Synergies between automotive OEMs and battery manufacturers to ramp up collaborative initiatives in battery development.

The global electric vehicle (EV) market is booming, highlighting the urgent need for lithium-ion (li-ion) battery production to keep pace. EV sales are estimated to increase from 10.5 million EVs in 2022 to over 14 million by the end of 2023. As battery manufacturers look to scale up their manufacturing capability, the spotlight is on gigafactories. At the same time, automotive OEMs and battery suppliers are increasingly opting for vertical integration strategies and partnerships to gain a competitive edge.

The push for higher li-ion battery production in gigafactories will receive further impetus from governments keen to ensure domestic energy security and lower the dependence of their critical industries on external sources. Events like the pandemic, the ongoing Russia-Ukraine conflict, and trade disagreements have exposed global supply chain vulnerabilities, while underlining the need for steady, uninterrupted component and raw material supplies. This imperative has taken on even greater urgency for stakeholders in the EV battery market considering global battery demand is projected to reach 6 terawatt-hours (TWh) by 2030. To meet this burgeoning demand, battery suppliers will have to work to secure long-term clients, establish robust raw material supply chains, and realize rapid capacity expansion through gigafactories.

This is being accompanied by the realization that Industry 5.0 technologies, including artificial intelligence (AI), Big Data, analytics, blockchain, and the Internet of Things (IoT) will be key enablers in supply chain, inventory, production, and revenue generation optimization. Uptake of digital technologies and software platforms will rise across the EV battery industry, with applications in every stage from design and development to manufacturing and delivery. Battery supply chain software platforms will evoke strong investor interest and emerge as a crucial component of global gigafactory market revenues.

To learn more, please access our forthcoming report on Giga Factory Strategies of Global Automotive OEMs Li-ion Battery Production, Forecast to 2030, Strategic Analysis of Disruptive EV Start-ups, 2023, or contact [email protected] for information on a private briefing.

Increasing Investments, Securing Supply Chains

Mirroring strong demand growth for li-ion batteries, investments are set to rise from $131 billion in 2022 to around $300 billion by 2030 as automotive OEMs and battery manufacturers push to ramp up battery production in gigafactories. Consequently, global battery production capacity is set to register a 49.7% CAGR over 2022-2030.

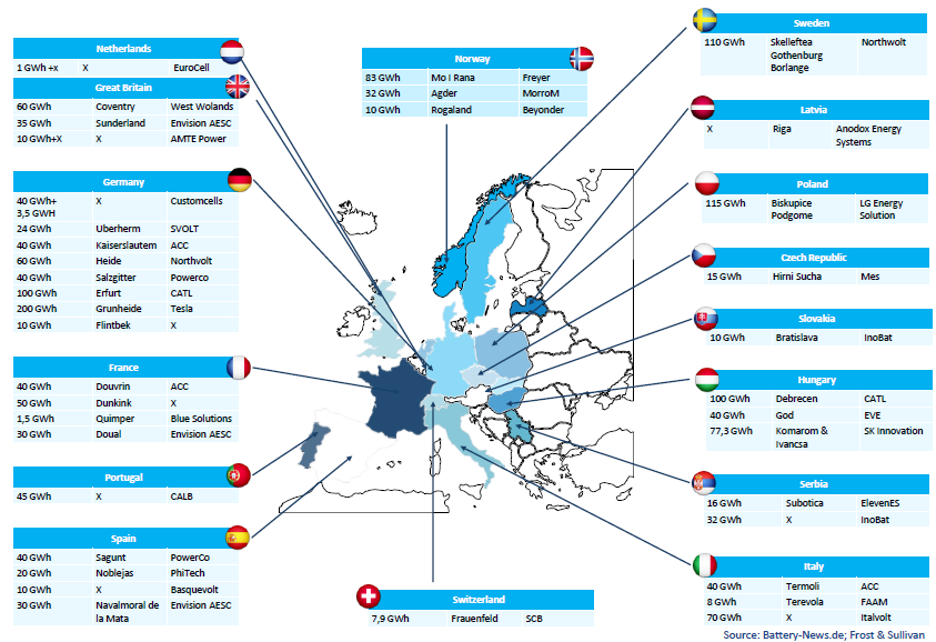

Gigafactory Investments by Battery Suppliers in Europe

Stakeholders will also look to offset potential shortfalls in local supply by securing sufficient raw material supplies at cell level, both in terms of the right capacity and chemistry. The EU, for instance, is likely to face deficits in lithium and nickel, stressing the importance of ensuring adequate supplies of main active materials. Localization of active material value chains will create growth opportunities in terms of building large active material processing and cell component capabilities.

