Frost & Sullivan’s comprehensive survey determines top performers in five key segments— manufacturing, charging infrastructure, battery technology, power electronics, and IT—of the electric vehicle ecosystem.

By Aman Gupta, Industry Analyst – Mobility

Rising fuel prices, government support, and climate change concerns are accelerating electric vehicle (EV) adoption. As the ecosystem develops, disruptive start-ups that can effectively address challenges related to the lack of charging infrastructure and associated range anxiety, lengthy charging times, and high prices stand to gain vital fist mover advantage. Accordingly, innovations whether technological like fast charging capabilities, wireless charging, and smart energy management or business model approaches will boost competitive positioning. Simultaneously, strategic partnerships between automotive manufacturers with innovative start-ups in critical areas like battery technology and charging will improve the customer experience, while fast-tracking the development of the EV ecosystem.

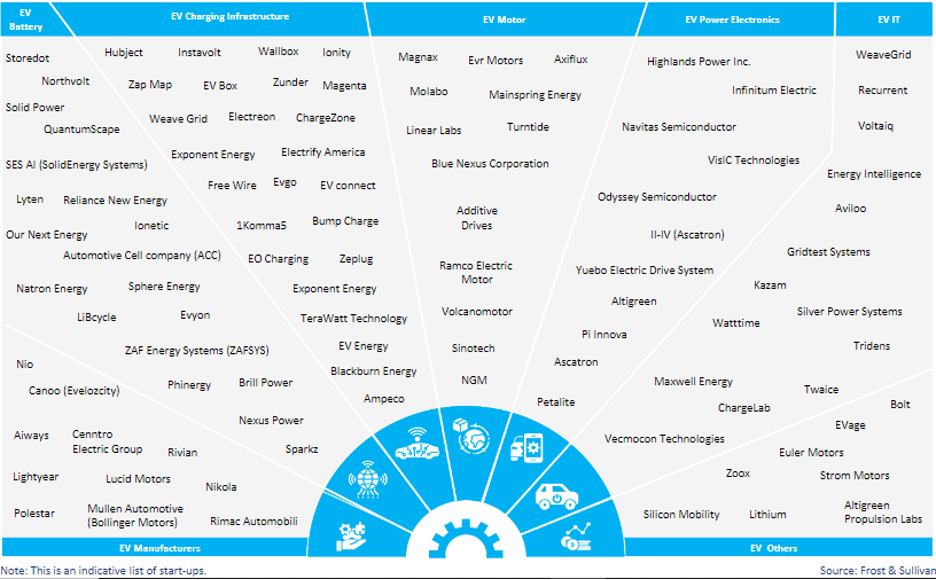

Today, the EV ecosystem is brimming with disruptive start-ups targeting both B2B and B2C markets. They are transforming segments from manufacturing and charging infrastructure to battery technology, power electronics and IT. Frost & Sullivan recently undertook a comprehensive study to understand the defining trends and KPIs that determine success in the intensely competitive and rapidly evolving EV space.

To learn more, please access Strategic Analysis of Disruptive EV Start-ups, 2023 or contact [email protected] for information on a private briefing.

From an initial base of nearly 800 companies active across five key segments of the EV start up ecosystem, we shortlisted 300 before further whittling it down to the top 20 start-ups in each of these segments. To determine the top performers, we benchmarked each of these companies against a rigorous set of criteria, including business scalability, total addressable market, portfolio strength and tech superiority, sustainable impact, and stakeholder ecosystem. Furthermore, for the disruptive start-ups that topped each of their categories, we identified unique selling propositions, strengths, sustainable initiatives, and growth strategies.

Global Electric Vehicle Ecoystem (EV), 2022

50% of start-ups belong to the EV battery technology and charging infrastructure space.

For instance, the U.S. based start-up that topped the EV manufacturing segment is commended for integrating modern technology, next-generation app, and audio streaming services with its uniquely designed EVs and its broad service portfolio for B2C and B2B markets. The company’s geographic expansion strategy— it has a partnership with a leading German OEM to produce electric vans at scale in Europe along with plans to build a factory in the region—also highlights its success. Having realized its production target of 25,000 units in 2022, the EV manufacturing start-up has ambitiously doubled this target for 2023.

The start-up that we selected as the most disruptive in the EV battery segment is noted for its unique, high-performance batteries made from sustainable materials like100% recycled cobalt, manganese, and nickel. In early 2022, it successfully supplied its first commercial shipment of cells to an OEM. By 2023, it plans for half its batteries to comprise materials extracted from used batteries.

Similarly, the U.S. based company that led the list of EV charging infrastructure providers stands out for being able to provide rapid, cost-effective charging, while supplying more EV chargers with faster speeds. As the largest public fast charging network in North America, it has invested nearly $2 billion towards improving infrastructure, access, and education programs and has, through strategic partnerships, sought to expand fast charging networks across North America with the goal of having around 10,000 chargers by 2025.

Industry-leading solutions aimed at enabling sustainable, decarbonized, energy-efficient operations across energy-intensive industries like commercial and industrial transport, construction, and agriculture underlined the top start-up disruptor in the EV motors and power electronics segment.

Meanwhile, the EV IT segment was led by a German based battery analytics software start-up which has won plaudits for its battery simulation models. Digital twin technology based predictive analytics software for lithium-ion batteries has helped enhance battery system design and performance.

Conclusion

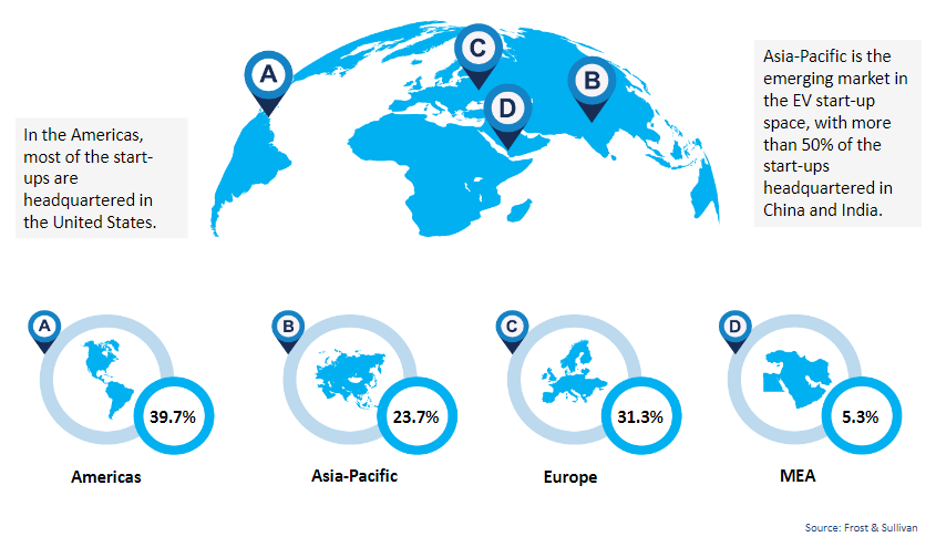

In 2022, nearly half of start-ups in the EV ecosystem were involved with battery technology and charging infrastructure. While the U.S. is the hub for most EV start-ups, Asia Pacific spearheaded by China and India, is emerging as the region to keep eyes on.

Regional Distribution of EV Start-ups, 2022

Start-up disruptors will need to keep pace with rapidly evolving trends in the EV ecosystem. Strategic partnerships and cross industry collaboration will be pivotal as stakeholders move to design innovative products and services, build up infrastructure and forge new business models.

With inputs from Amrita Shetty – Senior Manager, Communications & Content, Mobility