either Ford or Stellantis) to supply 800V capable traction inverters from 2025. Similarly, Marelli launched an 800V-SiC traction inverter platform in mid-2022. Similarly, BorgWarner is developing a SiC-based inverter for a German EV OEM.

SiC – Ahead in the WBG semiconductors race for EV traction inverters

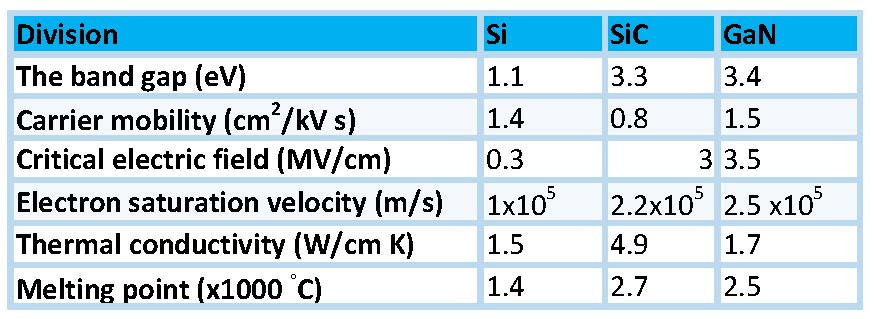

Using SiC MOSFETs in 800V capable traction inverters leads to a faster, more efficient, and lightweight EV drivetrain. SiC produces less heat,is less temperature sensitive when compared to Si, and enables more efficient power switching. The release of lesser heat leads to lighter cooling systems, leading to a lightweight and smaller inverter footprint. The higher band gap in SiC results in lower leakage currents at high temperatures, while the high critical field voltage significantly reduces the on-resistance enabling smaller/thinner devices. This lowers the switching losses, improves current carrying capability, and enables faster switching. Thermal conductivity is another critical aspect where SiC stands out. SiC modules can handle junction temperatures of up to 200 ◦C compared to Si, which can handle up to 80 ◦C. Another prominent WBG semiconductor, GaN, is at the very niche stages of development and applications in 800V EV applications.

Exhibit: Si Vs SiC Vs GaN – Material Comparison

GaN for 800V EV Applications – Navigating its way through Technological Advancements.

GaN has an almost comparable or even better band gap, critical electric field, and saturation velocity than SiC. However, its low thermal conductivity poses challenges to apply in high-power and temperature applications such as EV traction inverters. For GaN, 650V modules are the sweet spot that finds application in 400V EV systems, which is pretty much dominated by the matured Si-based chips. However, as the voltage increases to 800V, GaN loses its efficiency due to its lower thermal conductivity. The industry is working on developing vertical/3D GaN structures to support high power EV applications.

As discussed, GaN technology for 800V systems in EVs is still in the early commercialization phase. One of the major differences between the current GaN devices and other power devices (based on Si and SiC) is that the former has predominantly used a lateral device structure to conduct electricity (GaN on Si, GaN on SiC, or Gan on Sapphire) while the latter (Si and SiC) devices conduct vertically. Hence, to get to higher voltages with lateral GaN, the die size needs to get bigger, which isn’t feasible from a scaling point of view.

Several industry innovators are working on improving the efficiency of GaN devices through advancements such as vertical GaN structures and superior packaging technologies in lateral structures to make GaN FETs feasible for 800V EV applications. For instance, Odyssey Semiconductor recently demonstrated its 1200V capable vertical (GaN on GaN) device, and the engineering samples are expected to be tested by several automotive OEMs in 2023. Vertical GaN structures bring in the high switching efficiency benefits of GaN in the smallest possible die size to the voltages and the power levels currently only addressed by Si and SiC. Similarly, NextGen Power Systems recently tested their commercially viable 1200V vertical GaN Fin-JFETs. VisIC Technologies and hofer powertrain partnered to develop a 3-level 800V GaN-based traction inverter for EVs using VisIC’s lateral D3GaN (direct drive d-mode) technology. In early 2022, Transphorm demonstrated its 1200V lateral GaN power transistors expected to be available for sampling in 2023. Such technological developments and buzz highlight the potential of GaN to emerge as a market disruptor for EV applications.

