Small cells were supposed to be little fillers to boost low-power spectrum in order to bridge the gap in the radio coverage of macro cells. The macro cells, however, would continue being the main mechanism of the mobile network, and require all the support. Thus, small cell networks deserve the same support as macro cells. Small cells have become vital to mobile operators’ ability to keep pace with market growth and customer demand. Moreover, they are the only cost-effective way known to do so.

Small cells may be less expensive compared to macro cells; however, the numbers in which they are needed still make for a significant investment that requires thoughtful operational planning and investment. There are two ways to deploy small cells. They can be homed back to existing macro cells, with aggregated small and macro cell traffic backhauled to the MTSO. The second way of deployment is small cells can be homed directly back to MTSO which results in longer distance backhaul link. The first method results in increased capacity requirements onto the backhaul links currently feeding the macro cell, especially as increasing number of small cells are deployed.

This network architecture is likely to be the most popular method of rolling out small cells, as it results in shorter small cell backhaul links, meaning MNOs must endure fewer right-of-way negotiations, which are typically more time-consuming and extremely costly to close.

The second method of small cell deployment leads to more difficult and costly right-of-way negotiations, especially if protected dual small cell backhaul links are employed. The advantage of this architecture is that deploying small cells will not affect the capacity requirements of the existing macro cell backhaul links. In all possibility, a combination of these two small cell backhaul network architectures is deployed based on specific network requirements, deployment constraints (indoor or outdoor), and optical fiber availability.

However, as small cells thrive and combine to create heterogeneous networks (HetNets), it becomes more obvious that their role in delivering mobile services became far greater than just being a filler.

A HetNet is a network that uses small cells/Wi-Fi/DAS and macro in the same network. However, as the market is still evolving and complex, the scope of this study has been limited to include small cell and Wi-Fi technology alone.

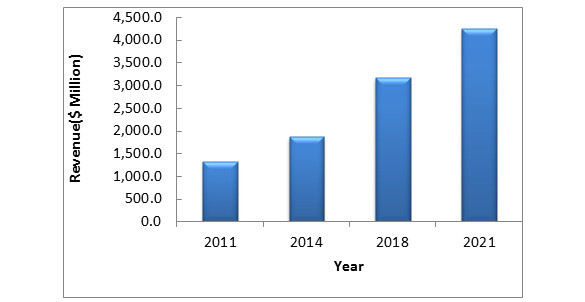

According to Frost & Sullivan research, the Global HetNet Test Equipment market reached $1,658.8 million in revenue in 2014.

The market is expected to reach $4,258.3 million in 2021, growing at a CAGR of 12.4% from 2014 to 2021 due to continued HetNet deployments. Factors, such as the need for continual network coverage and capacity, OPEX and CAPEX savings, as well as new technologies such as LTE, LTE-A, and 5G, drive the demand for HetNet deployments that, in turn, drive the demand for HetNet testing solutions.

HetNet Test Equipment Market: Revenue Analysis, Global, 2011, 2014, 2018 and 2021

Business Value for SPs and Enterprises: Compelling New Services

Some of the greatest benefits of HetNets are increased support for differentiated services enabled by better coverage and QoS.

The deployment of VoLTE, for instance, is expected to increase the heterogeneous nature of network infrastructure. As a result, it can be used to solve latency-related problems while transitioning between the area covered by VoLTE and another area in different network architecture. HetNet’s QoS and QoE still leave much to be desired, as issues with the handoffs between cellular and small-cell Wi-Fi networks still exist. In addition, roaming, traffic prioritization, and user authentication are among other HetNet challenges that need to be addressed. Thus, operators need effective solutions to test and monitor legacy-based network infrastructure and next-generation mobile wireless networks for proper coverage.

HetNets offer a compelling and cost-effective substitute for scaling network access in urban areas, as they successfully address the diverse and rapidly changing business goals of both operators and enterprises.

By bringing the network closer to the customer, HetNets find lower-cost, lower-power access nodes indoors and outdoors to ensure seamless mobility. Besides lower costs, users of HetNets realized the following additional benefits:

- Offloading nearly 80% of data during peak usage times

- Increasing the network capacity using three multi-standard small cells combining 3G, LTE, and carrier Wi-Fi per macrocell

- Increasing overall capacity 80 to 130%

The main benefits of small cells and increased cellular/Wi-Fi integration for enterprises stem from the ability to do more and to do it better. With the reliable, enhanced services enabled by small cells, businesses can improve customer relations, operational efficiency, and their competitive edge.

For operators, the opportunity to increase revenue from existing services while rolling out differentiated multimedia offerings exists. Guaranteed coverage and mobility will continue to lure traffic off traditional networks, enabling premium pricing while reducing the perennial churn arising from poor quality. Massive savings and more strategic relationships with customers also come into play.

HetNets bring network access closer to the customer. Small cells, femtocells, picocells, metrocells, and Wi-Fi access points are used to offload traffic from base stations, along with Distributed Antenna Systems (DAS). By boosting quality of coverage in buildings and outdoors in densely populated areas, HetNets improve customer satisfaction and enable emergence of new business models.

HetNets deliver a wide number of benefits to both SPs and enterprises:

- Increased productivity and end-user satisfaction

- Flexible and attractive service bundles

- Significant CAPEX and OPEX savings

- Higher revenues

Besides more flexible and attractive service bundles, HetNet deployments will not only enable managed services but also bring cost savings to the enterprises as well as SPs. According to a recent research, HetNet deployments consisting of small cells are bringing CAPEX and OPEX savings of over 32-36% a year to enterprises and at the same time promising a revenue opportunity for SPs of over $120 billion by 2021.

Small cells are used in the second phase of LTE and LTE-A network deployments after macro cell coverage is available. Small cells will improve the available capacity in densely populated areas as well as stadiums and shopping malls/indoors. The simplest deployment is when they are used as a dedicated carrier for the small cell layer to eliminate interference with the macro-cell network and avoid synchronization issues.

Once a centralized architecture using multiple bands becomes available, the base stations could be extended to use CA of LTE-A Release 10. In CA, multiple up- or down-link LTE carriers in contiguous or non-contiguous frequency bands can be bundled.

Initially, CA will only be used to aggregate carriers of the same site, but a centralized architecture permits multi-site CA. LTE-A Release 11 brought in the support of multi-site CA by supporting multiple uplink timing advance enhanced uplink power control for HetNets. In such a scenario, a base station with full coverage would work as a primary cell, providing system information, radio resource control signaling, and a small base station would serve local high data rate requirements.

According to Frost & Sullivan latest research, breadth of product offerings and the availability of features on a single test or monitoring platform are key end-user requirements.

As the technology keeps evolving at a rapid pace, having close relationship with NEMs, service providers, and security bodies is critical for a testing vendor. Additionally, as networks are becoming more intelligent, they require more sophisticated testing solutions.

Small cell security as well as service quality at the backhaul is a challenge, and the market is in need of effective security testing solutions.

End-to-end scaling is critical, as several backhaul test equipment vendors are working on virtualizing their platform and architecture to make them more scalable.

On the field test side of things, generating a real-time performance report is becoming increasingly important. Access to data—for instance, data that will help adjust an antenna tilt—will have a positive impact on customer experience.