The voice over LTE (VoLTE) and voice over Wi-Fi (VoWi-Fi) testing and monitoring market covers a variety of equipment and use cases. These can be grouped into 5 categories: network infrastructure testing; passive network monitoring solutions; active network monitoring; network optimizing and benchmarking equipment; and equipment used to test the conformance of end-user devices.

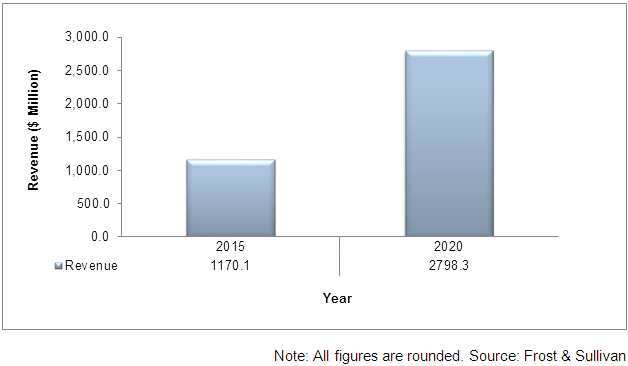

That said, the VoLTE and VoWi-Fi testing and monitoring market is expected grow at a healthy double-digit rate during the next 5 years, fueled by significant adoption of VoLTE and VoWi-Fi network deployments among network operators. Frost & Sullivan finds the VoLTE and VoWi-Fi testing and monitoring equipment market generated an estimated $1,170 million in revenue during 2015, and expects it to reach $2,798 million by 2020.

VoLTE and VoWi-Fi Testing and Monitoring Equipment Market: Revenue Forecast, Global, 2015 and 2020

Trends Poised to Positively Influence the Testing Market

The VoLTE and VoWi-Fi market will be influenced a number of external trends. While the proliferation of VoLTE and VoWi-Fi network deployments is undoubtedly one of them, other trends that are expected to positively influence this market include handover issues when moving from an area that is covered by legacy-based circuit switch networks to one that is predominantly IP-based. In addition, as the unlicensed spectrum continues to grow, a transition from licensed to unlicensed spectrum becomes the most obvious choice, to save on spectrum crunch. This transition is critical and should be done immediately, in order to avoid churn from within the end-user base. The same holds true when leveraging infrastructure off of a network that is beyond the network operator’s control.

Ultimately, the network operator must ensure that the quality of service and experience, if not exceptional, should not be degraded on account of incorporating a network infrastructure that is entirely new, which is a real possibility. In order enhance network visibility and control across the entire infrastructure, the operator should employ VoLTE and VoWi-Fi specific test equipment that have a higher degree of sophistication than any other product on the market.

Challenges Still Looming

While the challenges mentioned above are certainly trends that testing vendors can capitalize upon, challenges that hamper the market are also aplenty. For instance, the incorporation of such innovative, holistically thorough network silos could pose a problem. This challenge is compounded by the adoption of virtualized network functions (VNF) alongside software defined functions (SDN). If not incorporated effectively across these elements, the general utilization factor of these solutions could drop substantially, which will, in turn, reduce the return on investment the network operator can expect from the tool.

The communication testing market has, through the years, witnessed considerable consolidation, with smaller entities being picked up by larger conglomerates. While such acquisitions have undoubtedly enhanced many a company’s positioning in various other segments, the integration of two or more heterogeneous products could pose yet another challenge.

Conclusion

While the many challenges encountered by network operators are opportunities that the testing community can capitalize upon, growth of the testing market specific to VoLTE and VoWi-Fi technologies can be further enhanced if interoperability issues that arise from installing a solution across a multivendor environment can be addressed. Industry growth can be further accelerated through the successful implementation of heterogeneous solutions, which may have been acquired, thereby providing a continuous end-to-end testing solution for the end user.