With a key focus on innovation, advanced technologies, and affordability, Chinese auto OEMs are leveraging their strengths in electric vehicles (EVs) and related industries. Utilizing cutting-edge manufacturing techniques and novel business models, these companies, especially new energy vehicle (NEV) OEMs, are challenging established players to meet evolving consumer demands. Following their significant expansion in Europe and Africa, speculation about the entry of Chinese EVs into the U.S. market continues to grow. At F&S Mobility North America, we have been diligently tracking the strategies and tactics of Chinese OEMs, especially for their entry into the USA, and aim to share key insights through this article series.

Unveiling the Accelerated Advancement of Chinese Companies

To understand how Chinese OEMs are advancing so rapidly in EV technologies and achieving global dominance, it is essential to delve into China’s government structure and its government-owned and controlled State-owned Assets Supervision and Administration Commission (SASAC), the largest economic entity in the world.

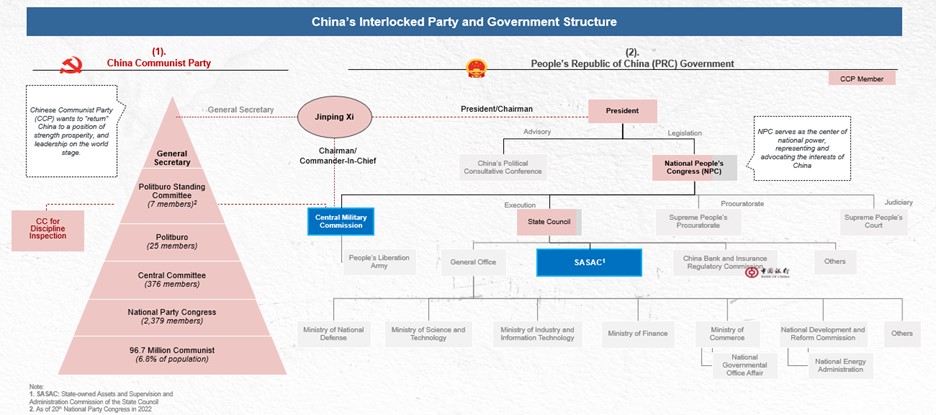

China’s political landscape is marked by a tightly interlocked system of party and government structures, designed to effectively implement national policies. With 96.7 million members, constituting 6.8% of the population, the China Communist Party’s (CCP) pyramid structure ensures county-level representation, with successful candidates progressing to higher levels such as provincial and national congresses.

Fig 1: China’s interlocked party and Government structure

On the PRC government side, the National People’s Congress (NPC) serves as the supreme organ of state power, representing and advocating for the interests of all citizens. State council implements the strategic directives outlined in a 5-year plan devised by NPC and they introduced EV technology as a priority scientific project under the 10th 5-year plan in 2001.

Under the state council, the State-owned Assets Supervision and Administration Commission (SASAC), which oversees all state-owned enterprises, is instrumental in steering companies toward CCP’s vision and goals with favorable regulations and heavy subsidy support. China’s integrated governance model underscores coordinated policy implementation which is pivotal in navigating complex challenges and advancing national priorities.

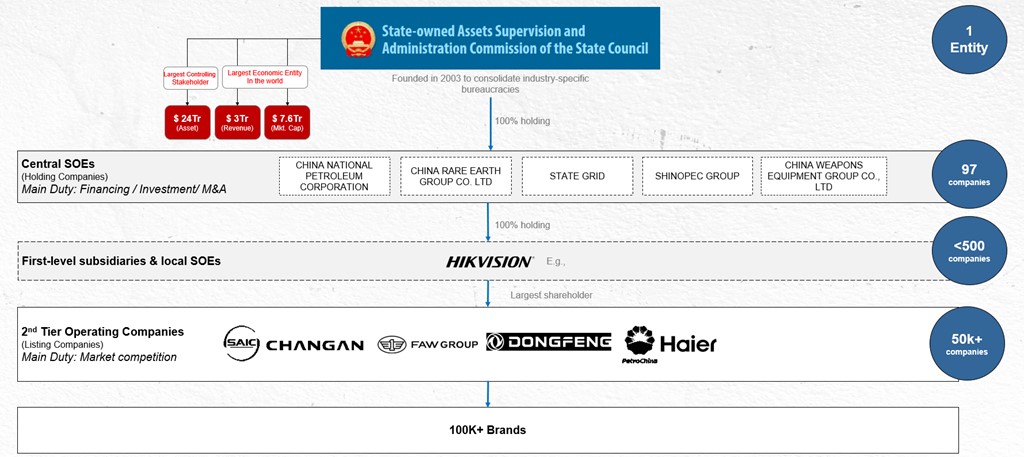

Now we must take a closer look at SASAC to understand its role in propelling any Chinese companies through unfavorable environments. Founded in 2003 to consolidate industry-specific bureaucracies, SASAC’s main duties include appointing top executives, approving mergers or sales of stock or assets, and drafting laws related to state-owned enterprises (SOEs). SASAC holds 100% ownership of 97 central SOEs, such as China National Petroleum Corporation (CNPC) and State Grid. These SOEs, in turn, fully own their first-level subsidiaries and local SOEs, encompassing approximately 500 companies. These 500 companies control over 50,000 second-tier operating companies through major shareholding. Well-known Chinese OEMs like Chang’an, Dongfeng Motor Corporation (DFM), FAW, and SAIC fall under the umbrella of these SOEs.

