Virtual Keys, Automated Driving Technologies, V2V Communication Technologies, and vCommerce Will Be the Driving Trends in the Vehicle Sharing Technologies Market

Vehicle sharing technology has evolved from simple manual technology such as telephony operator based reservations, manual lockbox mode of access for keys, and log books to advanced solutions such as app-based reservations, in-car diagnostics, and keyless smartphone based access control solutions. Higher penetration rates of smartphones will be the main driver for the adoption of smartphone based technology solutions. It is estimated that 1.2 billion phones will be equipped with NFC technology by 2018, providing a huge potential for smartphone-based remote vehicle control technologies. By 2025, advanced technologies such as automated driving, connected mobility, EV charging, and HWW solutions will play a pivotal role in improving the experience offered of vehicle sharing operators.

From factory installed to aftermarket, there is a wide range of technology service providers offering solutions to vehicle sharing operators. In-car hardware solutions are being transformed from being embedded hardware heavy on-board computers to hardware light smartphone-based access solutions and plug-in hardware solutions.

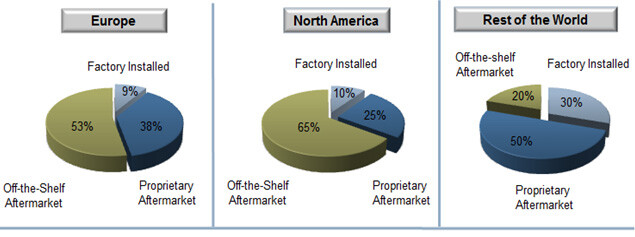

Chart 1: Traditional Vehicle Sharing Market: Technologies Market Share, Global, 2014

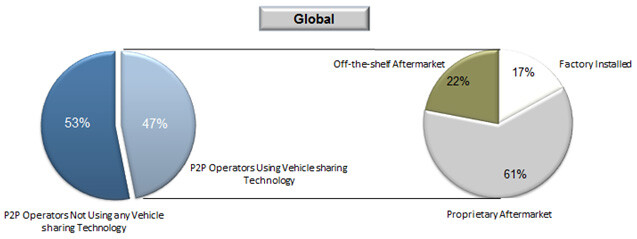

Chart 2: P2P Vehicle Sharing Market: Technologies Market Share, Global, 2014

According to a Frost & Sullivan (http://www.automotive.frost.com) study, Strategic analysis of Vehicle Sharing Technology, vehicle sharing technology is broadly classified as factory installed solutions (developed by OEMs with technology partners), proprietary aftermarket solutions (developed in-house by the car sharing operators) and off-the-shelf aftermarket solutions (third party solution providers). The traditional carsharing market in North America is more advanced than that of Europe when it comes to the adoptions of aftermarket software solutions. From Chart 1 we see that almost 65% of the key CSOs in North America are using aftermarket solutions. In other parts of the world such as Asia-Pacific, the percentage of vehicle sharing operators using proprietary solutions is higher.

Chart 2 shows the technology adoption rates by the P2P carsharing operators. In the P2P carsharing market, more than 50% of the P2P operators do not use any vehicle sharing technology for their vehicle sharing operations yet. Most of them are still dependent on physical exchange of car keys and have a simple booking system to run their car sharing operation. Out of the 47% of the key CSOs using vehicle sharing technology, almost 61% of the operators are using in-house developed proprietary solutions. Currently OEMs such as GM, Ford, and Audi are beginning to launch P2P carsharing services, either by themselves or in partnership with other P2P CSOs.

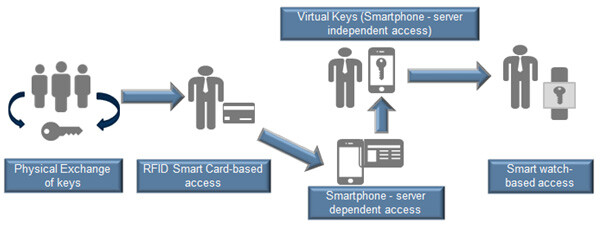

Figure 1: Evolution of Keyless Access Technology

Vehicle sharing companies have evolved from the process of physically exchanging the keys in the early ’90s to the use of smart cards/chips in late ’90s to access cars. Beginning mid-2000, vehicle sharing operators such as Car2Go, Zipcar, and DriveNow have started using smartphones to provide remote access to cars. However, these smartphone-based solutions required the information to be validated by the car computer routed via the server. Smartphone-based NFC solutions have been introduced in the market only recently, and are yet to be explored by CSOs.

Frost & Sullivan’s research indicates that CSOs will slowly move to virtual key access solutions, where the electronic key and authentication details are transferred directly to the sim card and would be read by the reader in the car. The car would be able to directly communicate with the smartphone. Virtual keys can be operated without any hassle, even in underground places, as the communication happens directly with the phone and not the server Intelligence built into smartphone brings in cost savings in areas such as maintenance of smart cards, software costs, hardware costs, and also has the potential to reduce fuel costs by use of eco-drive modes. Virtual keys enable last-minute or on-demand vehicle bookings and can be used in businesses of any scale.

In the future, Frost & Sullivan expects that RFID technology will be slowly replaced by the latest technologies such as NFC/BLE. Automated parking (Car2go experimenting with Bosch and Benz), semi-autonomous driving solutions will open up additional use cases for the carsharing operators. Factors such as rapid urbanization, increasing Gen Y population, and penetration rate of smartphones will be major drivers for the vehicle sharing market in the Asia-Pacific region. Aftermarket carsharing technology providers would expand their local presence in these regions to take advantage of the growing demand.

The year 2015 has seen two major consolidations between leading CSOs and technology companies (Zipcar and LocalMotion, Enterprise Holdings and Metavera). This trend will continue in the short term to allow CSOs achieve economies of scale. The carsharing market will see increase in number of partnerships among technology companies and CSOs, OEMs, and vehicle sharing/technology companies.

From car buying to car sharing, OEMs are increasingly looking at carsharing business models to create value and engage with a new customer demographic. Several OEMs have started to increasingly experiment with carsharing with their in-house developed technologies. OEMs can take carsharing into account during the car’s design. With easy access to leasing and dealer networks they can easily capitalize on the vehicle sharing model. In the vehicle sharing model the OEMs will have to ensure the car’s attractiveness by keeping the car’s software and technology updated. This can be enabled by providing OTA software updates, apps, and configuration management systems.