Focus on Battery Manufacturing Capacity Expansion

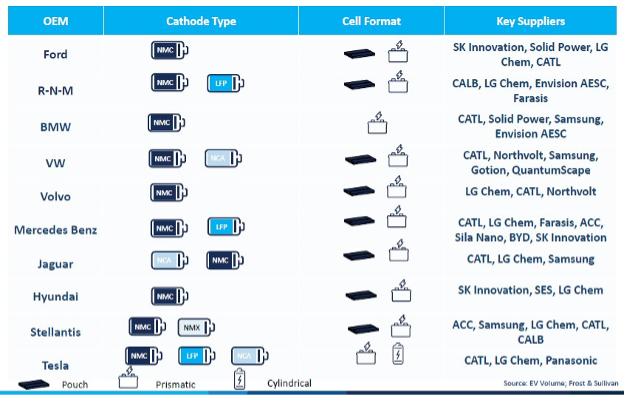

In terms of battery types, li-ion (NMC, LFP and NCA, among them) and solid-state batteries are currently widely used. Tesla uses NMC, LFP and NCA cathode types, while GM, Toyota, Mercedes- Benz, BYD, SAIC, Geely, Changan, Great Wall, Chery, XPeng, and RNM, among others, use both NMC and LFP. Hyundai, Rivian, Lucid, Honda, Volvo, BMW and Audi are among the several automakers that use NMC.

In terms of format, prismatic dominates and features in the portfolio of most battery suppliers. Frost & Sullivan analysis reveals that prismatic cells, which currently account for around 65% of the battery market followed by pouch and cylindrical formats, will continue to be the most common and widely used battery format.

At about 65.4% of GwH capacity in 2022, China has a runaway lead in terms of battery capacity, trailed far behind by Germany and then even further back by the US. To keep pace with rising EV demand, OEMs and suppliers in Europe and North America have announced capacity expansion plans for battery manufacturing using gigafactories. Meanwhile, consolidation is likely in regions like Europe and China which have densely populated and highly fragmented battery cell manufacturing markets.

All major global manufacturers, whether individually or as part of a joint venture, are on track to expand their battery manufacturing capacity till 2030. CATL is far ahead with plans to hit 900 GwH in battery manufacturing capacity by 2030. Competitors like LG, CALB, EV Energy, Svolt, and SK Innovations are also focused on strong capacity expansion. A clutch of emerging battery suppliers like Solid Power, Northvolt, Verkor, Freyr Batteries, and Morrow Batteries will intensify the competition.

Strategic Partnership of EV Automakers with Battery Suppliers

Our Perspective

Substantial growth in battery demand will require massive investments in gigafactories in order to boost production output. Besides seeking higher investments, stakeholders will need to adopt Industry 5.0 technologies. These will help enhance manufacturing techniques, streamline battery value chain processes, and provide a springboard for personalized battery products in mass production. Tesla, Ford and Stellantis have been front runners in adopting AI-enabled smart manufacturing to improve final product quality.

The central role of technology will require EV battery suppliers to collaborate with technology companies. This will enable them to more effectively integrate AI-based software solutions to enhance battery supply chain and inventory management in gigafactories.

In September 2022, Nissan, Audi, and Mercedes revealed their plans for second-life EV battery use. Similarly, stakeholders should exploit the potential of repurposing used batteries for second life applications. This must be backed by efforts to work in tandem with governments to standardize regulations encouraging second-life EV battery use.

With inputs from Amrita Shetty – Senior Manager, Communications & Content, Mobility