Fig 2: SASAC- the largest economic entity

With assets exceeding $24 trillion and an annual revenue of around $3 trillion, SASAC’s extensive control and resource base provide Chinese companies with the resilience to navigate international tariffs and economic challenges. This integrated governance and financial muscle ensure that Chinese OEMs can sustain growth and stability, even in unfavorable environments, as they expand into global markets. Please reach out to understand in detail the methods and strategies SASAC adopts to protect Chinese OEMs from any new unfavorable regulations or tariffs globally.

China’s Strategic Trigger for Global EV Dominance

China’s push for global EV dominance is driven by the Chinese Communist Party’s (CCP) strong visions. The People’s Republic of China’s (PRC) strategy aims to achieve “the great rejuvenation of the Chinese nation” by 2049. This strategic shift has triggered economic and foreign policies designed to expand China’s influence and dominance in several key areas.

China has focused on securing control over raw material mining and processing, critical for the EV supply chain. By investing heavily in infrastructure projects worldwide, particularly through initiatives like the Belt and Road Initiative, China has ensured a steady supply of necessary resources. Additionally, the country has prioritized technological advancements to gain dominance in semiconductor and energy technologies, crucial for EV production and innovation. This comprehensive approach, backed by the CCP’s long-term vision and strategic planning, positions China to lead the global EV market and reinforce its economic and technological superiority.

USA Entry Triggers: Learning from Japanese and S.Korean OEMs

Examining the historical entry points of Japanese and Korean OEMs into the U.S. market reveals critical insights. Japanese OEMs entered the U.S. during the 1970s, leveraging the global oil crisis to introduce small, fuel-efficient vehicles that appealed to cost-conscious American consumers. This strategy facilitated their market entry and was followed by forming local factories and utilizing local suppliers to consolidate their position. Similarly, South Korean OEMs made their move during the mid-1980s, amid an economic recession. They initially focused on offering cheap vehicles, which, though not high in quality, were affordable. Over time, they invested in reliability, quality, and brand development, eventually forming local factories to strengthen their market presence.

Looking Global EV market more closely, China currently has several triggers making any country’s (especially the USA) EV landscape ripe for entry. These triggers include but are not limited to:

- Goals to Transition to Clean Energy where majority of the legacy OEMs are struggling to transition to clean energy vehicles profitably and sustainably.

- Overcapacity in Chinese Production: With significant overcapacity in domestic production, Chinese manufacturers can leverage their existing capabilities to meet demand without incurring additional capital expenditure.

- Supply-chain crisis in the USA and Europe: The current supply-chain crisis in the U.S. presents an opportunity for Chinese OEMs to offer a stable supply of vehicles and components, ensuring availability and reliability.

Trigger conversion to strategic advantages:

China has adeptly converted its overproduction capacity into a strategic advantage, initially focusing on Europe exports. By saturating the European market with EVs and related components, Chinese OEMs have gained valuable insights and established a strong foothold. This phased approach allows China to thoroughly understand and prepare for the nuances of the U.S. market.

In response to the global supply-chain crisis, China has strategically focused on the mineral-rich ASEAN region. Through heavy FDIs in the Indo-Pacific Economic Framework (IPEF) countries during post-covid wake, China is positioning itself as the overseer of the upstream supply chain. This strategy ensures that even the U.S. will indirectly rely on Chinese-controlled supply chains for critical minerals and components.

Now for the major trigger- U.S.’s ambitious clean energy transition goals (where legacy OEMs in the U.S. are struggling to transition to electric vehicles profitably and sustainably), F&S Mobility North America have conducted extensive research and gained crucial insights into how China will strategize this.

Our research covers where they will focus their efforts (eg: indirect entry to EV ecosystem), the opportunities they will first leverage (eg: white spaces created by legacy OEMs), the routes they will take (eg: LATAM supply chain), and finally the key segments, brand values, and business models they will use in the EV market. By understanding these strategies, we can foresee how they will consolidate their position in the U.S. market. Please get in touch with us now to learn all about it.

Stay tuned for the next part of our article, where we will delve deeper into China’s playbook for these strategies and their advantage positions over existing U.S. players.

About Frost & Sullivan:

Frost & Sullivan, the growth pipeline company, enables clients to accelerate growth and achieve best-in-class positions in growth, innovation, and leadership. The company’s Growth Pipeline as a Service provides the CEO’s Growth Team with transformational strategies and best-practice models to drive the generation, evaluation, and implementation of powerful growth opportunities. Let us coach you on your transformational journey, while we actively support you in fostering collaborative initiatives within your industry’s ecosystem. Our transformation journey is fueled by four powerful components, ensuring your success in navigating the ever-changing landscape of your industry.

- Schedule a complementary Growth Dialog with our team to dive deeper into transformational strategies and explore specific needs within your company.

- Become a Frost Growth Expert in your area of specialization and share your expertise and passion with the community through our think tanks.

- Join Frost & Sullivan’s Growth Council and become an integral member of a dynamic community focused on identifying growth opportunities and addressing critical challenges that influence your industry.

- Designate your company as a Companies2Action to increase exposure to investors, new M&A opportunities, and other growth prospects for your business.