Even for the EVs with 400V architecture, the OEMs may have to move from Si to WBG

While the move towards 800V EVs is inevitable for apparent reasons, it is also important to note that 400V systems will not be phased out. 400V EVs are expected to be utilized in cost-sensitive markets. Moreover, owing to the new efficiency targets set by countries globally, even the 400V battery system EVs may have to transition to SiC in the short term, following Tesla’s footsteps (SiC modules in its 400V Tesla Model 3). For instance, China released its target for cars sold between 2021 and 2023 in 2020, wherein it reduced maximum acceptable energy consumption in certain EVs from ~23kW/100kms to ~18kW/100kms. SiC increases the driving mileage per kWh by nearly 5-10% due to its heat resistance, low on-resistance, and faster switching than Si. Hence, companies such as ROHM Semiconductor and STMicroelectronics also offer SiC solutions for 400V EVs. Further, Borgwarner announced in late 2021 that a leading European automaker would be utilizing its 400V SiC traction inverter in EVs, expected to go into production in 2023.

SiC supply chain challenges and evolving industry relationships

As SiC becomes a significant trend in EVs, there is a strong need for chip manufacturers to pursue better planning to ensure optimum capacity and a robust supply chain to address the imminent SiC surge in EVs. The transition from planar to trench structure, the move from 6-inch to 8-inch wafers, and the capacity expansion initiatives will bring cost and performance advantages. Further, to improve the wafer defects concern with SiC and to attain self-sufficiency in the SiC supply chain, the industry is witnessing an increased vertical integration trend with semiconductor companies acquiring supply-side companies.

Moreover, automotive OEMs are venturing into designing and manufacturing their own traction inverters, leading to their direct relationships with chip manufacturers, which was uncommon in the industry traditionally. To help automotive OEMs with their inverter designs, the chip design and manufacturing vendors, as well as several engineering consulting firms, are providing turnkey software-based solutions to the automakers to speed up their inverter development times.

Conclusion

As the EV industry moves from 400V to 800V battery systems, the move to WBG semiconductors seems inevitable. Owing to its technical specifications, SiC is currently the perfect choice for automakers. The application of GaN, a relatively new and niche technology, is currently limited in the EV power applications owing to its low thermal conductivity and lateral structure. However, the technological advancements such as vertical GaN structures and advanced packaging is expected to provide significant market opportunities for GaN in 800V EV traction inverters.

In the short term, top-end 400V EVs may also embrace WBG-based traction inverters owing to the stringent emission and efficiency norms set by the countries globally. In the long run, entry- and mid-level 400V EVs, mostly in cost-sensitive markets, would ultimately transition to SiC and GaN technologies.

The industry is witnessing an overhaul of traditional supply relationships. Automotive OEMs and tier-1 suppliers are looking to secure their component and chip supplies through strategic cooperation and direct relationships with chip manufacturers. Also, the automakers are moving towards designing their traction inverters in-house rather than relying on tier-1 suppliers. Further, the chip manufacturers are vertically integrating by acquiring supply-side companies to have better control over the supply quality and product development.

The expected pace of transition from 400V to 800V battery systems in EVs is something that the industry has never witnessed before, and the semiconductors landscape has a crucial role in enabling it. With Si no longer able to address the performance needs of EVs, the race towards WBG semiconductors is up with all force. The device technologies, be it Si, SiC, or GaN will find ways to sustain the market transition and will co-exist with no technology completely replacing the other. What remains to be seen is who eats in what share of the other’s pie! Frost & Sullivan will be exploring various aspects of the market, including how SiC and GaN will witness adoption across the end-user industries in the mid to long term in its upcoming study on the WBG semiconductors market.

The views and findings in this article are a result of the extensive research the semiconductor practice within Frost & Sullivan put forward with Global Electric Vehicle Semiconductor Growth Opportunities (Research code: K725) and its other semiconductor-based studies.

Navdeep Saboo, Industry Analyst, Frost & Sullivan

This article was originally published in Power Electronics magazine. To read it, please click here.

About Frost & Sullivan

For six decades, Frost & Sullivan has been world-renowned for helping investors, corporate leaders, and governments navigate economic changes and identify disruptive technologies, Mega Trends, new business models, and companies to action, resulting in a continuous flow of growth opportunities to drive future success. Contact us today.